Family Trust and Holding Company Structure

Teaching Kids about Shaf's structure of Trusts, Holding Company and Operating Companies to manage key considerations such as tax implications, dividend distribution and asset protection with a long term strategy.

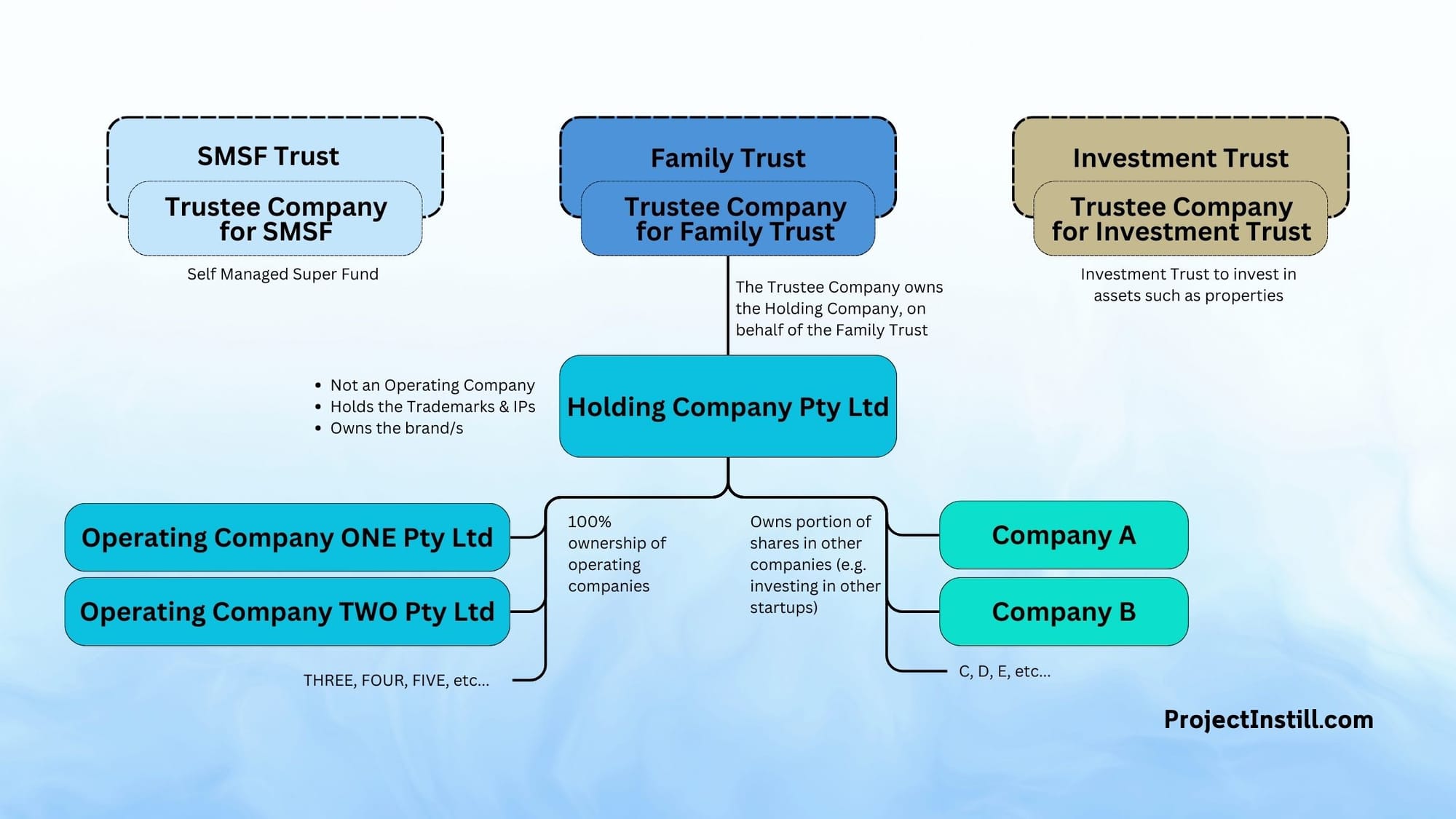

After speaking with multiple experts (legal and tax compliance), I have ended up with the structure below. I have been told this is a common structure with several privately owned businesses.

It took me two years to formalise this structure. I'll explain the thought process below.

Reflecting on the past, I could have made some strategic decisions and started the structure with a family trust early on. Its never too late!

-> I am not a Legal Expert.

-> I am not a Tax Expert.

-> I am not a Corporate Structure Expert.

-> I am not a Financial Planning Expert.

-> I am not an Investment Strategy Expert.

I am not an expert in anything!

Please research and engage relevant experts before you make any decisions.

The information I've shared is of a general nature and should not be considered as advice. It does not take into account your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided regarding your objectives, financial situation and needs. In particular, you should seek independent professional advice and engage relevant experts before making decisions.

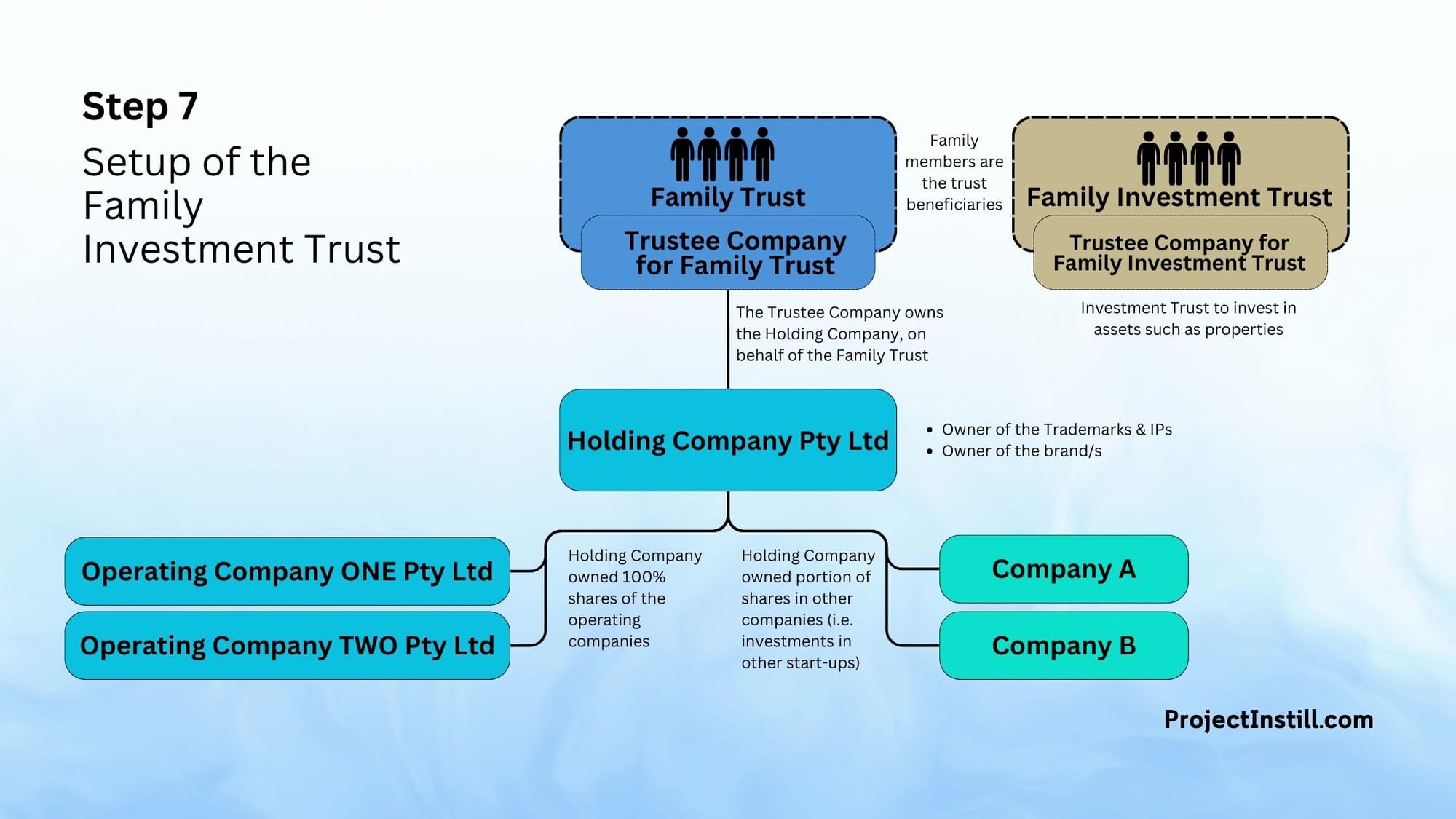

Structure as of 2024

Sequence of events

These are the sequence of events in my structure. These do not represent step-by-step instructions for you to follow.

This will give an insight into the reasons behind the decisions I made to create such a structure.

You must seek professional advice to review your structure and get advice based on your circumstances and target intended outcomes.

Here is a quick summary:

- In 2013, I set up my first company, Operating Company ONE Pty Ltd.

- I, as an individual, owned 100% of the company's shares.

- In 2018, I set up another company, Operating Company TWO Pty Ltd.

- I, as an individual, owned 100% of the company's shares.

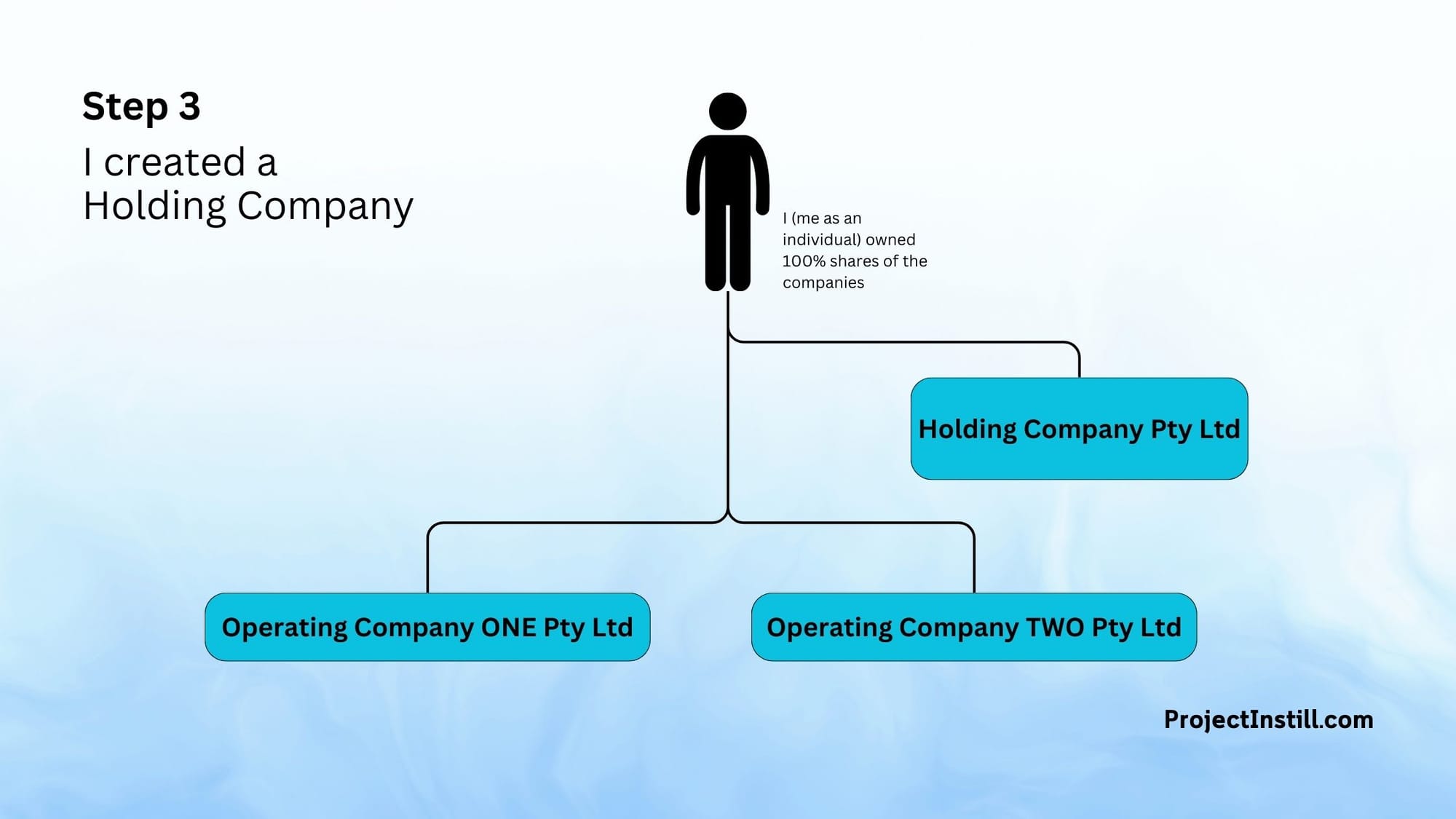

- In 2021, I set up a new company - Holding Company Pty Ltd.

- I, as an individual, owned 100% of the shares of the Holding Company.

- After setting up the Holding Company,

- I registered trademarks using the Holding Company Pty Ltd.

- I transferred my shares to the Holding Company (i.e. I sold my shares of the Operating Company ONE and Operating Company TWO to the Holding Company).

- Using the Holding Company, I invested in other companies started by people whom I knew personally.

- In mid-2023, I started a Family Trust.

- A Trustee Company was created to act on behalf of the Trust.

- My spouse and I were directors of the Trustee Company so that we could control the direction of the Trust.

- My family members were named beneficiaries of the Trust.

- I sold my shares of the Holding Company to the Family Trust.

- In late 2023, I started another trust - Family Investment Trust.

- A Trustee Company was created to act on behalf of the Trust.

- My spouse and I were directors of the Trustee Company so that we could control the direction of the Trust.

- My family members were named beneficiaries of the Trust.

- I purchased a property under the Family Investment Trust.

- In late 2024, I started investing in ETFs/Stocks via the Family Trust.

- Even though I intended to hold stocks/ETFs long-term, I might not know when I would sell a share. If the sale of shares happens after 12 months of purchase, a Trust can take advantage of the CGT (Capital Gain Tax) discount of 50%. Hence, my decision to invest in ETFs/stocks using the Family Trust. Read here on Investing in Stocks/ETFs.

To Do:

- Set up Trusts for each kid so they can start investing their own money at a very young age.

- Setting up Trusts for each kid will also help allocate dedicated funds for each child.

- Setting up a will. This has been heavily recommended by experts to ensure I have a will documented and formalised.

Start of Operating Company ONE

While working full-time, I registered my first company, Operating Company ONE Pty Ltd, in 2013.

- I (as an individual) owned 100% of company shares.

I did not have a clear business plan and wasn't sure how my business would perform. I wanted to develop and sell web apps to clients - and this needed a company to make things look professional - so I set up the company.

Over the years, there were some odd projects here and there - nothing significant in nature. I started to get clients in 2018, and things were shaping up well.

Pros and Cons

Advantages

- The company tax rate is 30%, and the lower tax rate is 25%. This is much better than our personal income tax brackets.

Note: If the company has an aggregated turnover of less than $50 million, the business is eligible for a lower rate of 25%. My company was eligible for the lower tax rate. - All company expenses directly related to my business were expensed out of the company before tax. This reduced the total profit, thereby reducing the company's taxable income.

Disadvantages

- End of the financial year, after the tax is filed, and if dividends were declared and were to be paid to me (as an individual), I would pay in a high tax bracket because the dividends would increase my personal taxable income.

- Another issue - that I was not aware of at the beginning - but later on after several years was that - if the trademarks are registered by the same entity that is also operating the business, this could be a risk. If the operating entity gets into trouble, the trademark will also be impacted because the same company holds it.

Start of Operating Company TWO

In 2018, I saw another opportunity to create a new company - Operating Company TWO Pty Ltd. Again, I (myself as an individual) owned 100% of the company's shares.

Pros and Cons

Advantages

In addition to the advantages similar to the Operating Company ONE, there are some key advantages:

- Operating Company Two was independent of Operating Company One.

- Their profit and losses were independent of each other.

Disadvantages

In addition to the disadvantages similar to the Operating Company ONE, there are some key disadvantages:

- In my case, since I was the Director of both companies, they were not wholly de-risked from each other.

- The profit or loss from one company is trapped with the company. It can not be shared across another company (e.g. if one company performs well to get profit, but the other companies go into loss - they can't be balanced with each other).

- My compliance activities and costs (i.e. filing quarterly BAS, annual tax filing, etc) have increased. I have to now do it separately for each of the companies.

Start of Holding Company

In 2021, I wanted to register a trademark for one of the operating companies.

After engaging with legal expertise, I was advised to create a Holding Company.

The holding company can control the subsidiary’s policies and oversee management decisions but doesn’t run day-to-day operations.

The holding company may also own property, such as real estate, patents, trademarks, stocks, and other assets.

Holding companies are protected from losses accrued by subsidiaries—so if a subsidiary goes bankrupt, its creditors can’t go after the holding company.

The advice I received was to register the Trademark under the Holding Company.

- This is to ensure that the company holding the trademarks is not impacted by the actions carried out by the operating companies.

- In other words, to de-risk the ownership of the trademark and IP.

Example of litigation:

- Andrew Christodoulou got a letter from the ATO alleging he owes $437,000 for unpaid superannuation guarantee contributions. In this case, the director's personal assets can be sold to pay the tax debt.

So, in 2021, I created a new company, Holding Company Pty Ltd.

- Again, I (as an individual) owned 100% company shares.

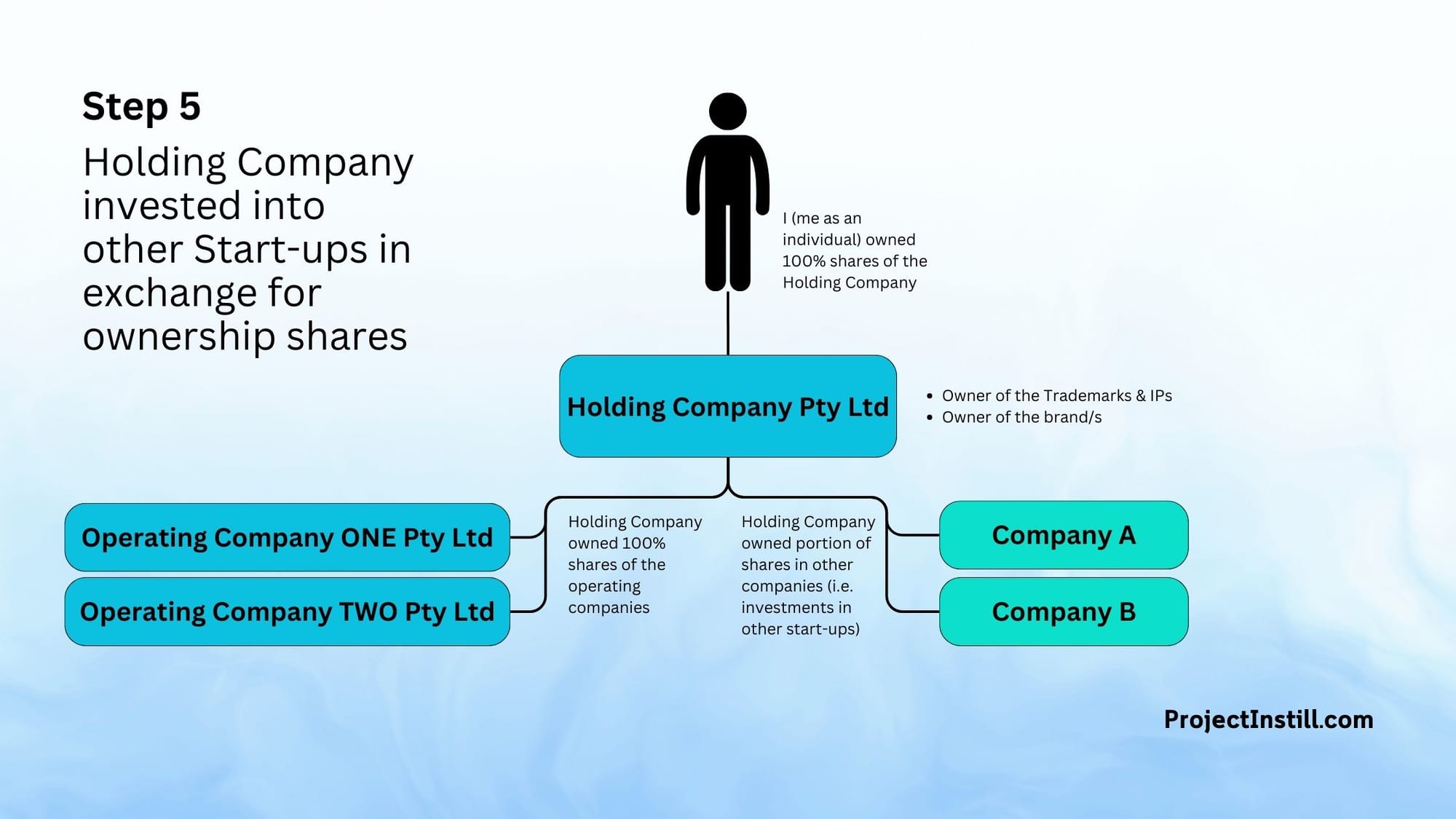

After setting up the Holding Company Pty Ltd, I registered the trademarks under the Holding Company Pty Ltd.

- I engaged a legal advisor to facilitate drafting a licencing agreement to use the brands by the operating companies (i.e. the Operating Companies were licensing to use the brand from the Holding Company).

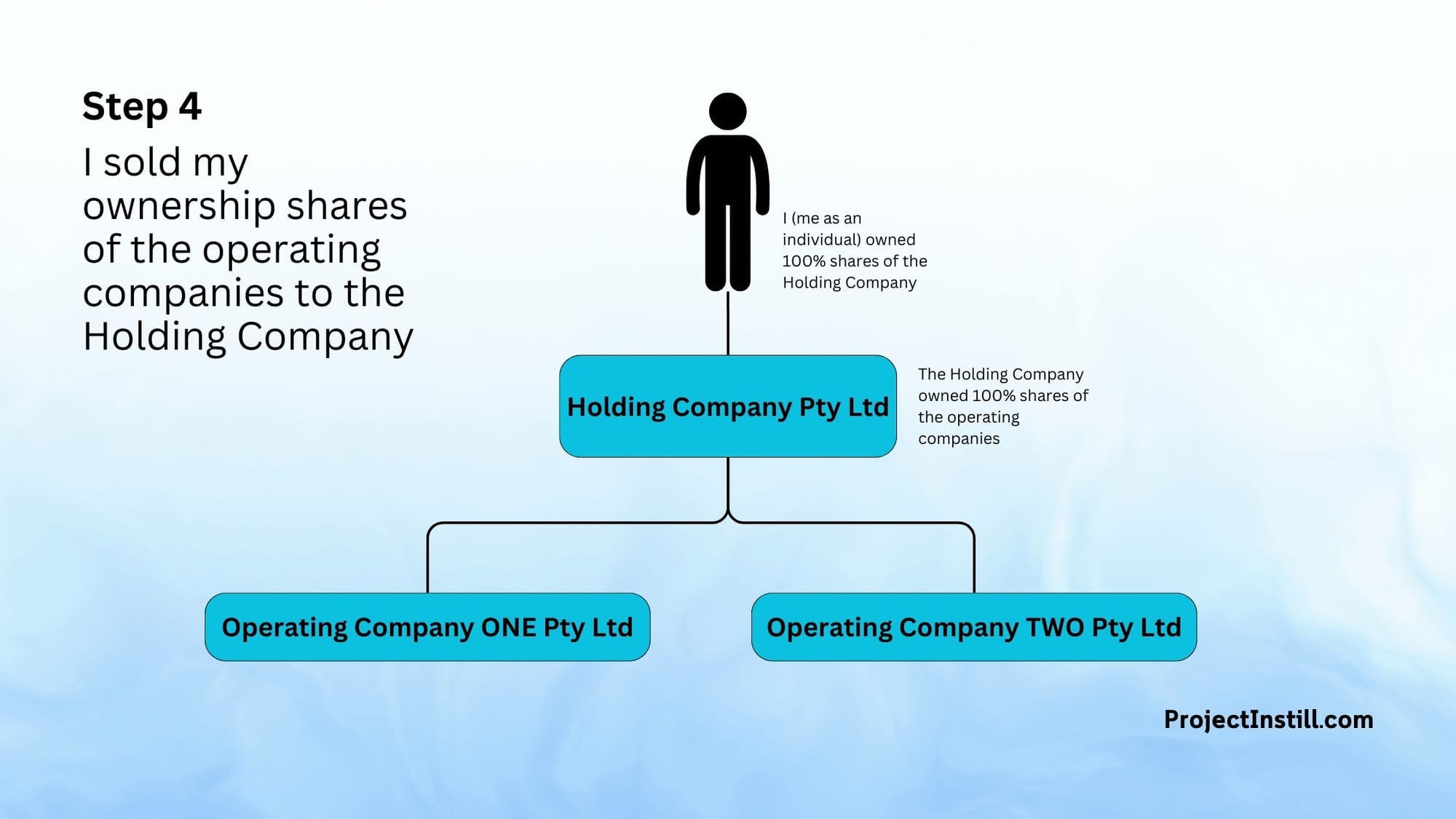

After registering the Holding Company Pty Ltd, I had to change the ownership of the Operating Company ONE Pty Ltd and Operating Company TWO Pty Ltd from me to the Holding Company Pty Ltd.

- From an accounting and tax perspective, there is no such thing as transferring shares. One party has to sell the shares to another party.

- So, as an individual, I sold my shares of both the operating companies to my Holding Company Pty Ltd, even though I owned 100% shares of the Holding Company Pty Ltd. This included notifying ASIC (Australian Securities and Investments Commission) of the sale of the company's shares.

- As part of the sale, there were tax implications, for which I engaged my Accounting Advisor to navigate the process.

The new structure

- I (me as an individual) owned 100% per the Holding Company Pty Ltd

- The Holding Company Pty Ltd owned 100% of both

- Operating Company ONE Pty Ltd

- Operating Company TWO Pty Ltd

In 2022, the businesses started giving me sufficient cash flow. I started thinking of the next steps.

Pros and Cons

Advantages

- The Holding Company owns the trademarks - and is not exposed to the risk of the activities carried out by the operating companies.

- There was flexibility with the Holding Company in creating new operating companies or investing in other companies.

- There was flexibility in keeping the retained earnings (dividends from the Operating Company) in the Holding Company at a reduced tax rate of 25%.

Disadvantages

- Legal & Compliance activities and cost goes up further.

- I still owned the Holding Company. So, if the Holding Company paid me dividends, my taxable income would increase and push a high tax rate.

Investment in other start-ups

I used the Holding Company Pty Ltd to invest in other companies started by people whom I knew personally:

- The Holding Company Pty Ltd bought 20% of shares from a start-up Company A.

- The Holding Company Pty Ltd bought 10% of shares from a start-up Company B.

While I was getting sufficient cashflow from my operations, I was also curious about the below:

- What would happen if something happens to me?

- How do I ensure that my family become the beneficial owners of the Holding Company?

- What are some investment options?

- Should I explore investing in real estate?

- Should I explore investing in shares?

- I have some superannuation fund. Is it performing well? Is there a better alternative? Should I explore a Self Managed Super Fund?

- How do I protect my assets?

Start of the Family Trust

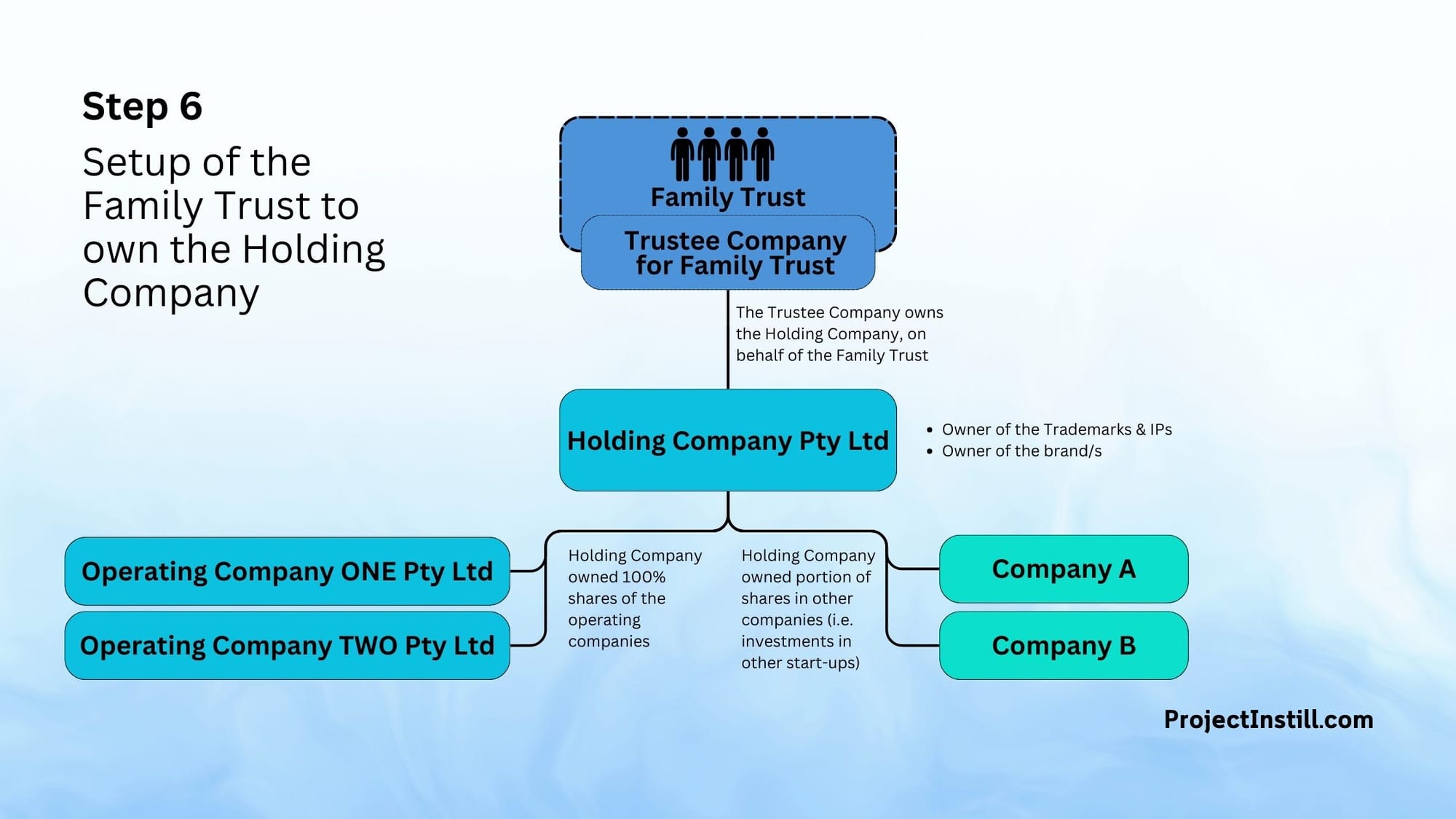

In mid-2023, I executed setting up the Family Trust.

A trust is a business structure that doesn't have an owner, like a company.

The trust has a trustee (a person or a company) to hold and operate the assets for the benefit of the trust beneficiaries. The beneficiaries of the Trust have limited rights and control over the business. However, the Trustee Company controls the assets on behalf of the beneficiaries.

A trust is created by creating a deed document (drafted by a legal entity) that we sign in front of a witness. The deed defines how we operate the Trust.

A company has shareholders - who own a portion of the company based on the number of shares they own. The Trust has beneficiaries who can benefit from the money the Trust earns.

A Company is registered with ASIC (Australian Securities & Investments Commission). Anytime, anyone with proper access can check and validate the company's details with ASIC. However, a Trust is not monitored/tracked by a central agency like ASIC.

There are several types of trusts. Click here to read about them. I set up a discretionary Trust for my family trust.

- I created a new discretionary Trust.

- My family members were named as beneficiaries of the Trust.

- I did not want to be the Trustee (the person who acts on behalf of the trust). So I created a company - a Trustee Company - to act on behalf of the Trust.

- My spouse and I were the directors of the Trustee Company - so we could control the direction of the Trust.

- This is so that my spouse can operate the trust if something happens to me.

- In the future, when the kids grow up, they can also be appointed trust directors.

The target state was that the Family Trustee Company acts as the trustee for the Family Trust.

After the setup of the Family Trustee Company to act as the trustee for the Family Trust, I had to change the ownership of the Holding Company from me to the Family Trust.

- So, as an individual, I sold my Holding Company Pty Ltd shares to the Trust. This included notifying ASIC (Australian Securities and Investments Commission) of the sale of the company's shares.

- As part of the sale, there were tax implications, for which I engaged my Accounting Advisor to navigate the process.

Pros and Cons

Advantages

- There is increased flexibility in income distribution to my family members who are beneficiaries of the Trust. We can decide how much income to distribute to whom.

- The Trustee company reduces liability.

Disadvantages

- The trust can not distribute losses.

- Increased costs to operate and manage.

- The structure is now quite complex. The movement of dividends and calculations needs accounting expertise. In other words, we are now dependent on Accountants!

- The trust has annual administrative tasks that need to be executed.

Start of the Family Investment Trust

In late 2023, I executed setting up the Family Investment Trust.

This was also a discretionary Trust set up independently.

The primary objective of this Investment Trust was to invest in real estate and hold assets for the long term.

The intended outcome of the company structure was to have the Family Investment Trustee Company act as the trustee for the Family Investment Trust:

- My family members were named as beneficiaries of the Trust.

- A Trustee Company was set up because I did not want to be the Trustee (the person who acts on behalf of the trust).

- My spouse and I were the directors of the Trustee Company - so we could control the direction of the Trust.

Once the Family Investment Trust was set up, I purchased a property under the Family Investment Trust.

Further recommended reading: