Reinvesting dividends from ETF investments

Teaching Kids the basics of financial literacy and investing. We learn about dividends and what we can do with dividends.

What did I want to do?

- I wanted to explain to my kids Ash (12 years old) and Adh (10 years old) what was a dividend, and what we can do with dividends.

- As part of this exercise, I also wanted to give them the opportunity to make decisions with dividends.

- We have already gone through why we need to invest and why ETF is an investment option to be considered, and purchasing ETFs on CommSec.

What is dividend?

We get dividend from an ETF if the ETF has a stock pool of companies that pay dividends. ETF issuers collect any dividends paid by the companies whose stocks are held in the fund, and they then pay those dividends to their shareholders - in this example us. Let's break this down:

- Dividend is distribution of the profits by a company to it's shareholders.

- Remember, ETF is a fund that has invested (i.e. purchased shares) in a collection of companies.

- When any of the companies pay any dividend, the ETF issuer will receive the dividend because the ETF is a shareholder of the company.

- After receiving the dividend, the ETF issuer will then pay the dividends to the shareholders of the ETF - in this case us, as we have invested (i.e. purchased shares) in the ETF.

- Since we own ETF shares, we are shareholders of the ETF.

Our first dividend

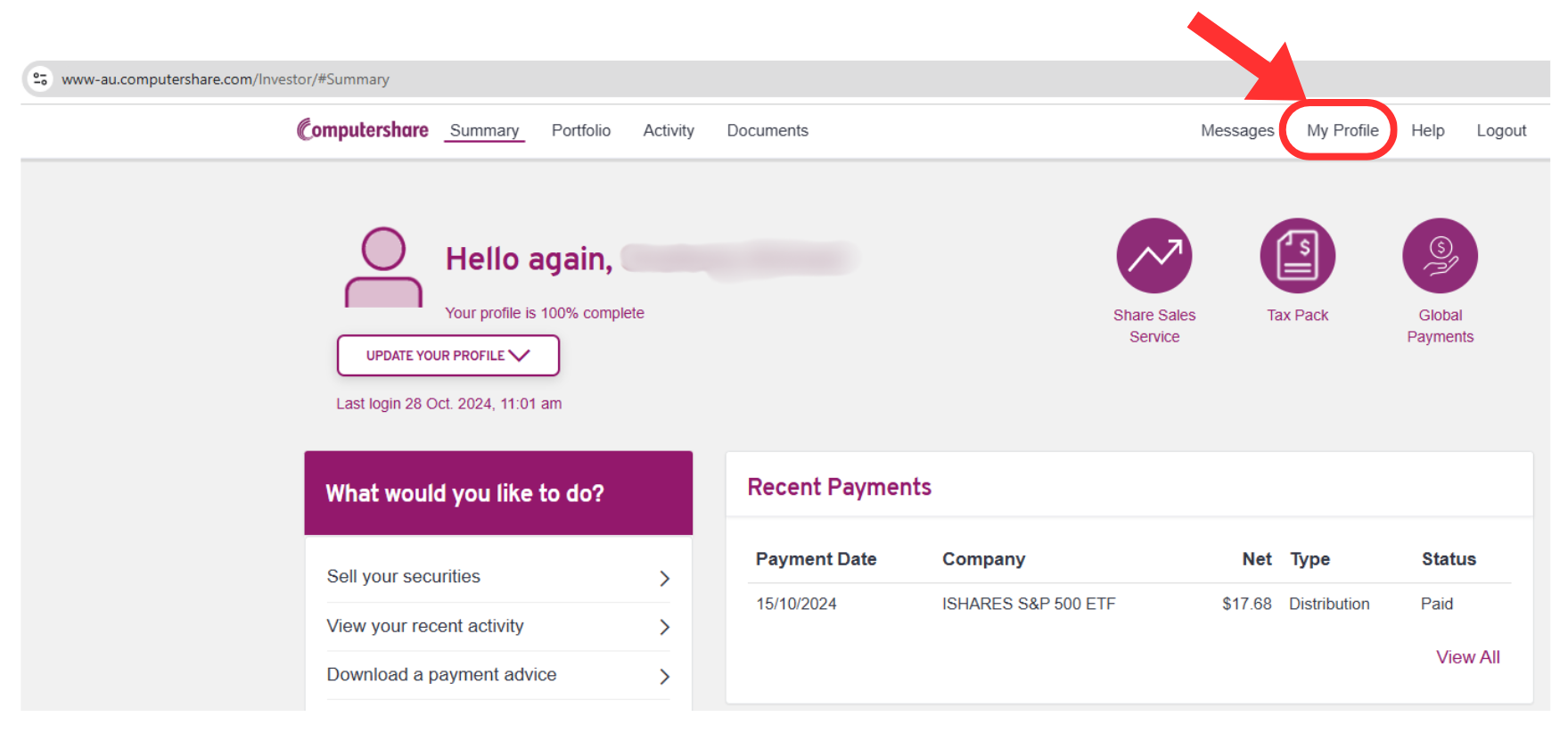

On 15-Oct-2024, I got my first dividend for IVV (ISHARES S&P 500 ETF)

The dividend was paid to my CommBank CDIA account.

I started thinking - what should I do with the dividend?

- Should I take out the money and use it?

- Should I reinvest a portion of the dividend back into IVV in this case?

- Should I reinvest the whole dividend back into the portfolio?

I was not keen on taking the money and spending it.

I wanted to re-invest into the same IVV (ISHARES S&P 500 ETF).

One way of reinvesting would be - to use this money and buy more IVV ETF Shares. But this would mean that I would need to:

- Manually move the money to the investing account, and

- Placing an order for this value. In order to save on brokerage fee, I could add this money along with my monthly investment capital. But this would mean that I manually calculate and add this.

I wanted to understand if I could automate dividends being reinvested.

Dividend Reinvestment Plan

I called CommSec, and they advised me to contact the Share Registry and ask for a Dividend Reinvestment Plan - this was the key word.

In my example, the Share Registry company in Australia for IVV (ISHARES S&P 500 ETF) is Computershare.com/au.

When I called Computershare, they asked the below three questions to verify us:

- SRN/HIN

- Company I have shares with - in this case, IVV (ISHARES S&P 500 ETF).

- My name (in my case, my company and trust name)

The person checked and said IVV offers reinvestment plans.

- This is when I realised that not all shares offer this reinvestment plan!

The person said I can also do it online on their Computershare investor website.

Setting up a Dividend Reinvestment Plan with Share Register

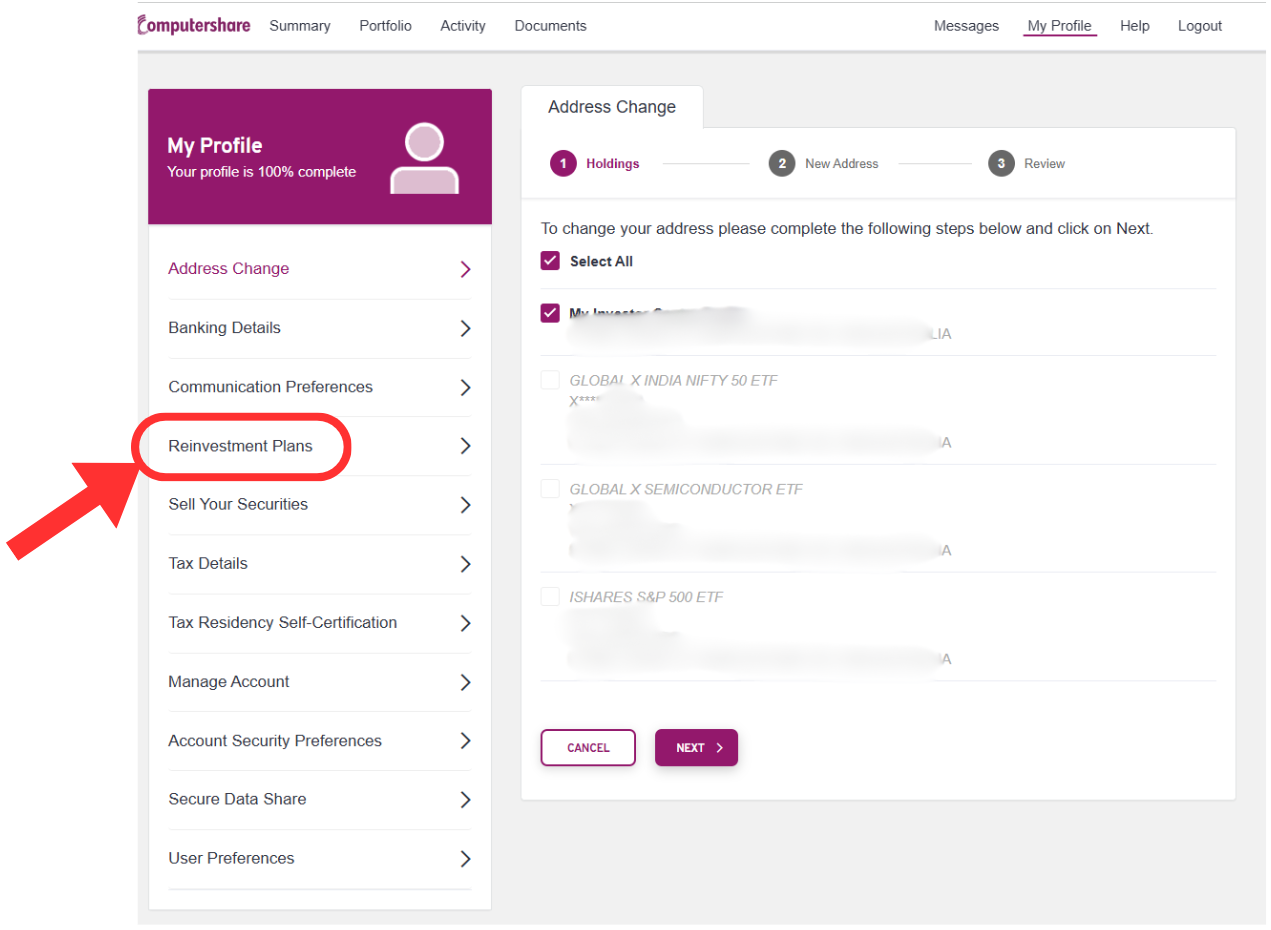

In this example, I am explaining the steps of setting up the Dividend Reinvestment Plan in Computershare Investor website:

- Log in

- Go to My Profile

- Click Reinvestment Plans

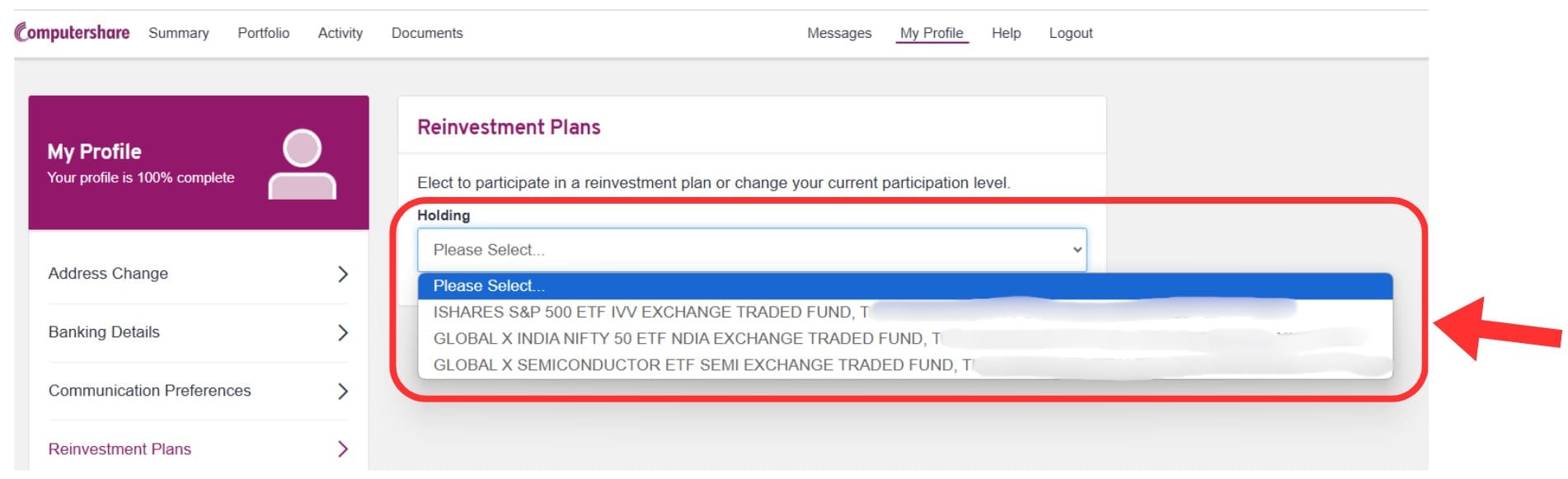

- Select Holding

In this case, I am selecting ISHARES S&P ETF IVV EXCHANGE TRADED FUND.

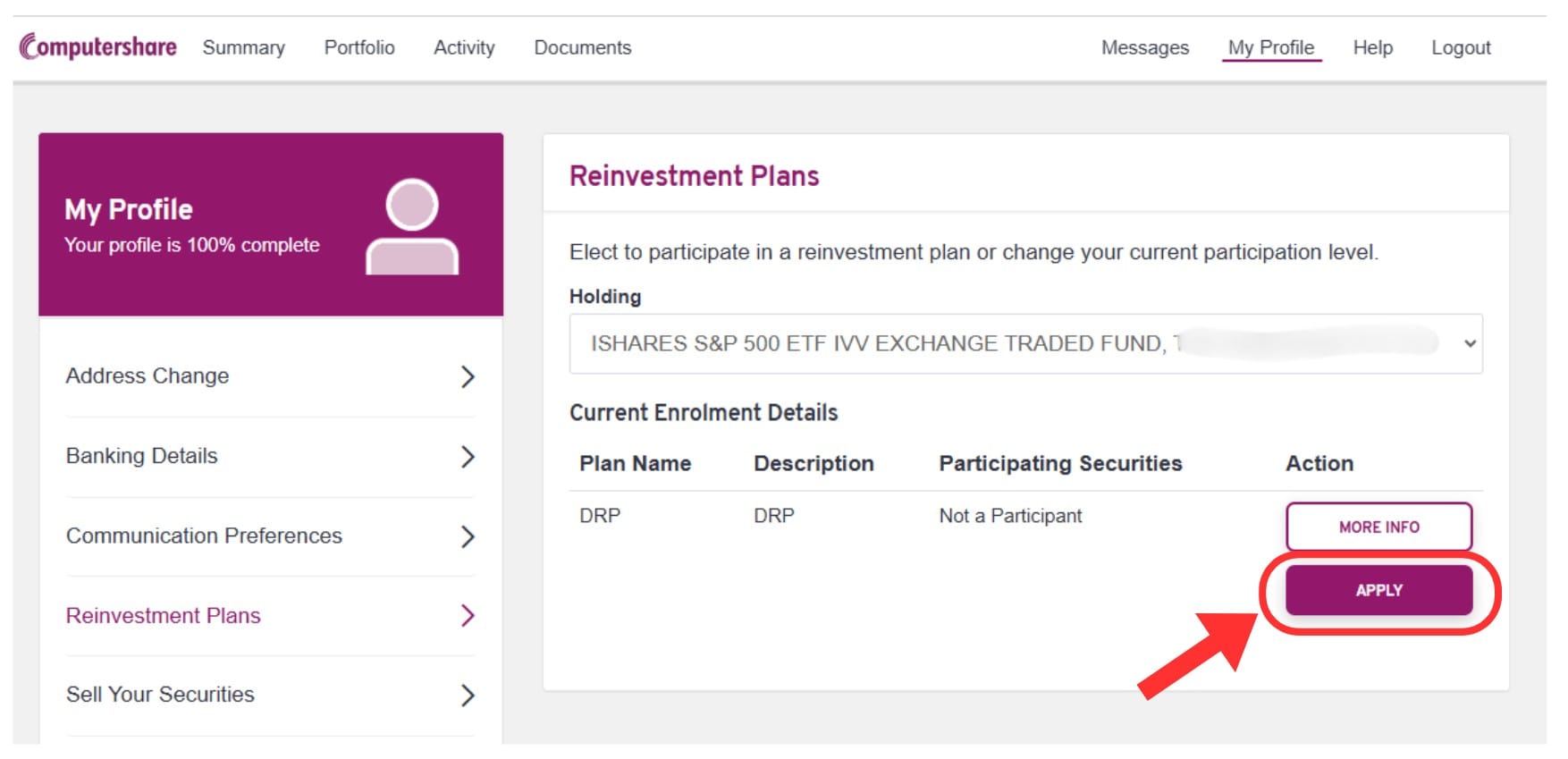

Note: DRP = Dividend Reinvestment Plan

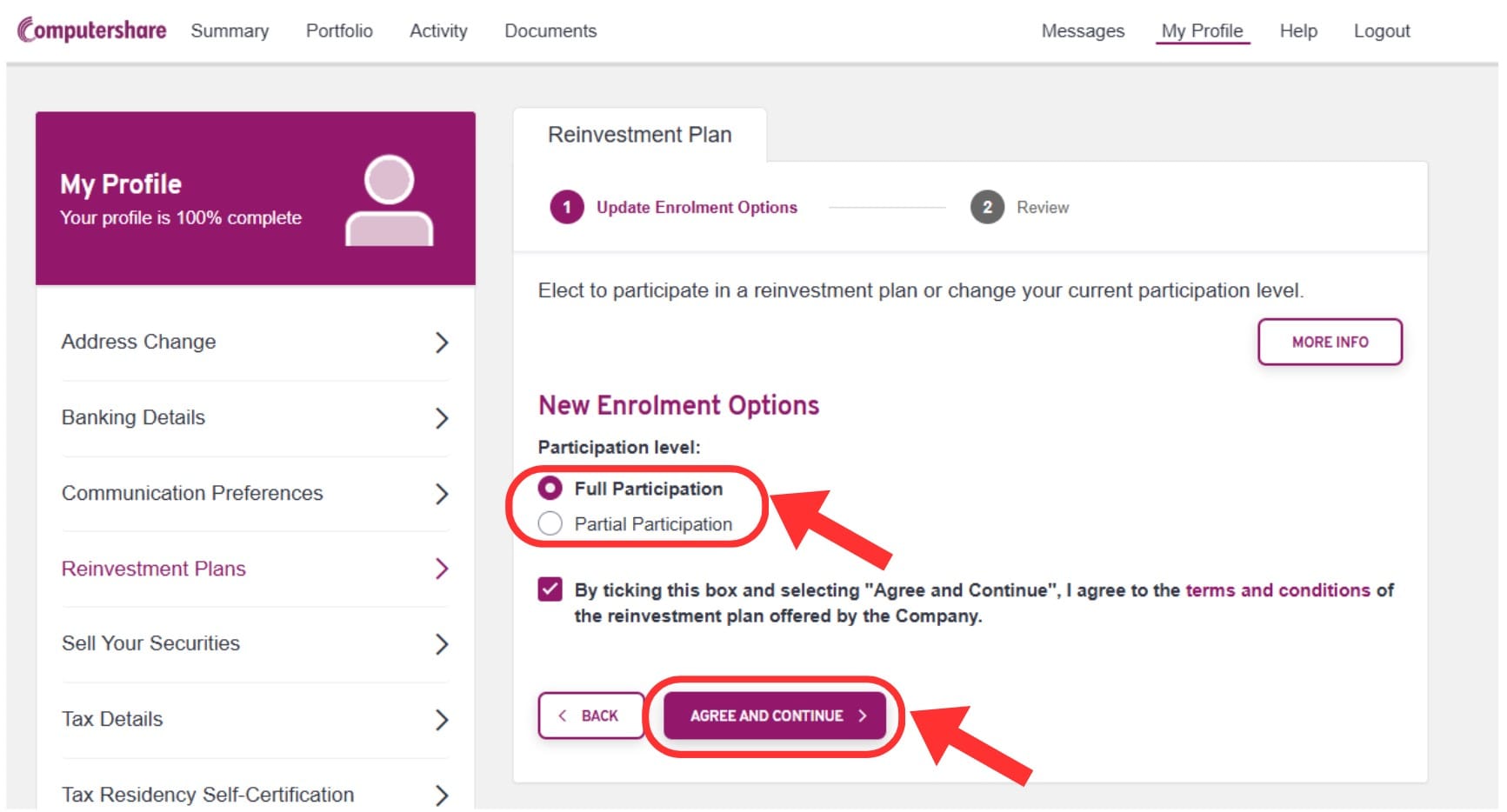

- Select the Participation Level:

- I selected Full Participation, because, whatever dividend I get, I want it to be reinvested in full.

- Click AGREE AND CONTINUE.

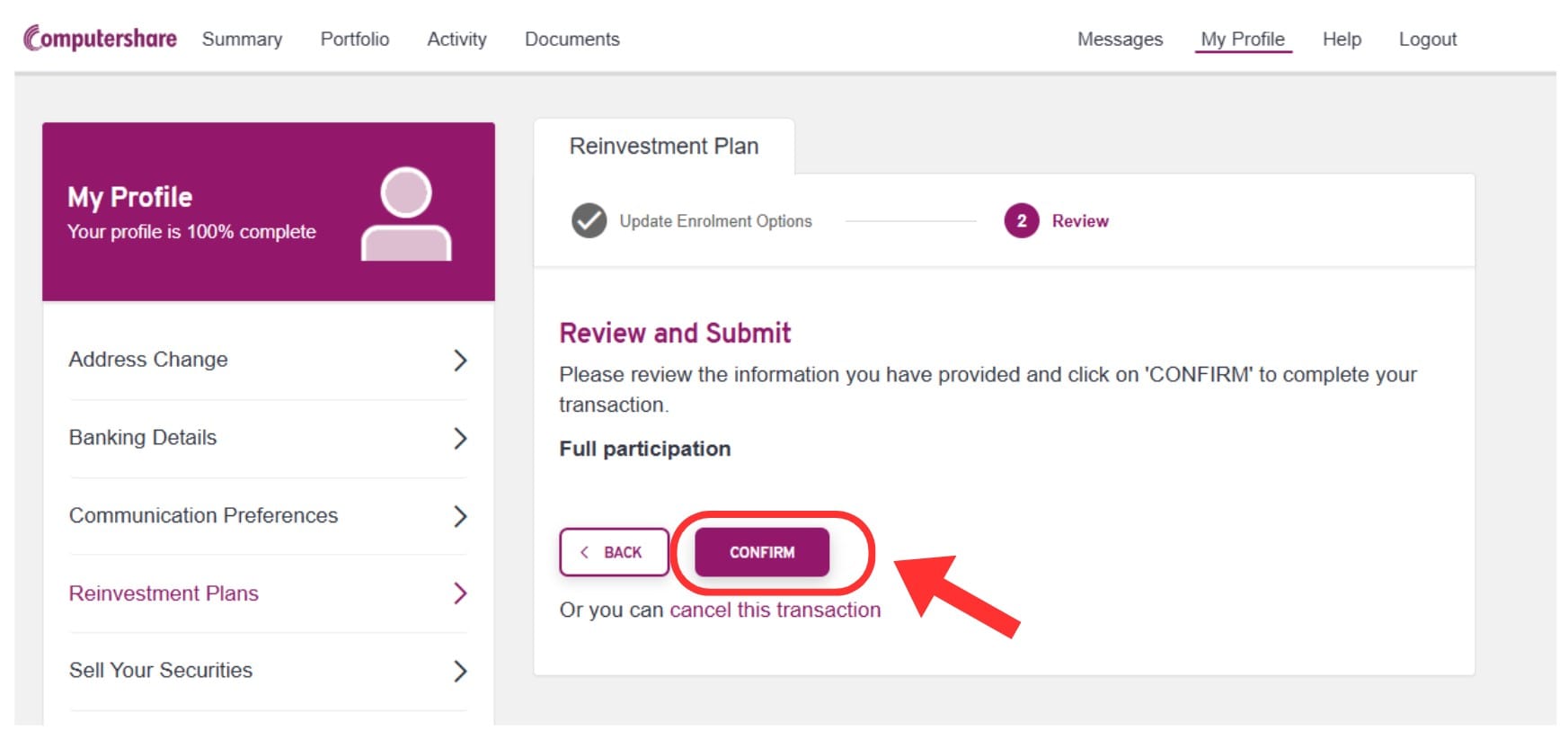

- Review the details and click CONFIRM

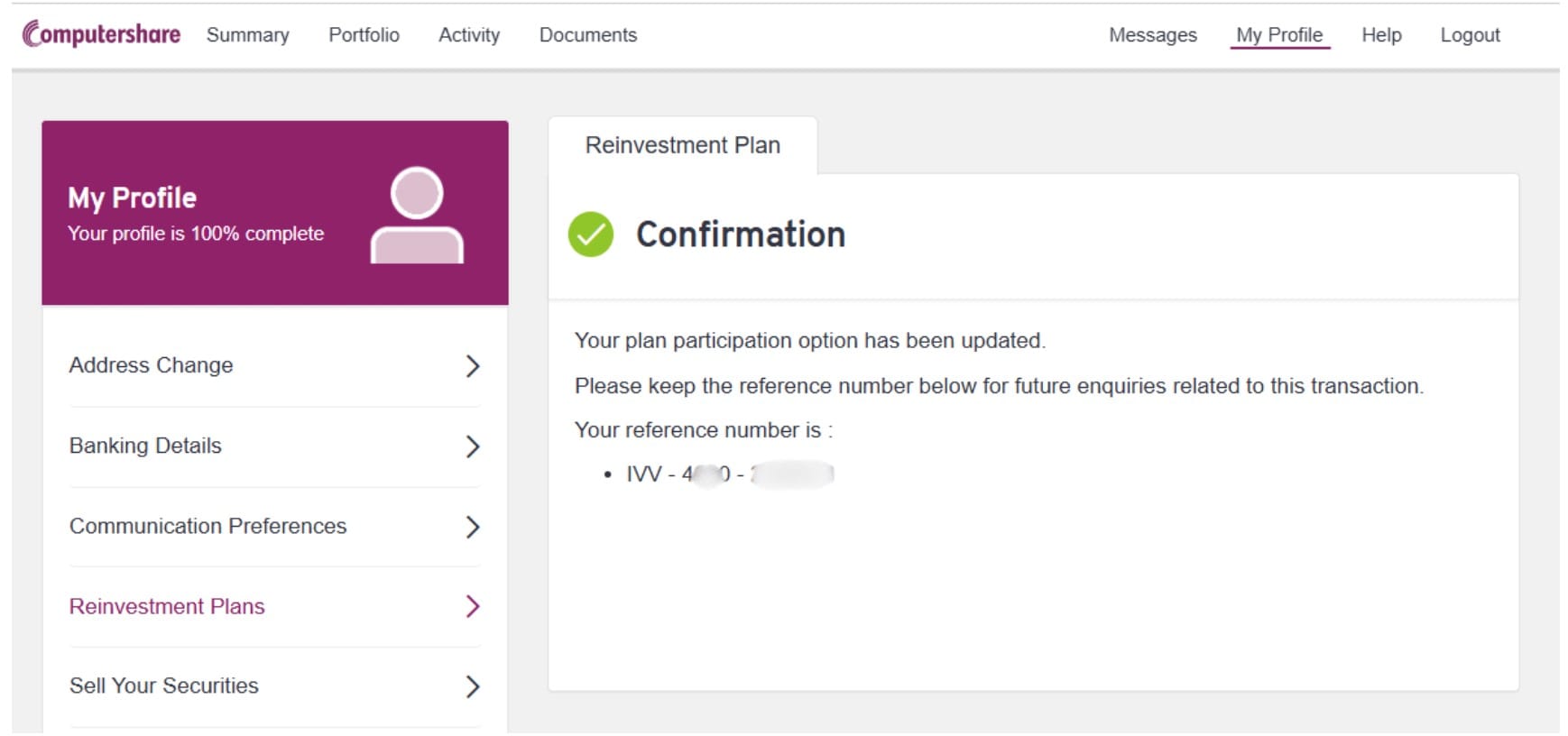

- The next page will be a Confirmation screen displaying the reference number

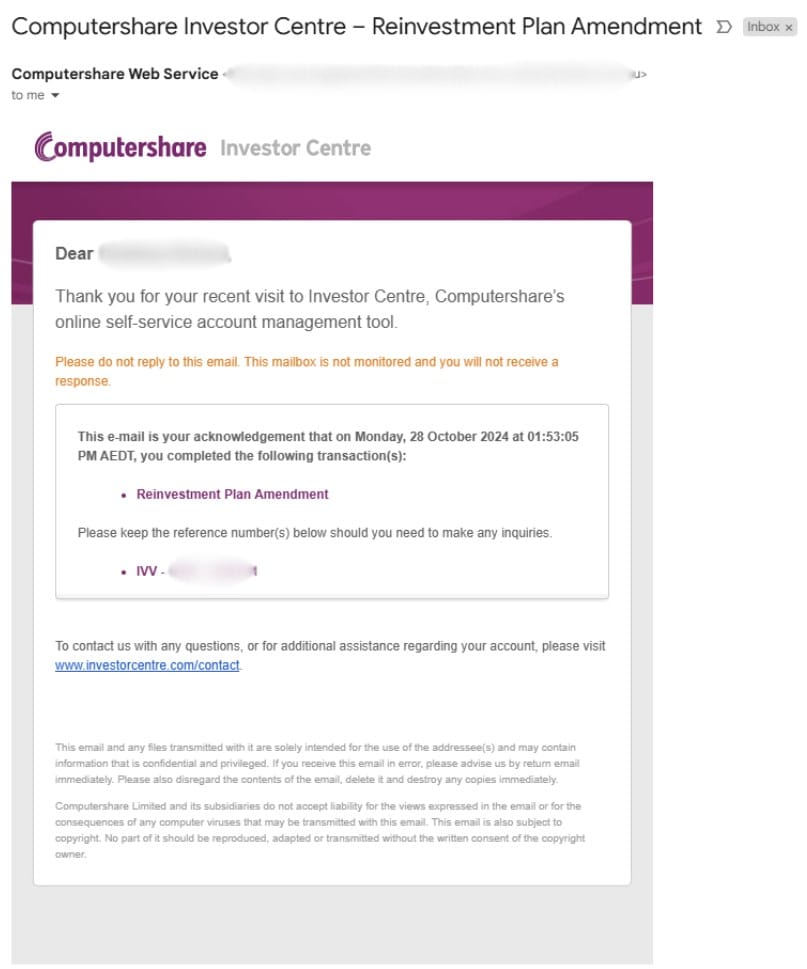

- I also received an email as below

That's it!

Next Step

Let's look at:

- How do we bookkeep dividends?