Recording a refund in Xero

Teaching kids about recording a refund in Xero bookkeeping.

What did I want to do?

- I wanted my kids to record a refund that we received.

- I had cancelled the Elementor plan, for which we received a refund.

- I wanted to introduce the below concepts:

- When do we get refunds?

- How to reconcile refunds?

- We have already done the following:

- Learnt the basics of reconciliation by doing a few bank reconciliations in Xero.

- Recorded multiple combinations of invoices in Xero.

Refund Transaction in Bank statement

Below is how the refund transaction hit our bank account.

A couple of observations:

- The amount refunded was 110.88 USD.

- The amount that hit our bank account was 181.42 AUD. We are expecting to see this value in Xero bank feed import.

- Even though the transaction says Value Date: 11/08/2024, the amount hit our bank account on 14-Aug-2024.

- We expect to see the date 14-Aug-2024 in the Xero bank feed import.

- We expect to see the date 11-Aug-2024 in the Elementor refund document.

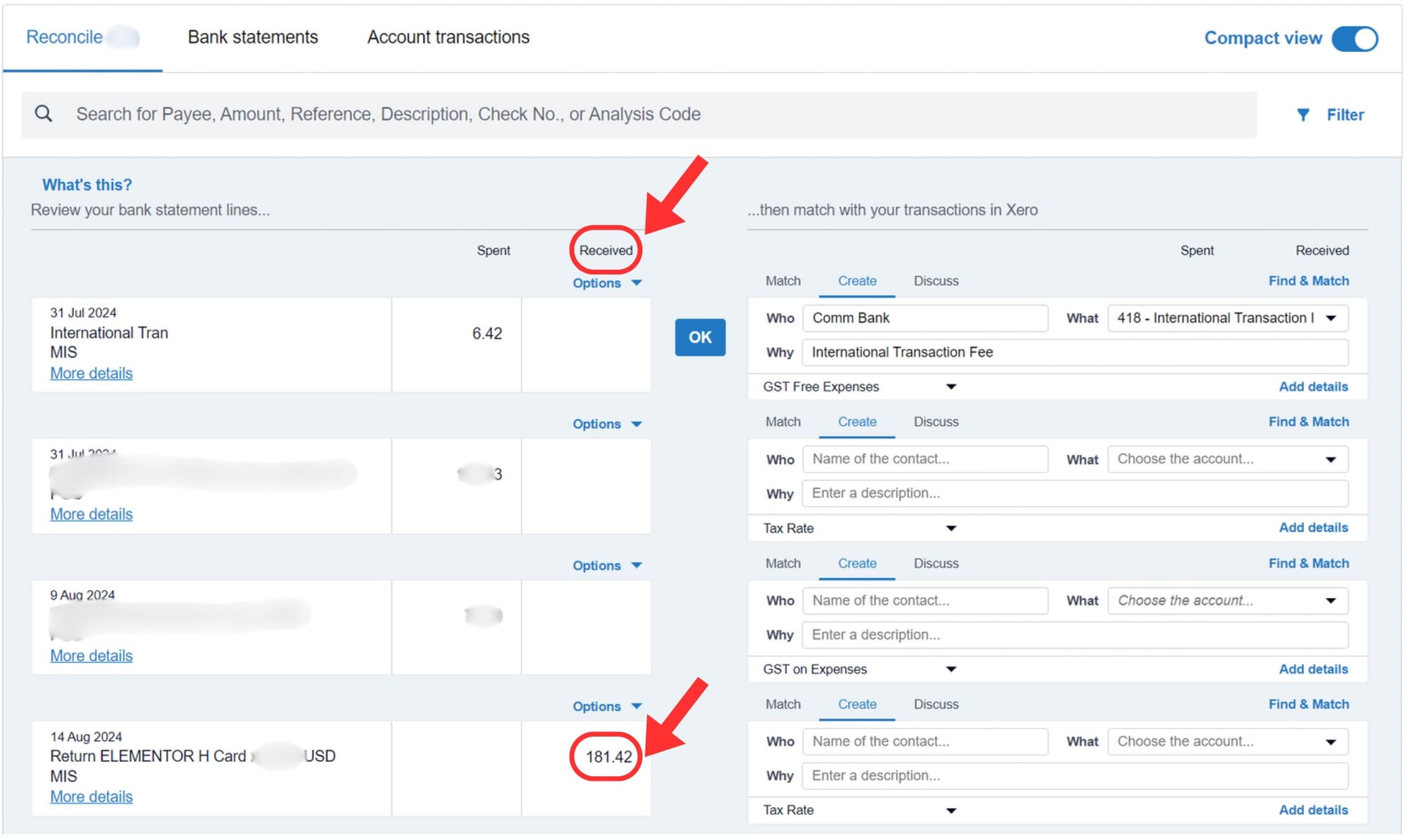

Refund Transaction in Bank feed appearing in Xero

Below is how the transaction appears in Xero.

A couple of observations:

- The amount 181.42 appears in the Received column of the left section.

- The bank feed that came into Xero was also dated 14-Aug-2024.

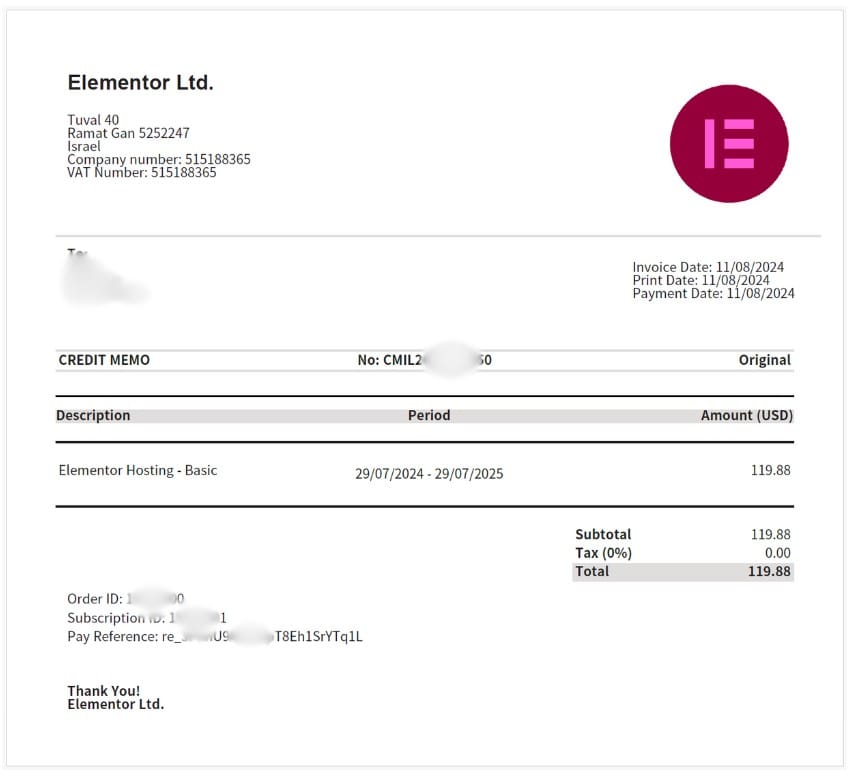

Refund note provided by Elementor

When I cancelled the Elementor plan, below is the document I received from Elementor explaining to me how much was being refunded.

The refund credit note says that 119.88 USD is being refunded.

Note: GST is not being refunded because GST was not collected in the payment I made when I originally purchased the Elementor plan.

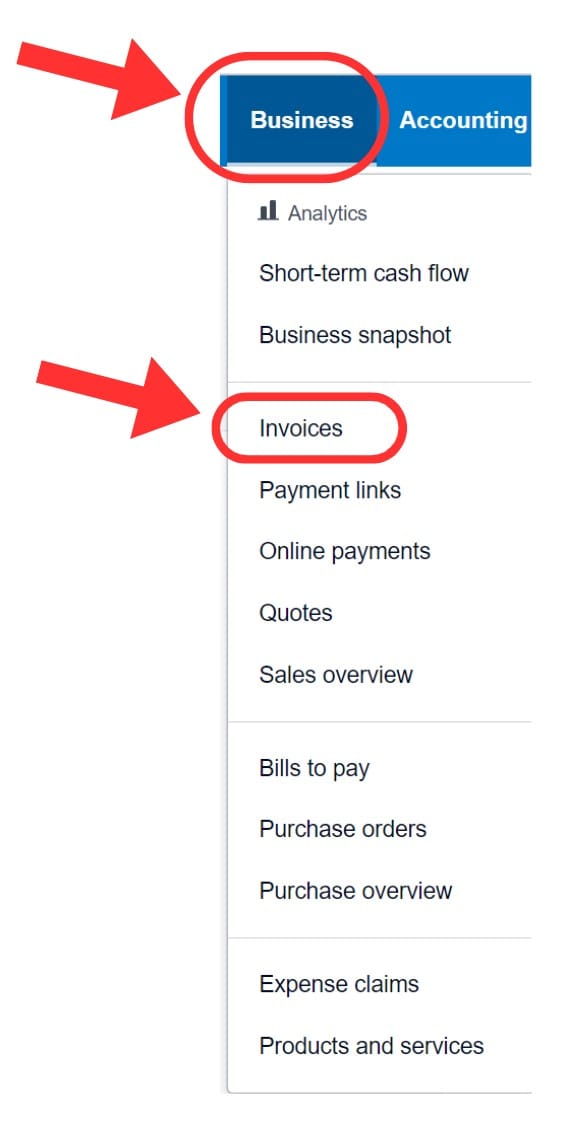

How to record a refund in Xero?

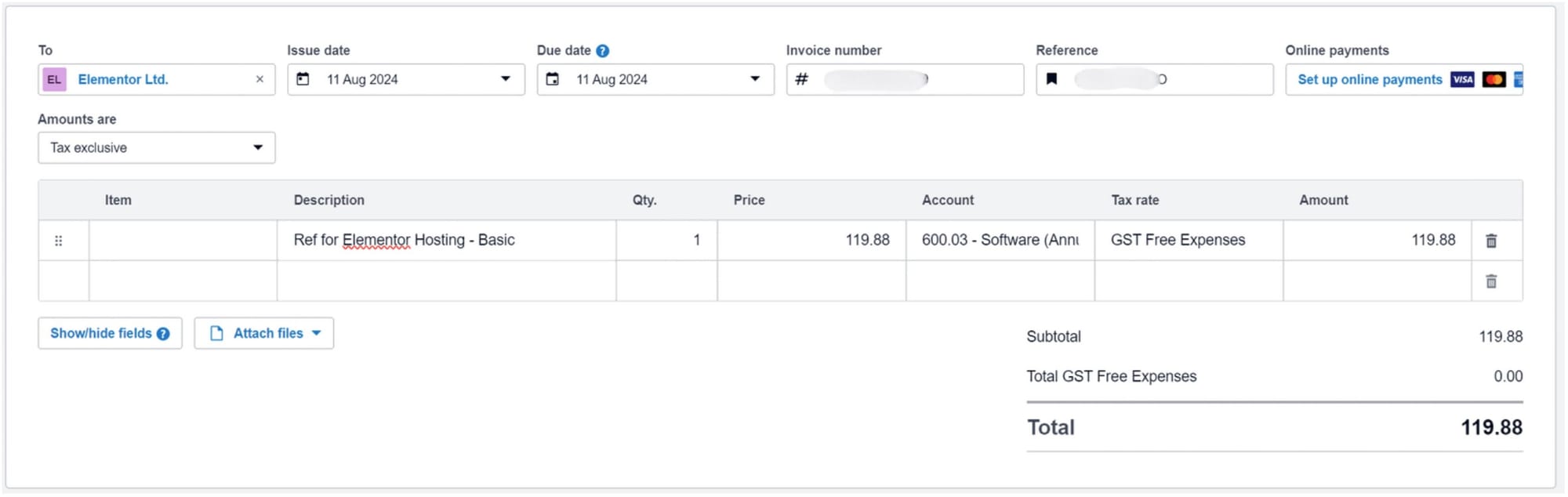

The refunds will need to be added by creating a new Invoice.

We have to create an invoice.

So, I showed this on my screen. This is a kind of pre-training of invoices.

- Click Business

- Click Invoices

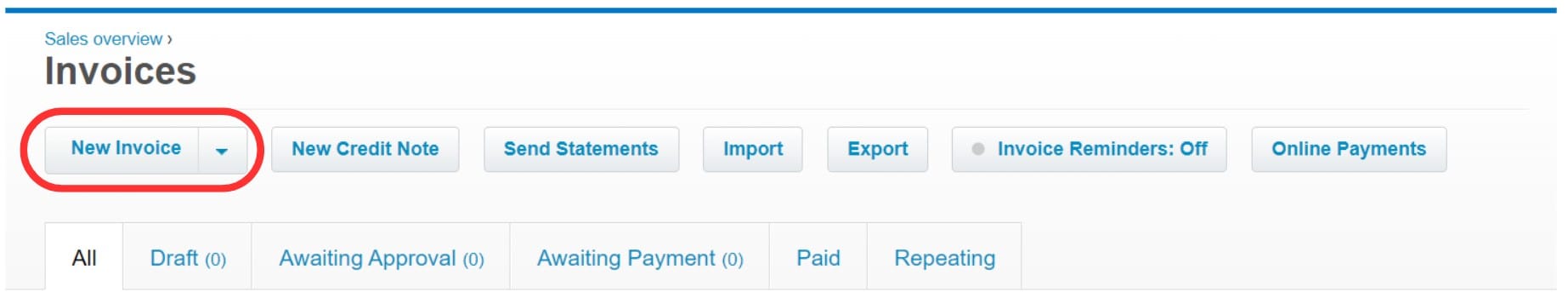

Click New Invoice

Enter the below details:

- To (the company name, in this case, Elementor)

- Issue date

- Due date

- Invoice Number

- Reference

- Description

- Price

- Account: Choose the same account you used when you made the purchase). In this example, I chose the same account, Software Annual, and marked it as a GST-free expense.

The next step is reconciliation.

We will look at reconciling the sales invoices at a later stage.

Next Step

Now it's time to record different types of invoices to see what we can learn next! Check out our next step here.