Bank Reconciliation in Xero

Teaching Kids Business. What does the term reconciliation mean in bookkeeping? It's the process of checking if the records we have are correct. Read this article for step-by-step instructions on how to reconcile in Xero.

What did I want to do?

- I wanted my kids (12 and 10 years old) to learn about expenses, how we record them, and how we reconcile them in Xero.

- I wanted to use this opportunity to explain the reconciliation process in Xero.

- We had already created invoices in the same base currency AUD, and one with a different base currency USD.

What is Bank Reconciliation in Xero?

Bank reconciliation is the process of comparing the record of sales and expenses against the bank records. It is the process of checking and confirming if all the transactions in our bank accounts are recorded correctly in Xero accounting records.

Reconciliation = comparing two sets of records to check that the figures are correct, confirming that the accounts are consistent and complete.

Objective

The objective of bank reconciliation in Xero is to check if we have recorded all the bank transactions correctly.

What does the Objective mean? Why do we need to reconcile?

The aim of bank reconciliation in Xero is to:

- match each statement line in the bank account to an existing transaction (such as revenue or expense) in Xero, or

- create a transaction during the reconciliation process.

This process also helps us to:

- find and fix data entry mistakes or missed transactions.

- identify fraud or wrong payments.

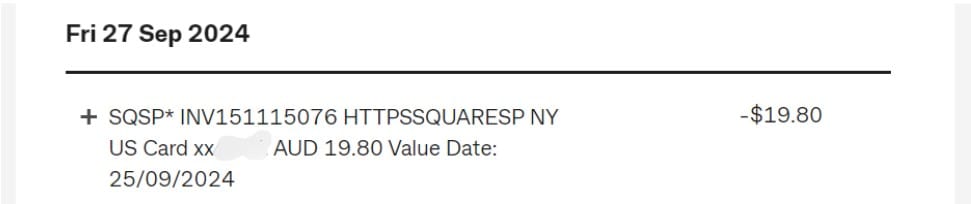

Reconciliation of the same currency invoice

First, let's look at the transaction on the bank statement for the SquareSpace Invoice in AUD.

See that the bank transaction also has the Invoice number. This will come in handy because it will be easy to match this transaction against what we have entered in Xero.

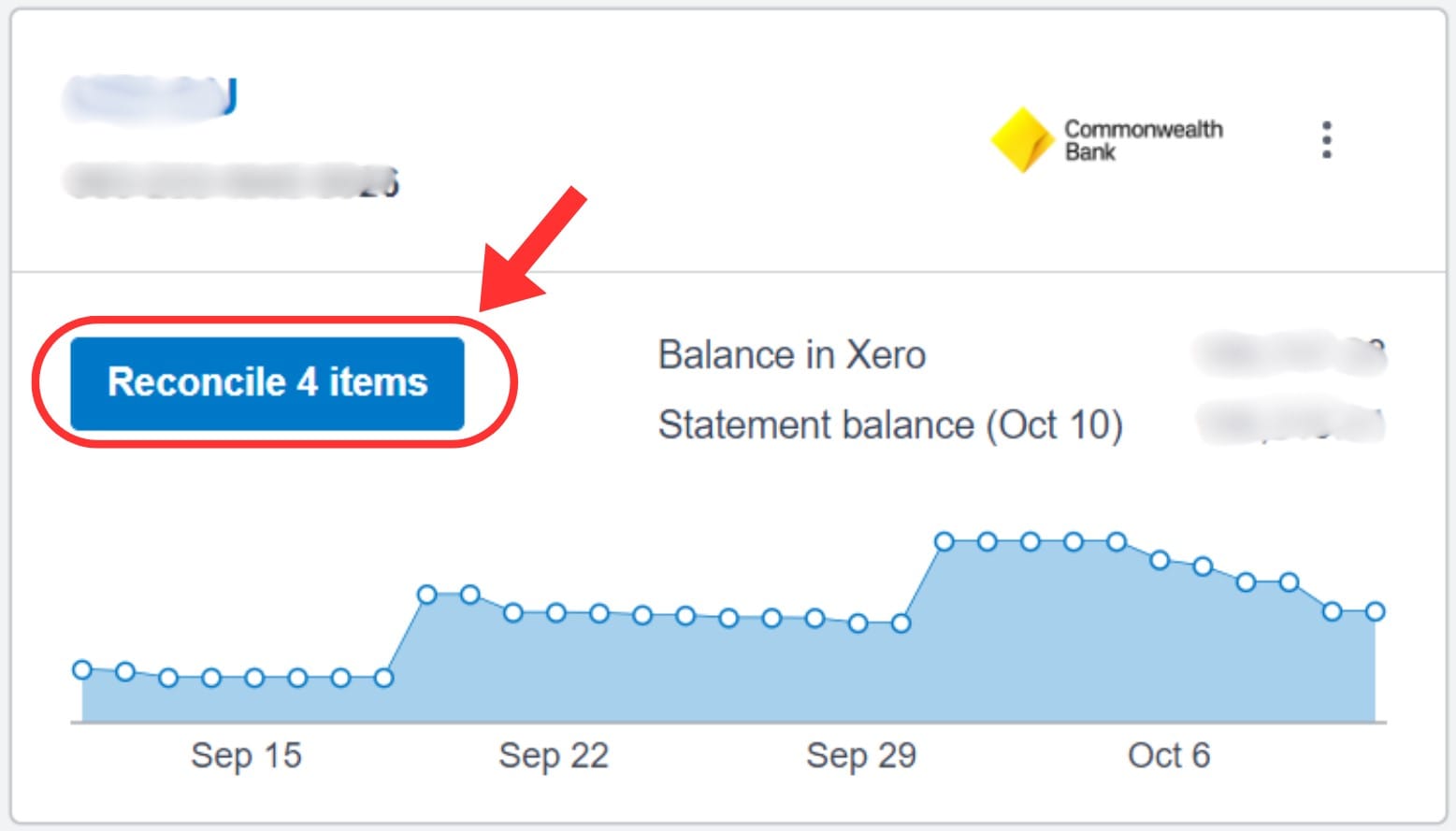

Now, we need to check if this transaction has come in correctly as part of the daily automated feed into Xero.

Note: It is too early to explain the daily automated bank feed into Xero to the kids. This can be learnt at a later stage.

Go to Xero and click on the Reconcile button.

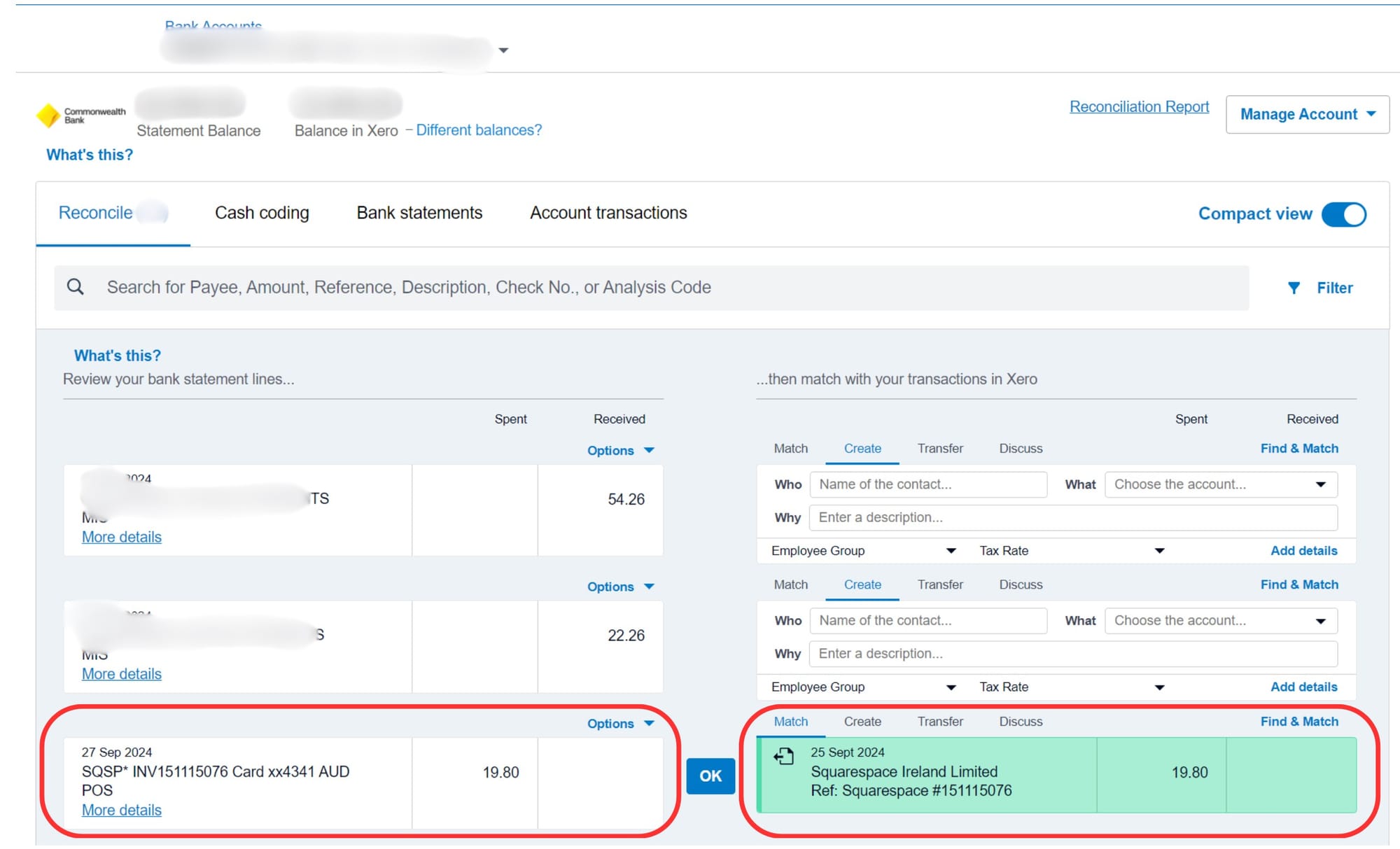

Since we added the SquareSpace Invoice number in the reference field when we created the expense in Xero, and this reference number matches the transaction in the bank account, the associated line item will appear green.

On the left is the list of transactions Xero imported from the bank.

On the right is what we need to do - either create a new transaction or match it to an already created record.

The Xero system automatically identified the match, making it easy for us.

All we have to do is click the OK button.

That's it!

Reconciliation for this transaction is complete!

Next, let's look at a transaction where the Xero system does not automatically identify a match.

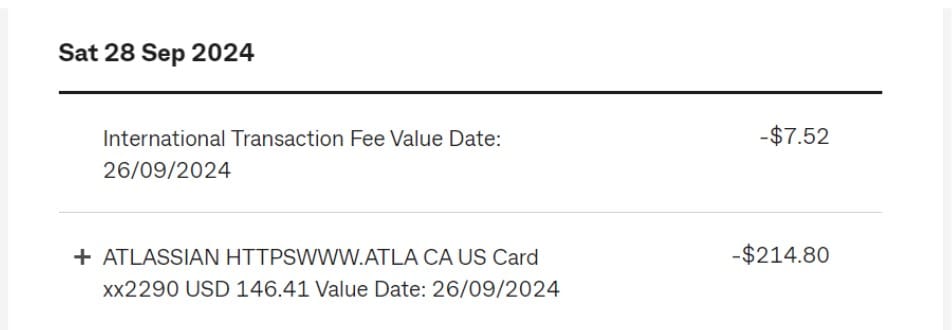

Reconciliation of a different currency invoice

First, let's look at the transaction that appeared on the bank statement for the invoice with a different base currency USD. Note: The invoice we entered in Xero was in USD, but our bank account card is in AUD.

Let's see what came into our bank account.

A couple of things to note here:

- The Invoice reference number did not appear in our bank transaction. So, there isn't enough information for the Xero system to automatically identify and match the expense we created in Xero.

- Even though the invoice was for 146.41 USD, the amount deducted from our bank account was 214.80 AUD.

- There is another charge, "International Transaction Fee", of 7.52 AUD. This fee is charged by our bank - for paying in a different currency (i.e., in any currency other than AUD) because our bank account's base currency is AUD.

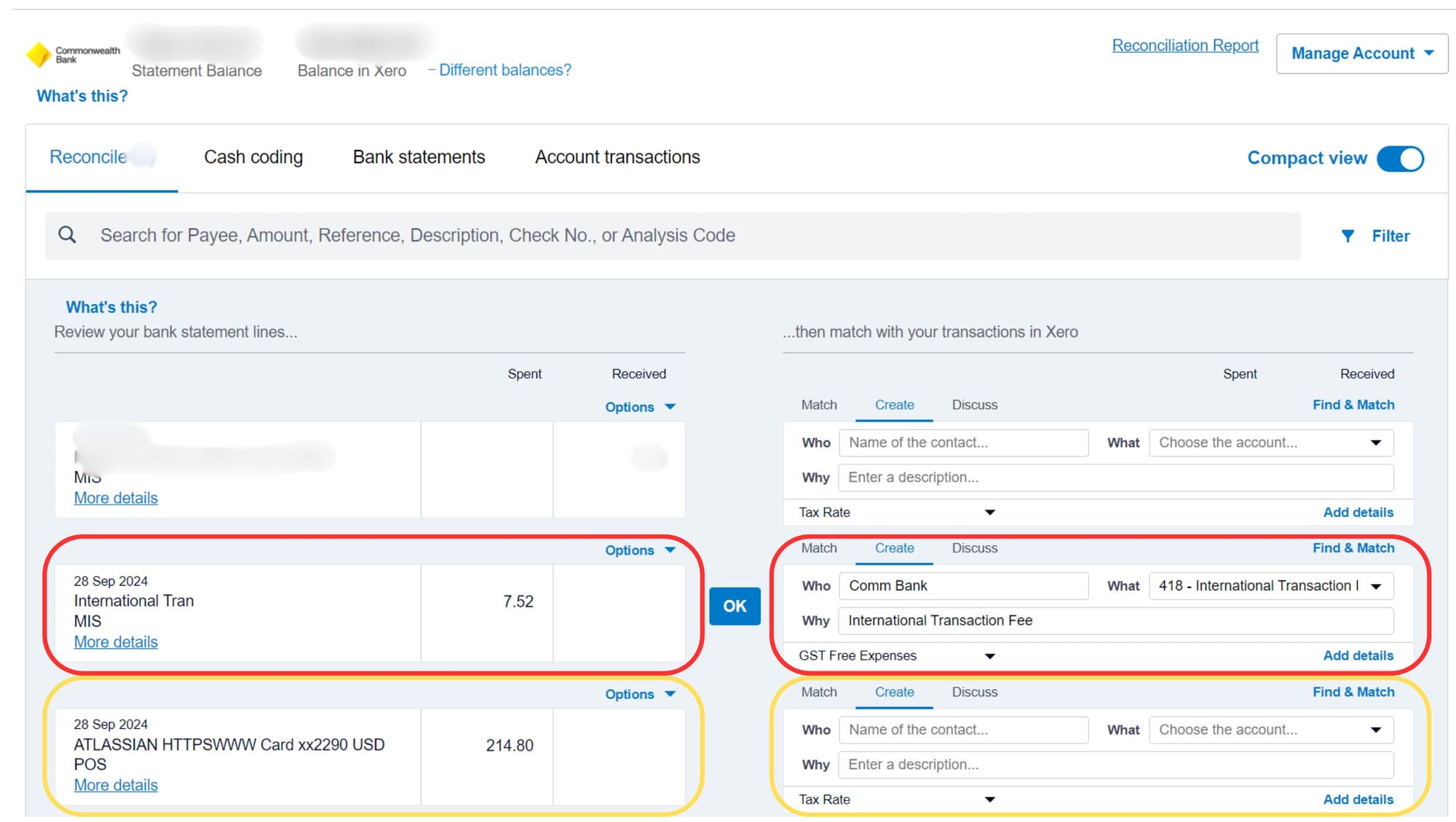

Let's see how they appear in Xero after the daily feed pulls this bank data into Xero.

On the left is the list of transactions Xero imported from the bank.

On the right is what we need to do - either create a new transaction or match it to an already created record.

International Transaction Fee of 7.52

- The left shows the transaction of 7.52 under the Spent Column.

- The right, even though the system did not find a match, has been pre-populated based on similar old entries I had made. I had several such transactions in the past, and every time I had a bank charge like this, I would reconcile them against the 418 - International Transaction Fee code.

- This has made it easy for me (because I had similar transactions in the past).

- I can click OK or Add details to add additional information and create the record.

- That's it! Reconciliation for this International Transaction Fee is complete!

Atlassian payment of 214.80 AUD

- Even though the Atlassian invoice was only 146.41 USD, the money deducted from my bank account was 214.80 AUD. This is due the the currency conversion we discussed earlier.

- The left shows the transaction of 214.80 under the Spent Column.

- The right does not show anything and is empty. This is because Xero has not identified a match. After all, the invoice number was not included in the bank transaction. Xero also did not pre-populate based on similar transactions in the past.

- This means - we have to create a new transaction.

- But wait! - We had already created the expense transaction previously.

- This means we don't have to create one, but rather, we can MATCH this transaction to the previously created expense record.

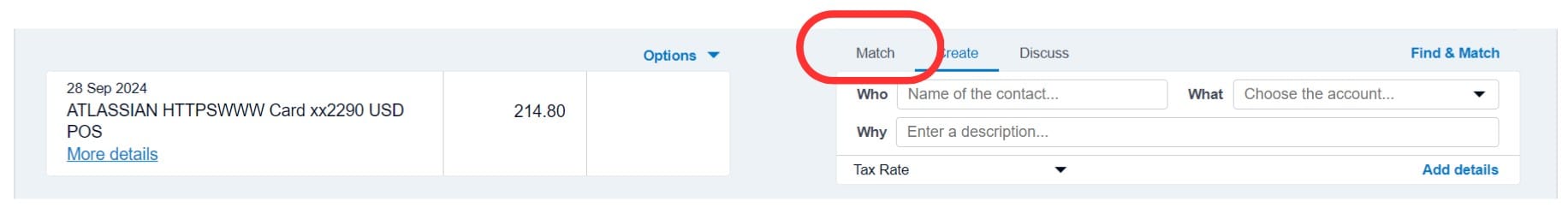

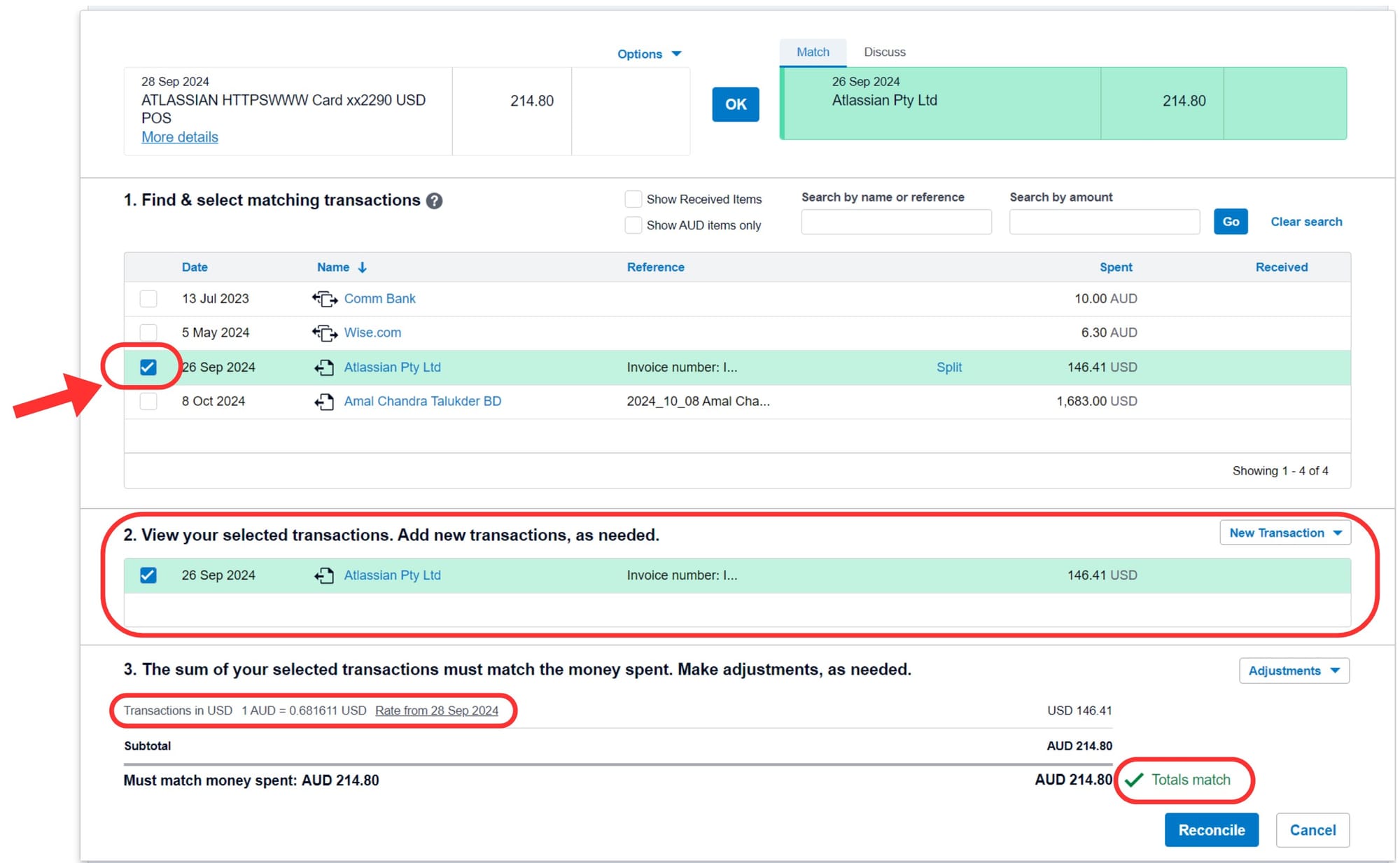

Click on Match

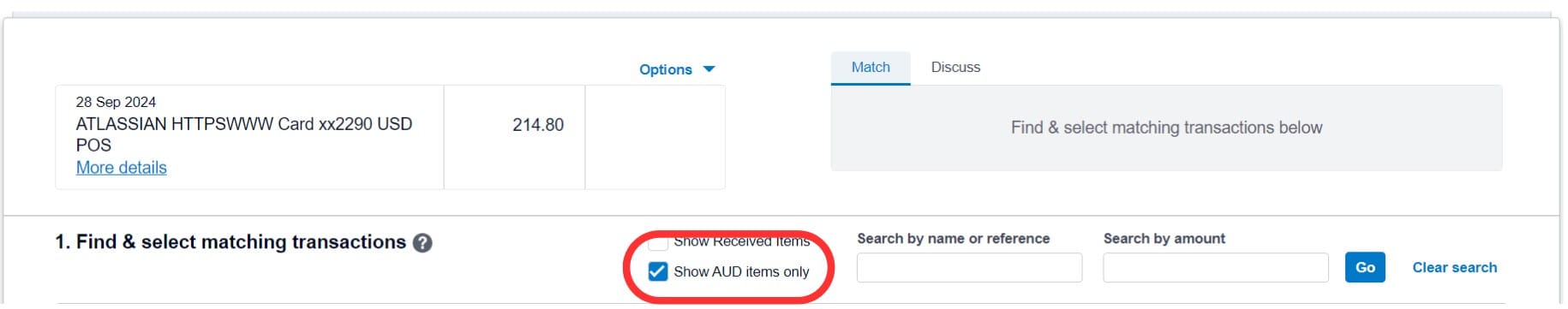

In the next step, since we will match an invoice recorded in Xero in USD, we need to un-check Show AUD items only.

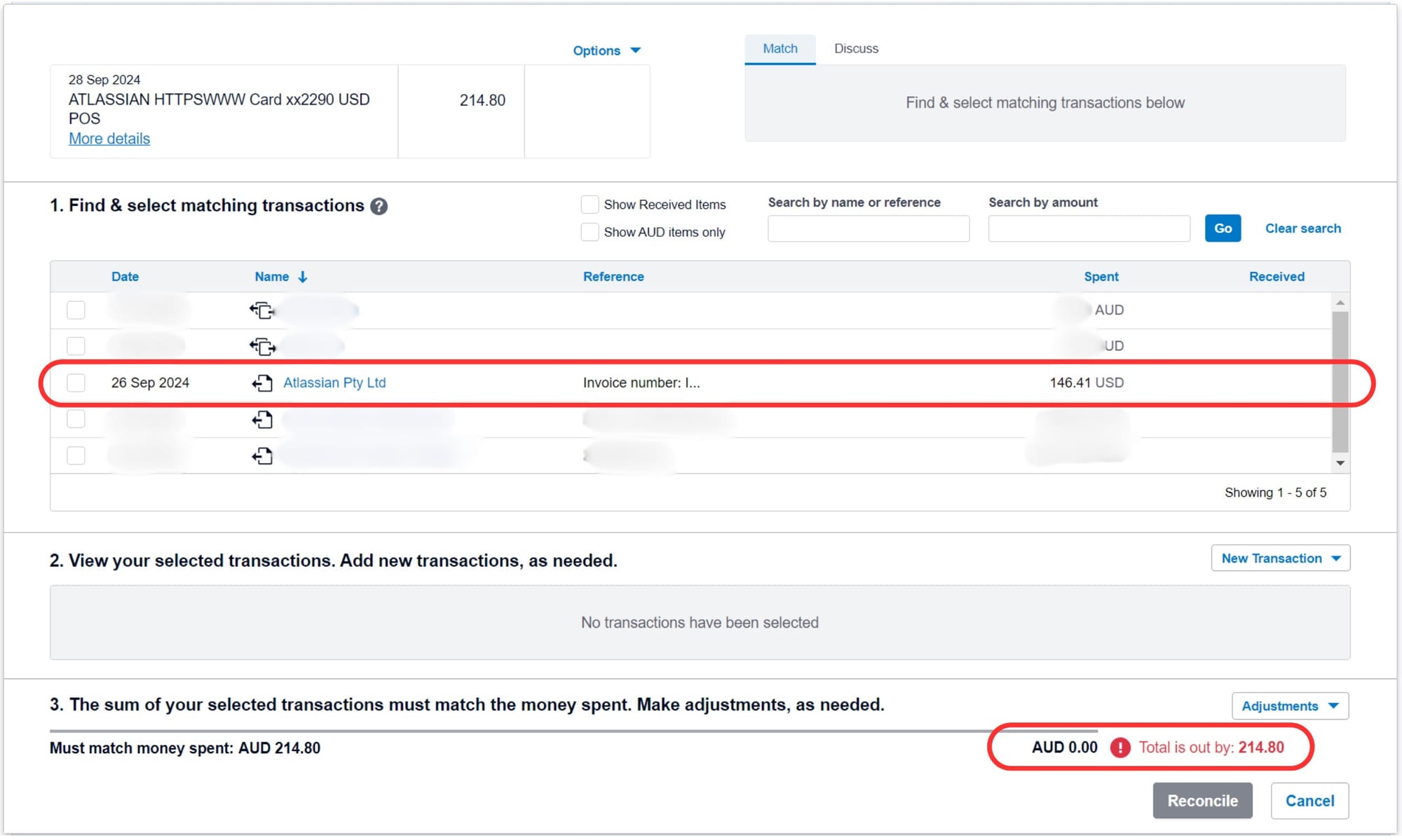

This will show all the invoices recorded in non-AUD currencies.

At the bottom right will show in red that the Total is out by: 214.80.

When you select the expense, the transaction will be matched and appear green.

A couple of things to observe:

- The bottom right corner shows that the Totals match.

- Section 3 - also shows the Currency Exchange Rate that Xero has deduced based on the Expense recorded in USD in Xero vs the money we paid in AUD from the bank account. Note: This excludes the International Transfer Fee charged by the bank.

Now, all we have to do is click Reconcile.

That's it!

Reconciliation for this transaction is complete!

Next Step

Now that we have understood the basics of reconciliation, it is time for us to do more expense records to practice.

As and when different types of expenses are added, we will come back to reconciliation to understand how they are done.

There are more things to learn, such as:

- Split Invoice

- Adjustments

- Bank Fee

But they are for a later day!

Check out our next step here.

This post will be updated with new scenarios as and when we learn.