Investing in ETFs - Buying and Selling on CommSec

Teaching Kids the basics of financial literacy and investing. Step-by-step instructions on using CommSec to buy and sell ETFs.

What did I want to do?

- I wanted to explain to my kids Ash (12 years old) and Adh (10 years old) how to purchase ETFs using the CommSec brokerage platform.

- As part of this exercise, I also wanted to complete the bookkeeping process after the purchase is completed.

- We have already gone through why we need to invest and why ETF is an investment option to be considered.

Considerations before starting investments in ETFs

- Personal or Company or Trust?

- Create an account in Brokerage

- I applied for a CommSec account.

- Making the first purchase

- What should I expect after purchasing the ETFs?

- Bookkeeping - how do I account for the transactions

- How much should I invest?

- Key Challenges

-> I am not a Legal Expert.

-> I am not a Tax Expert.

-> I am not a Corporate Structure Expert.

-> I am not a Financial Planning Expert.

-> I am not an Investment Strategy Expert.

I am not an expert in anything!

Please research and engage relevant experts before you make any decisions.

The information I've shared is of a general nature and should not be considered as advice. It does not take into account your objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information provided regarding your objectives, financial situation and needs. In particular, you should seek independent professional advice and engage relevant experts before making decisions.

Personal or Company or Trust?

I had a few thoughts in mind before starting ETF investments:

- I want to hold the investments for the long term.

- I want to hand over the investments to my kids in future. In this case, I want minimal tax implications.

- If something happens to me now, I want my family (spouse and kids to receive the benefits of my investments).

- When I sell an ETF, I want minimal tax implications.

Before reading the below, please check on how I have structured my companies and trusts to understand the context of how I inferred the impacts in my circumstances.

If I make ETF investments in my name:

- One day, if I want to give the investments to my kids, then I may have to sell the ETFs and give the cash to them. This will be a sale event triggering tax implications.

- If I make a sale, then the profit I make from the sale of the ETF will increase my taxable income for the year - thereby pushing me to a high tax bracket.

- I am not sure how it works when I pass away. How does the transition work? How will the kids receive the benefits? I am not sure.

If I make ETF investments in my Holding Company:

- The company will be the owner of the ETFs.

- The company is owned by my Family Trust, which has my family members as beneficiaries. So, if something happens to me, my family already controls the investments.

- If the company sells an ETF and has a profit, this sale event will trigger tax implications as the company's profit increases.

If I make ETF investments in my Family Trust:

- The Trust will be the owner of the ETFs.

- The Trust has my family members as beneficiaries. So, if something happens to me, my family already controls the investments.

- If a Trust makes a capital gain, it can be distributed to its beneficiaries.

- Trusts are eligible for the 50% CGT discount if an ETF was held for more than 12 months and then sold.

My decision

- Invest in ETFs in our Family Trust.

Apply for a CommSec account

I used CommSec because I am already a customer of CommBank - and I am comfortable with CommBank services.

Importantly - I was just too lazy to research and find out which brokerages are in the market to analyse and pick the best.

Yes - I am lazy!

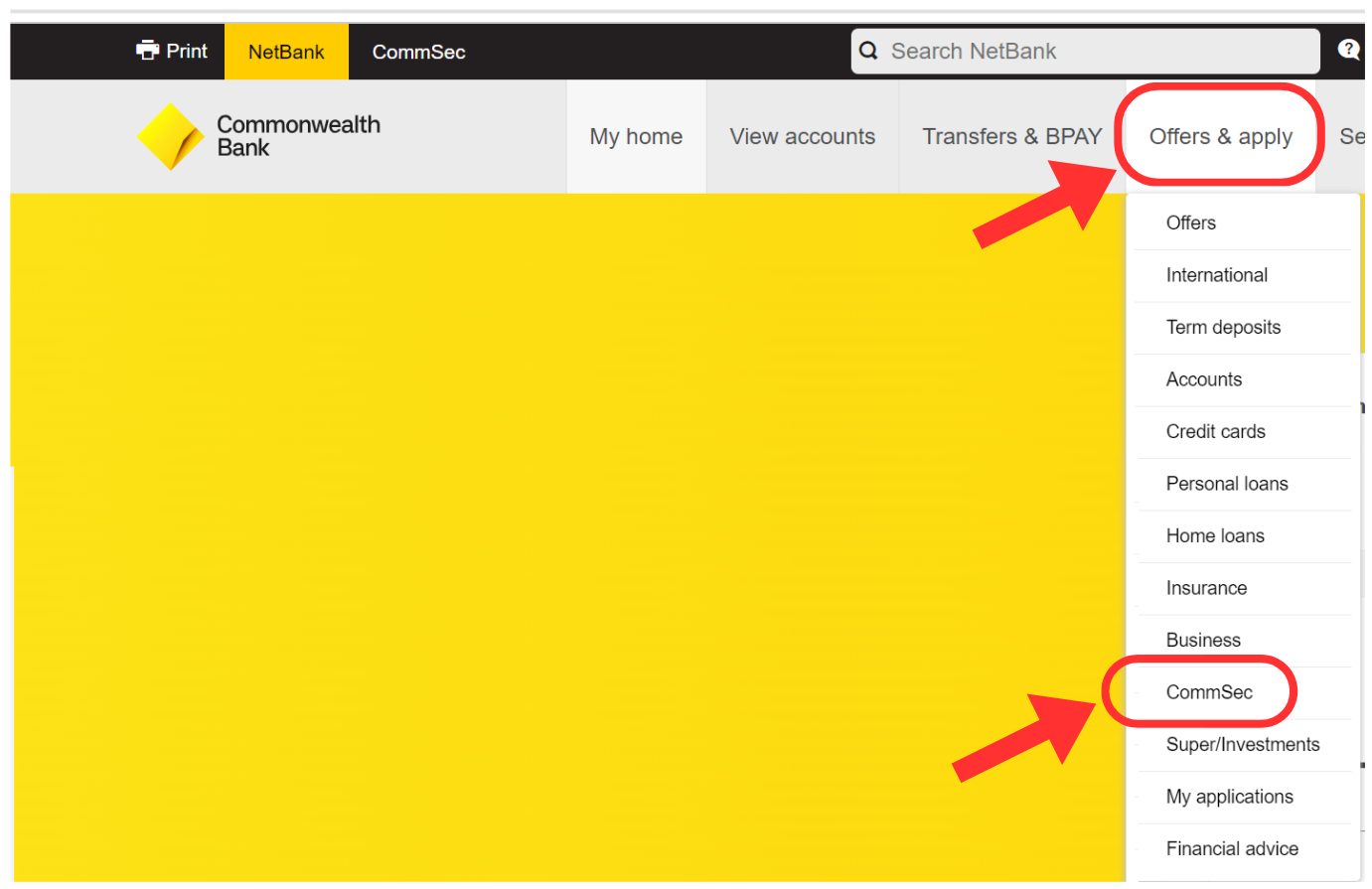

- Log into CommBank (Note: I am already a CommBank Customer)

- Click Offers & apply

- Select CommSec

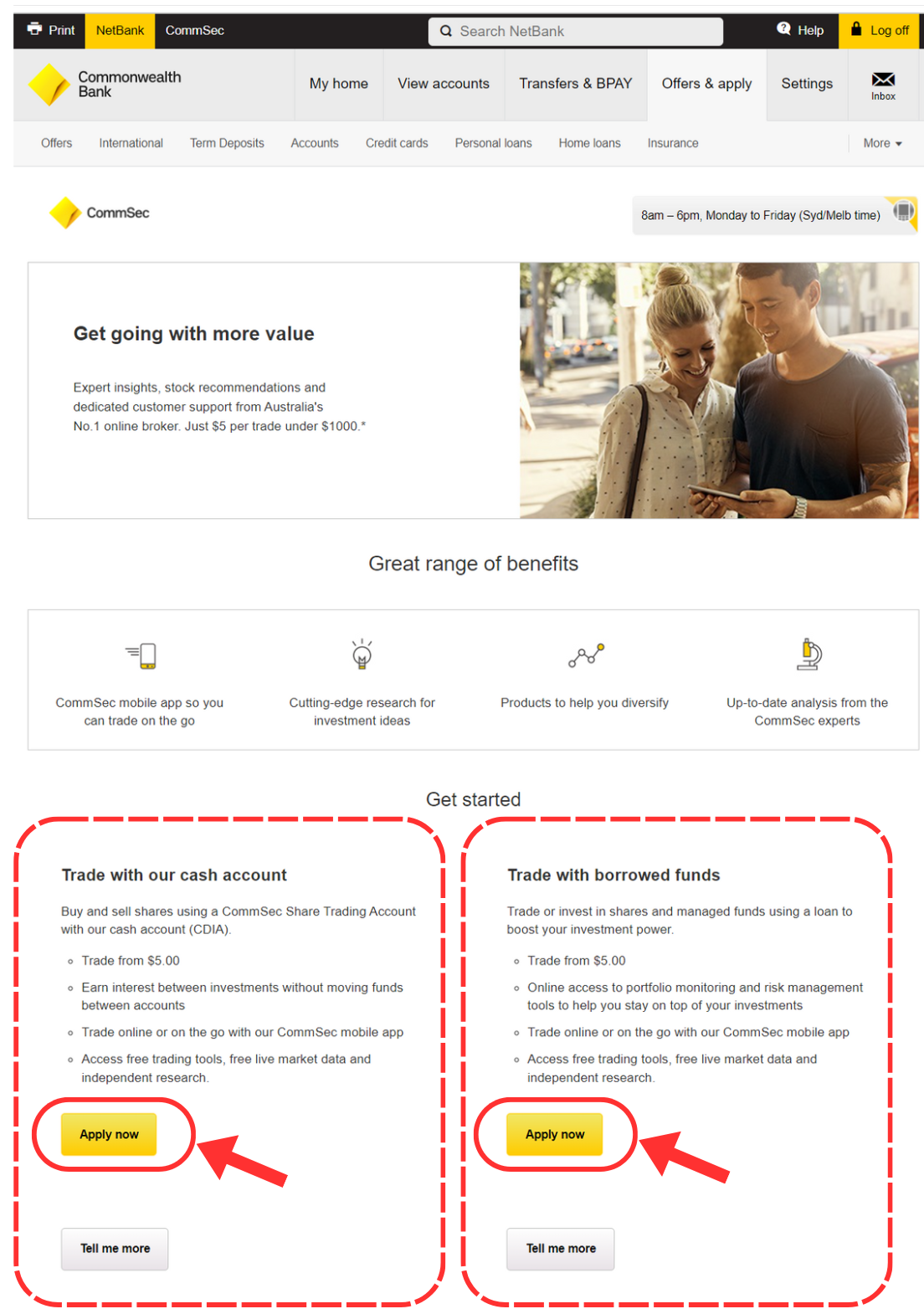

- Choose Account and click the button Apply now.

- There are two options: Trade with our cash account and Trade with borrowed funds.

- I chose the left option - Trade with our cash account. This will open a CommSec Share Trading Account with the cash account (CDIA).

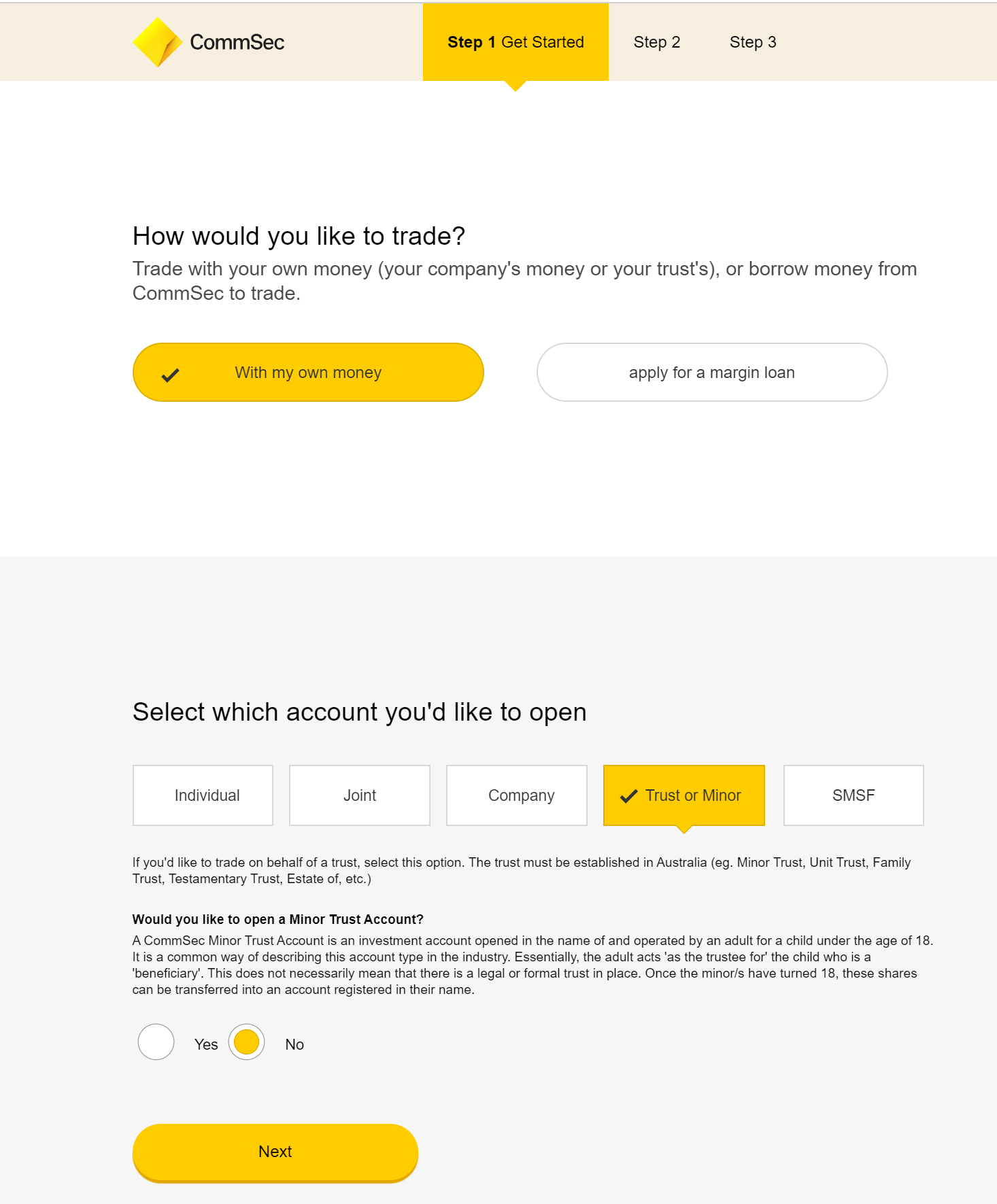

- On the next page: Step 1:

- Question: How would you like to trade?

- I selected: With my own money

- Question: Select which account you'd like to open?

- I selected: Trust or Minor

- I also selected No for the question: Would you like to open a Minor Trust Account?

- Question: How would you like to trade?

- On the next page: Step 2:

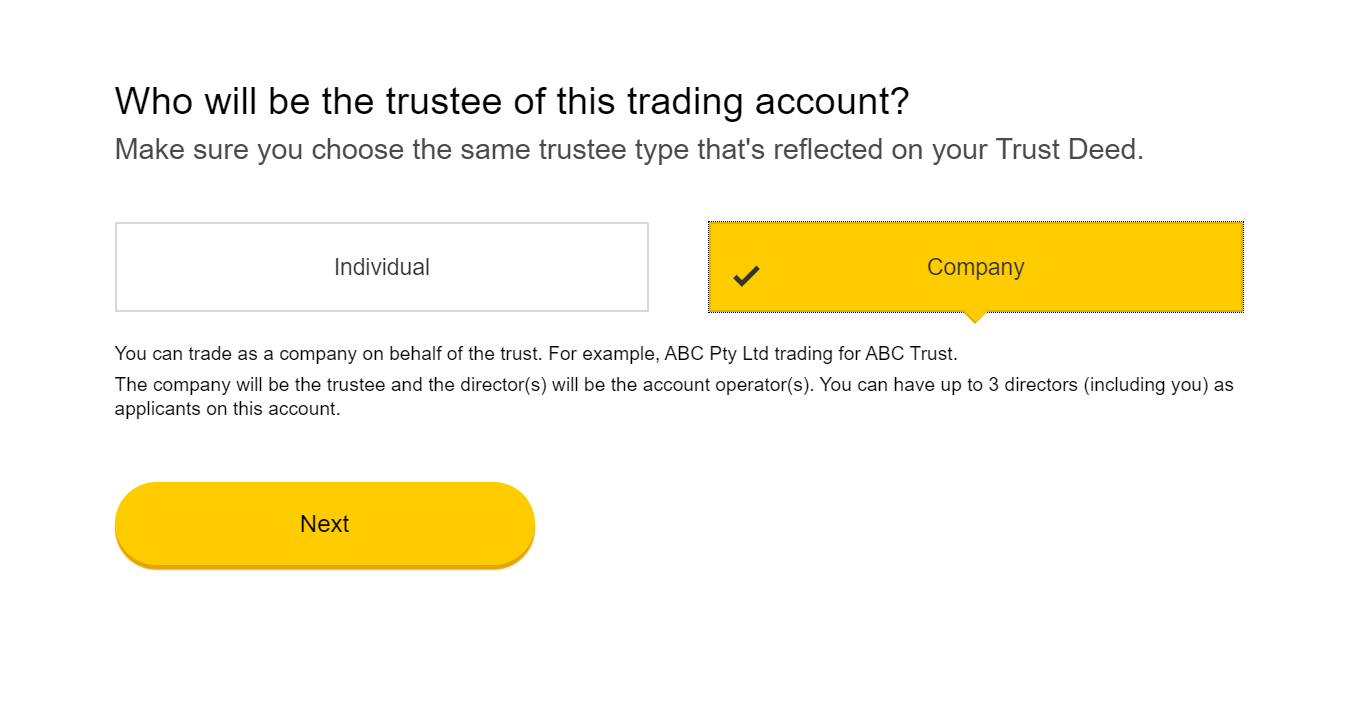

- Question: Who will be the trustee of this trading account?

- I selected: Company

- Note: This is based on how the trust is setup. I have a Trustee Company acting as trustee for the Family Trust.

- On the next page: Step 3:

- Please follow the guide to complete the details of your trust.

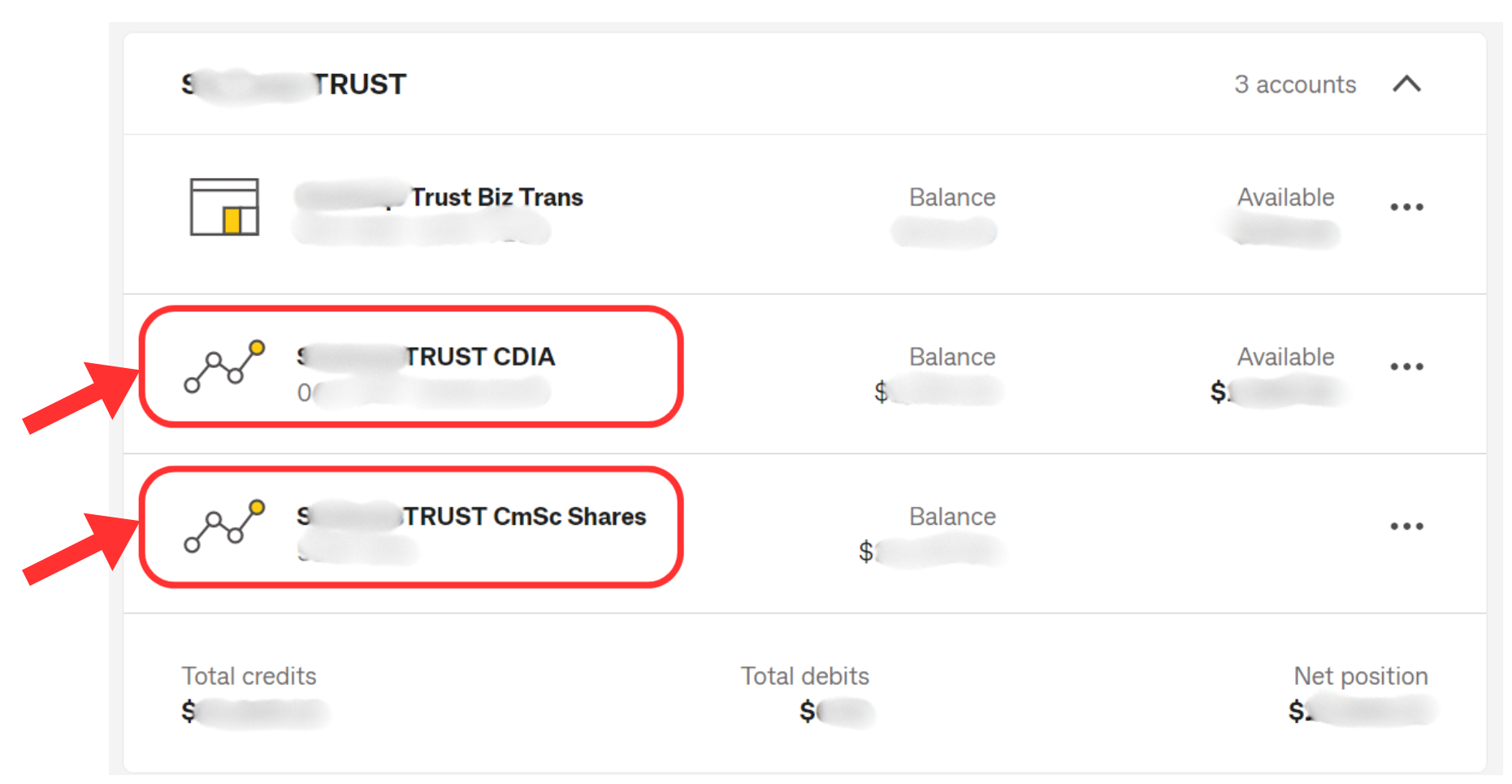

After getting CommSec approval

After CommSec application has been approved, the below two accounts will appear in CommBank:

- CDIA Bank Account (This will have BSB and Account Number just like a normal bank account)

- CommSec Shares - This is the Shares account for your Domestic Shares (i.e. shares that you purchased from the Australian Market)

How do these two accounts work:

- When you purchase an ETF, the purchased ETFs will be shown in the CommSec Shares account, and the money will be taken from the CDIA account.

- So when making the ETF purchases, I always need to ensure sufficient funds are in the CDIA account.

(1) I had to call up CommBank to correct a typo in the CommSec Shares trading account. So once the accounts are created, it is always good to check if the CDIA and CommSec Shares accounts have been created with the right entity and if the name is correct.

(2) After a month, there was TFN withholding Tax - money was taken out of the CDIA account. When I called CommBank, I was told that the bank account did not have the TFN of my Family Trust. So, I advised them about the TFN, and they advised me that the TFN withholding tax would not be applied. So, check if our TFN numbers are added to the bank account.

The next step is to log into CommSec and buy ETFs.

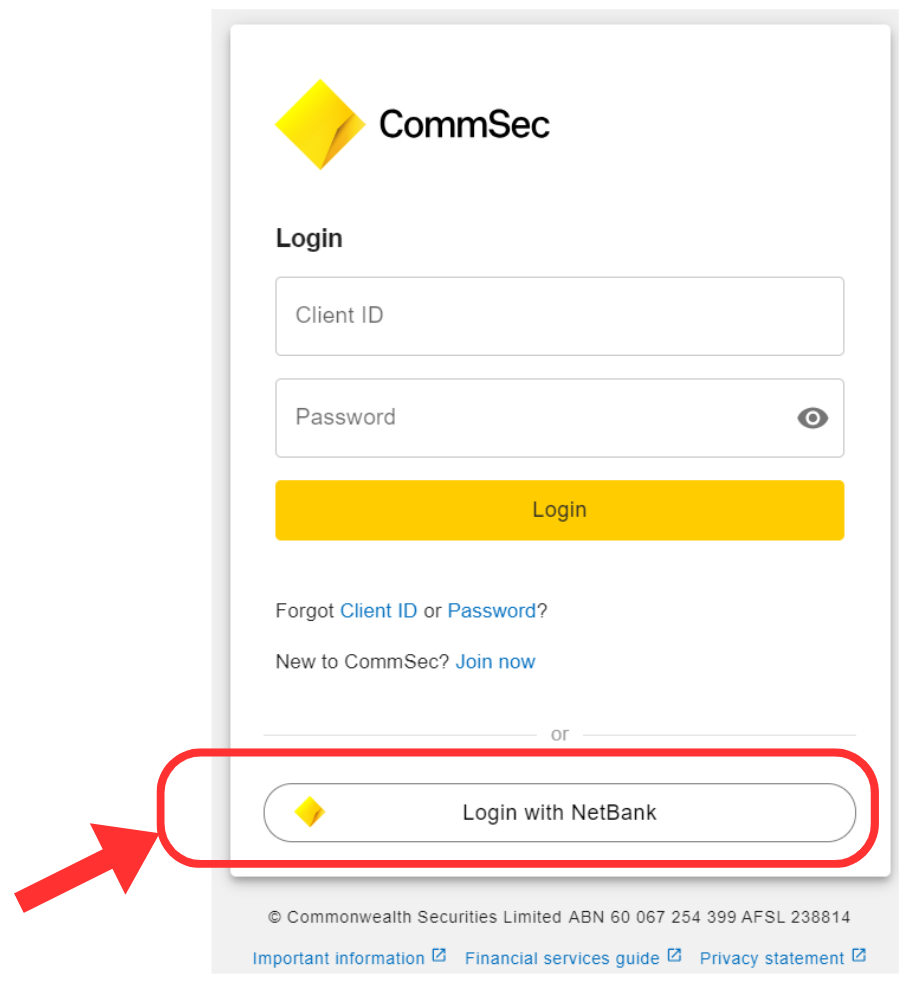

Logging into CommSec

After CommSec application has been approved, the below two accounts will appear in CommBank:

- Go to CommSec.com.au

- Click Log in

- I log in with my CommBank NetBank.

Why? I am too lazy to create a separate login username and password for CommSec!

- Login by entering your NetBank username and password.

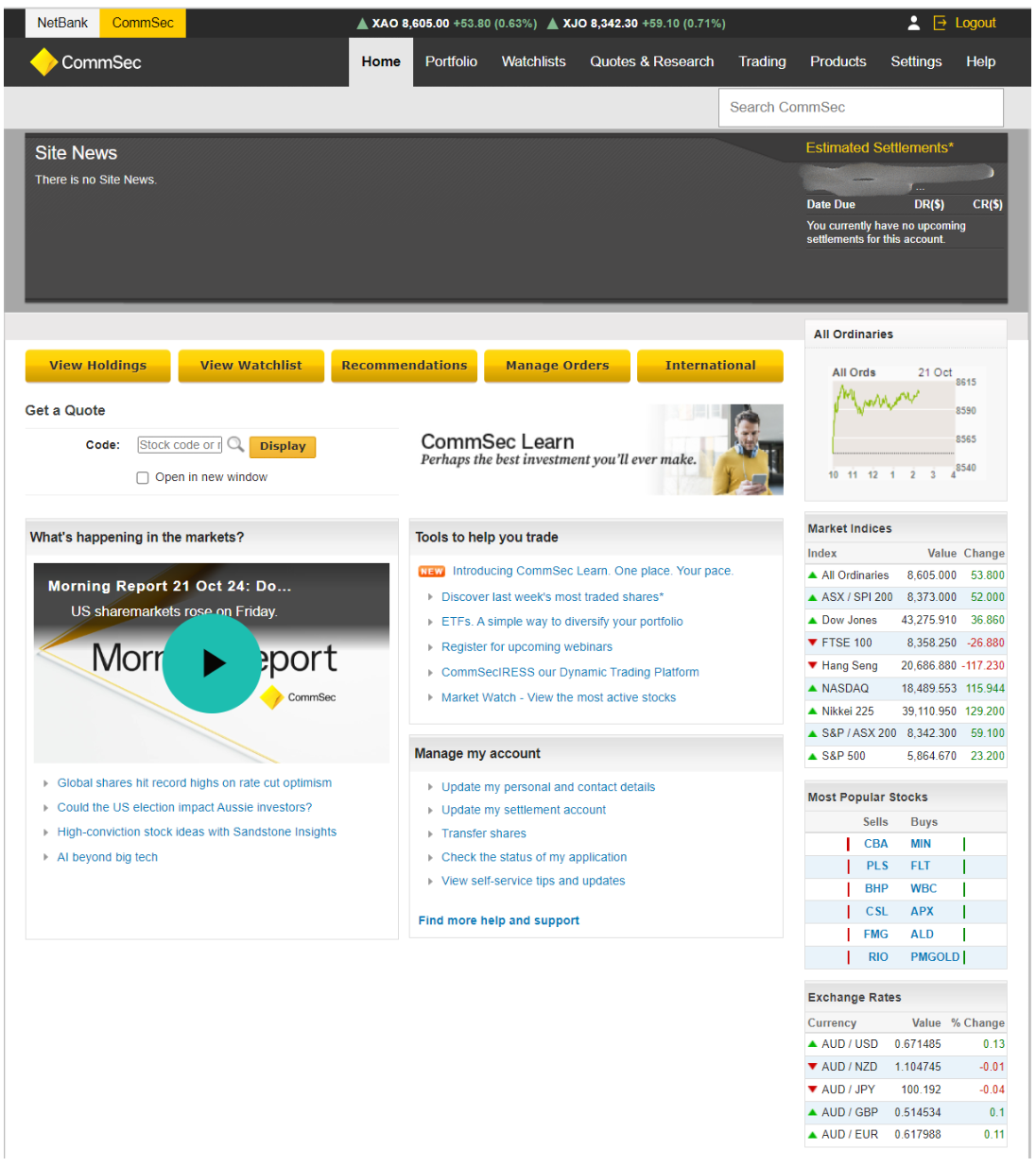

- You will be able to see the CommSec dashboard home page, which looks like the below:

Transfer Money to CDIA

Before making a purchase:

- I needed to transfer money from by Trust Business Account to the CDIA Account.

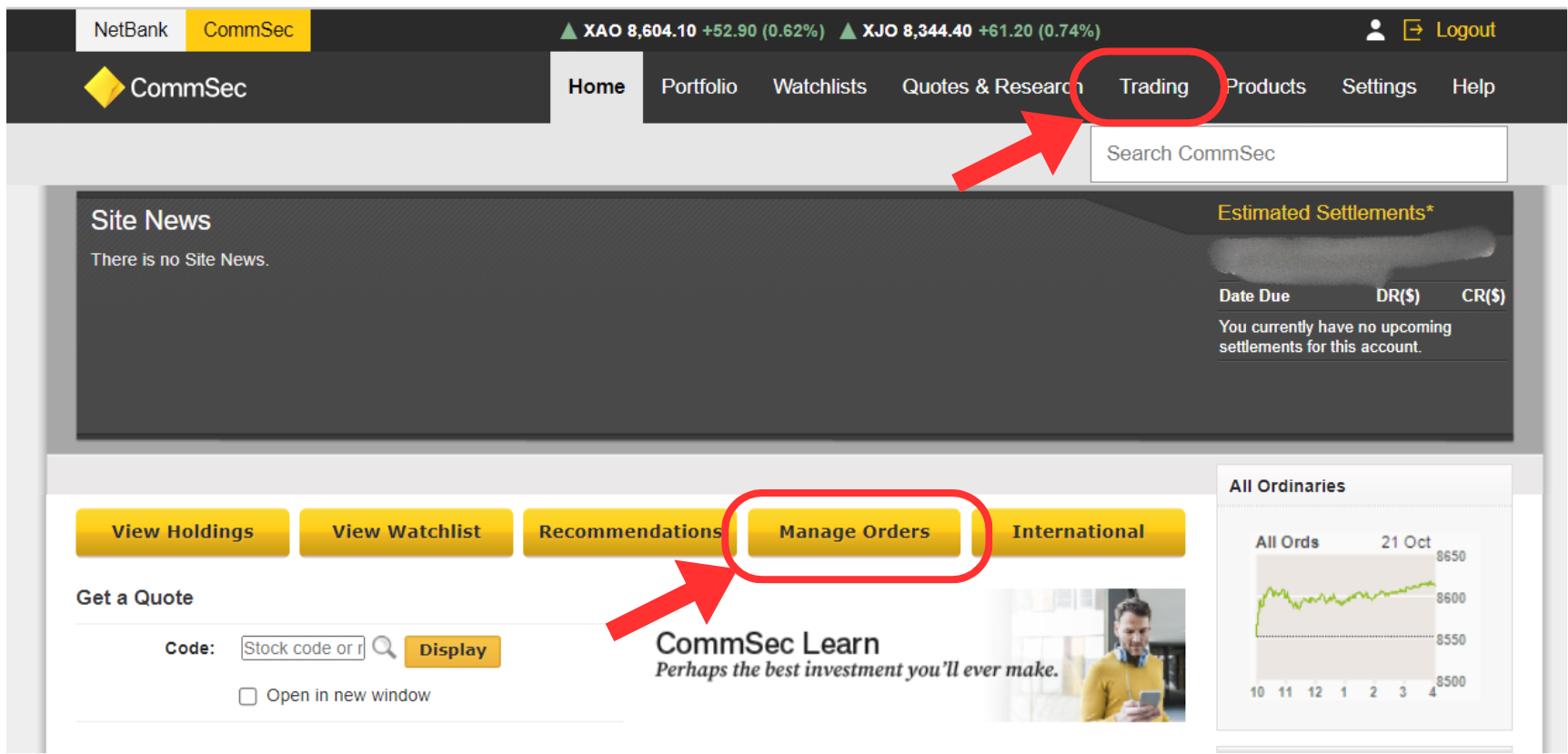

Placing order

In order to buy or sell ETFs, we need to place an order.

If you are buying an ETF during trading hours, you can buy at Market Price (i.e., the price that someone is currently willing to sell an ETF to you at that moment in time when you want to buy).

If you are buying outside of the trading hours, all you can do is place a bid at a specific price and tell the system to execute the order the next day when the market opens.

In Australia, the market is open from 10:00 AM to 4:00 PM (Sydney time) on ASX business days. This is called “normal trading,” when most trades take place.

Buy ETF

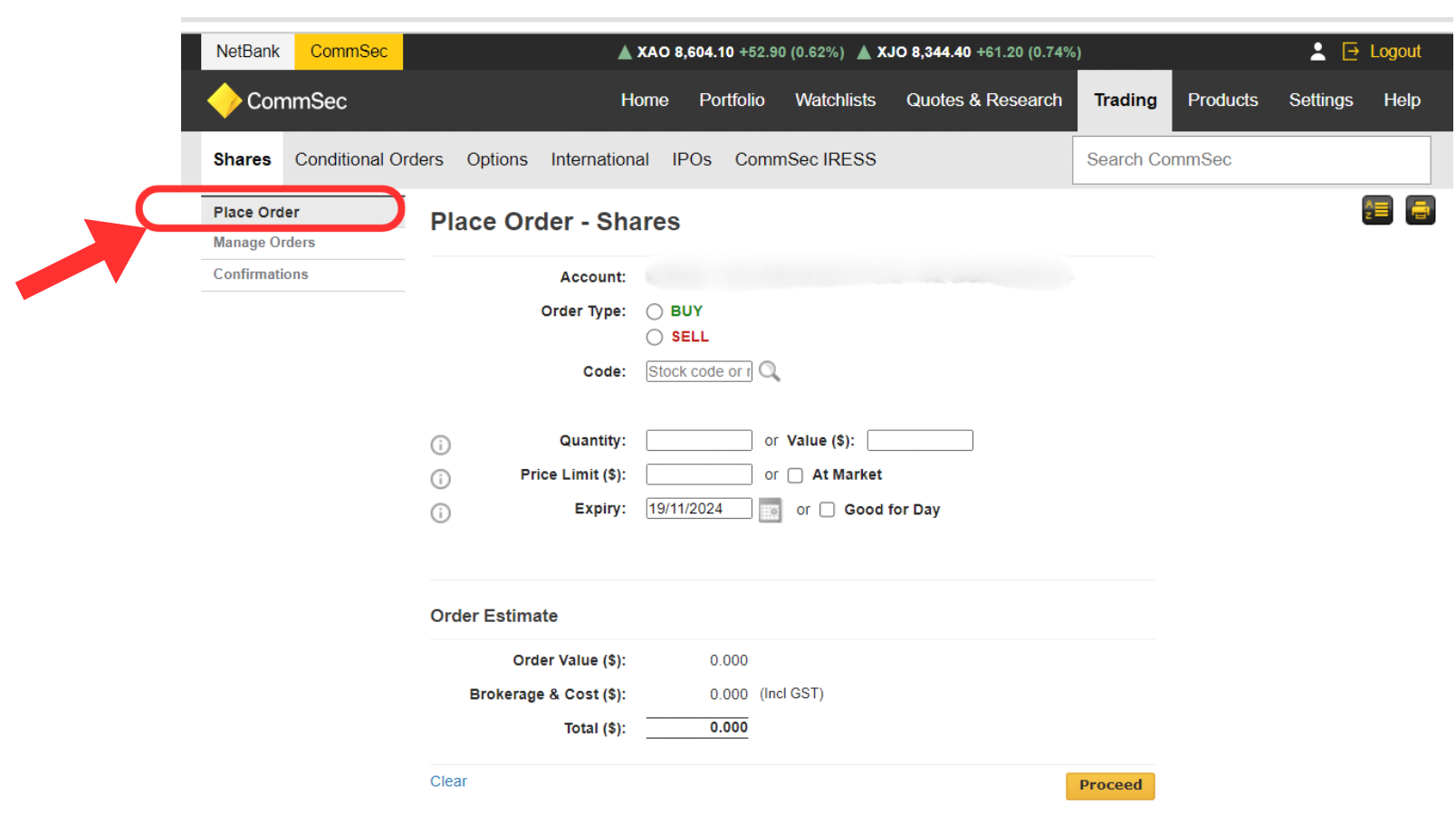

- Go to Manage Orders... or click Trading in the top right.

- Click Place Order

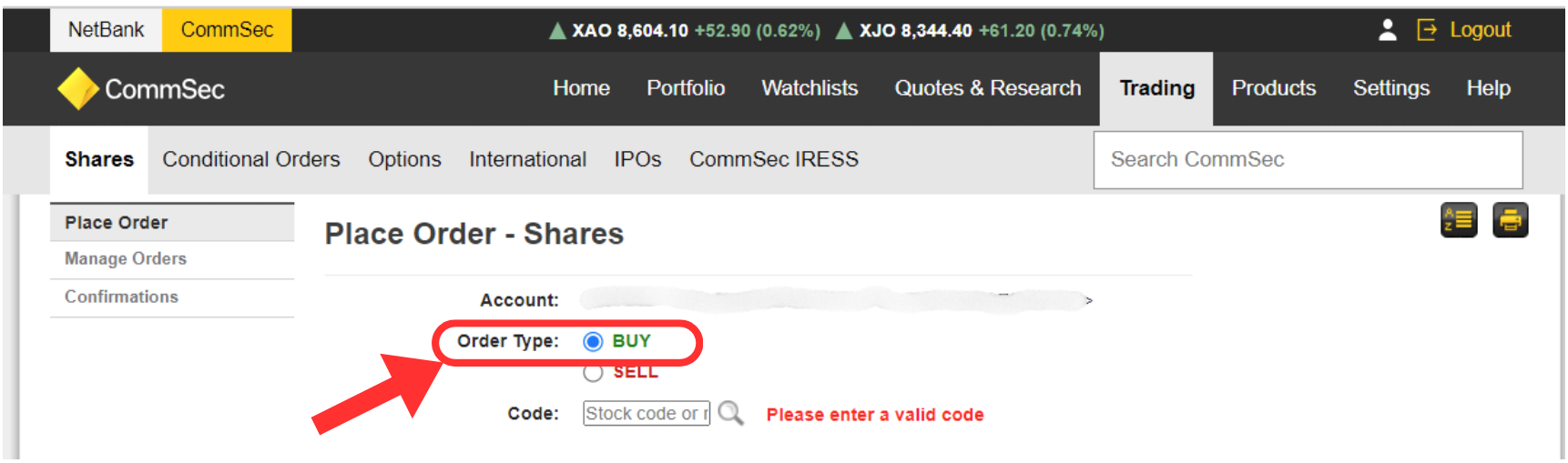

- Click on BUY

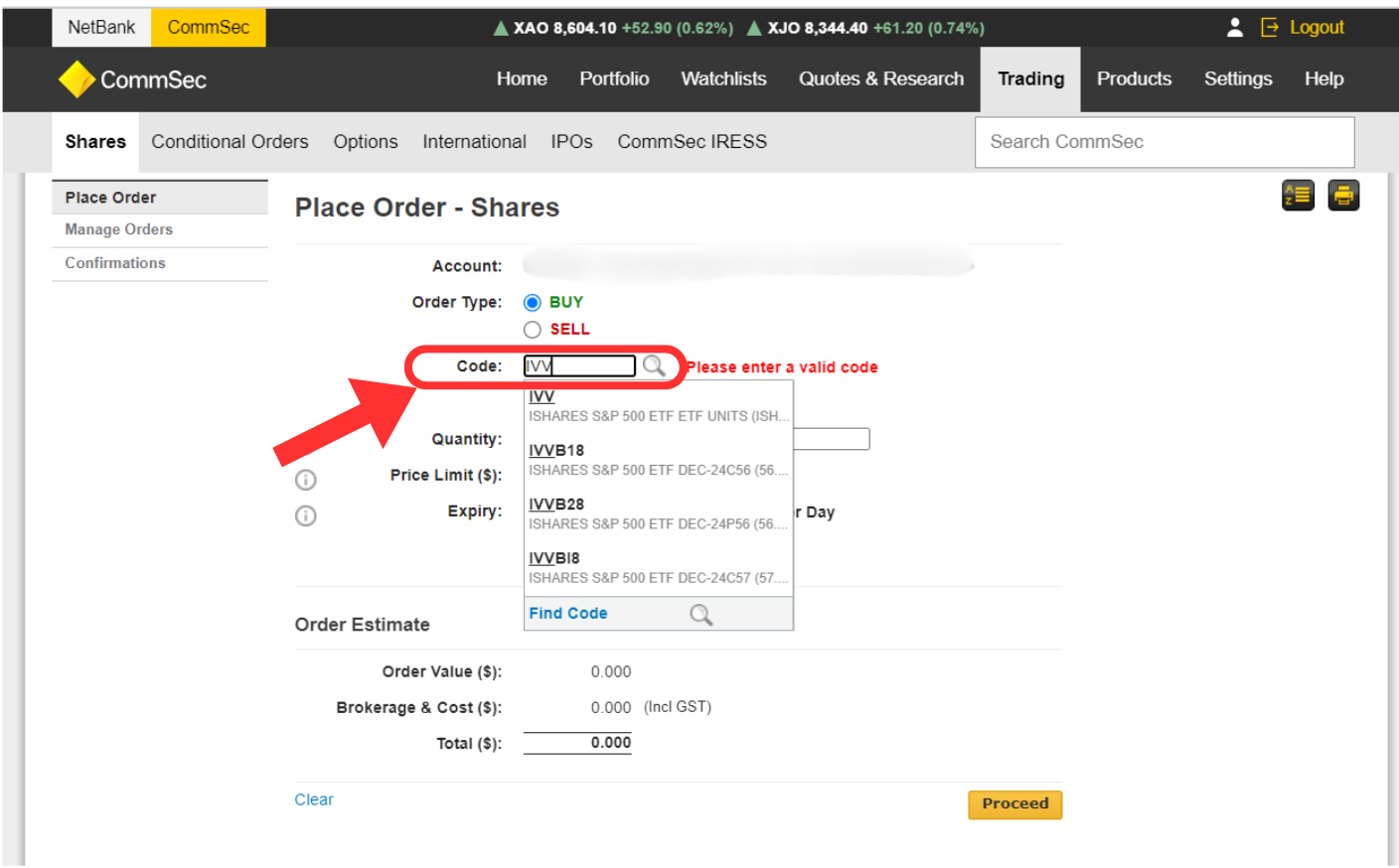

- In Code, type the ETF Code. Here, I want to buy IVV - so I have typed IVV.

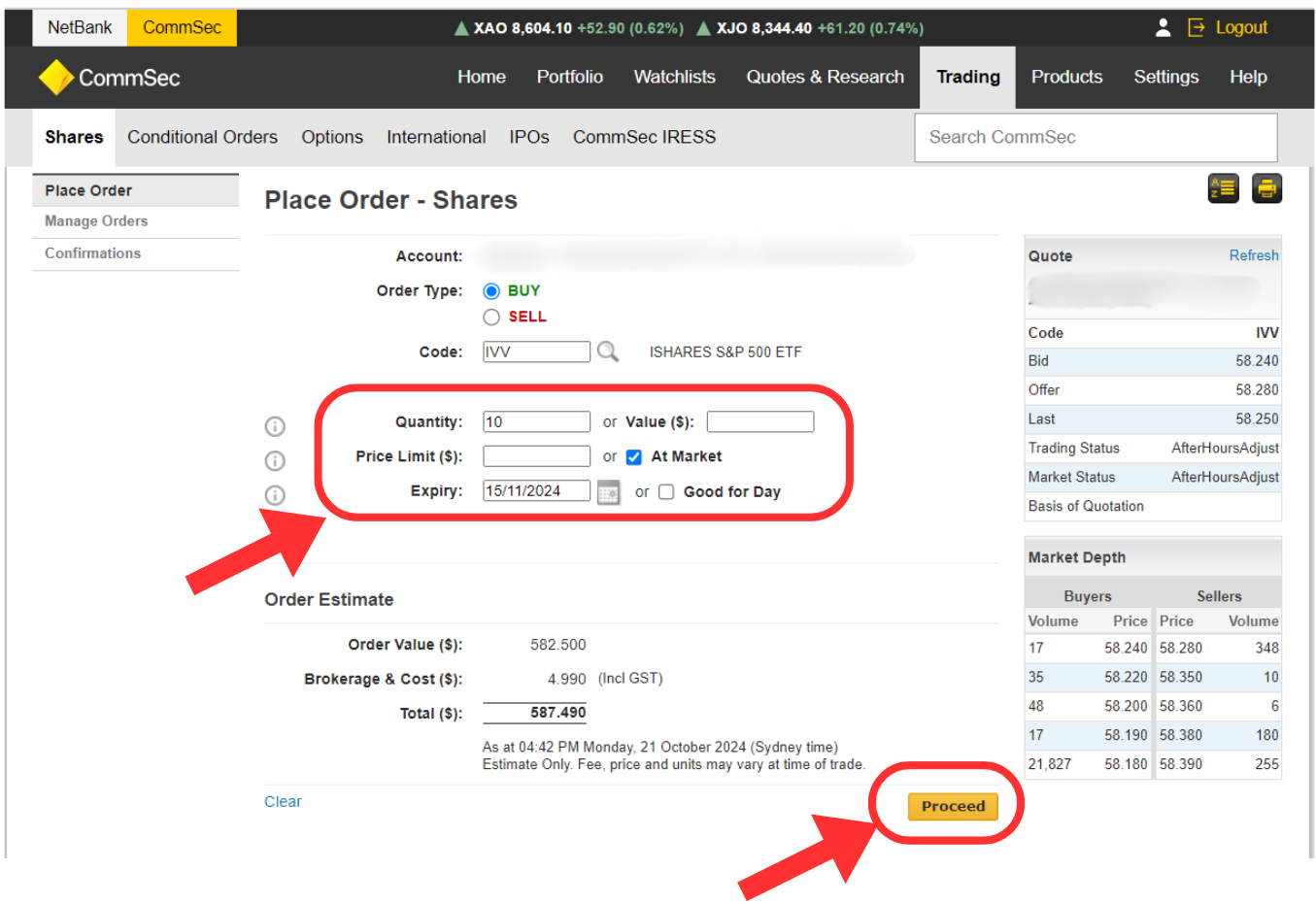

- Enter the below details:

- Quantity or Value

- Price Limit or At Market

- Price Limit can be used during trading hours and after-hours trade order placements.

- At Market is used if making a transaction during trading hours.

- Expiry

- And Click Proceed

In the below example, I want to buy 10 ETF shares of IVV. The order estimates show that:

- Order Value = $582.50

- Brokerage Cost = $4.90 (Note: This amount includes GST)

- Total = 587.49

If I am placing an order after hours, I can only select Price Limit

That's it!

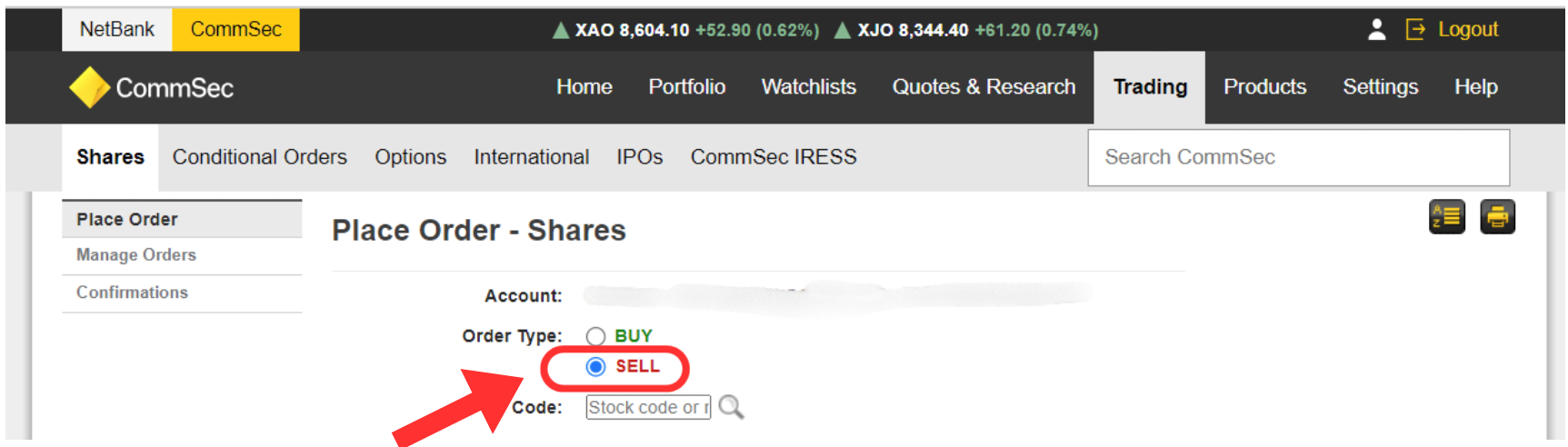

Sell ETF

The difference between Buying and Selling is selecting the order type as SELL instead of BUY.

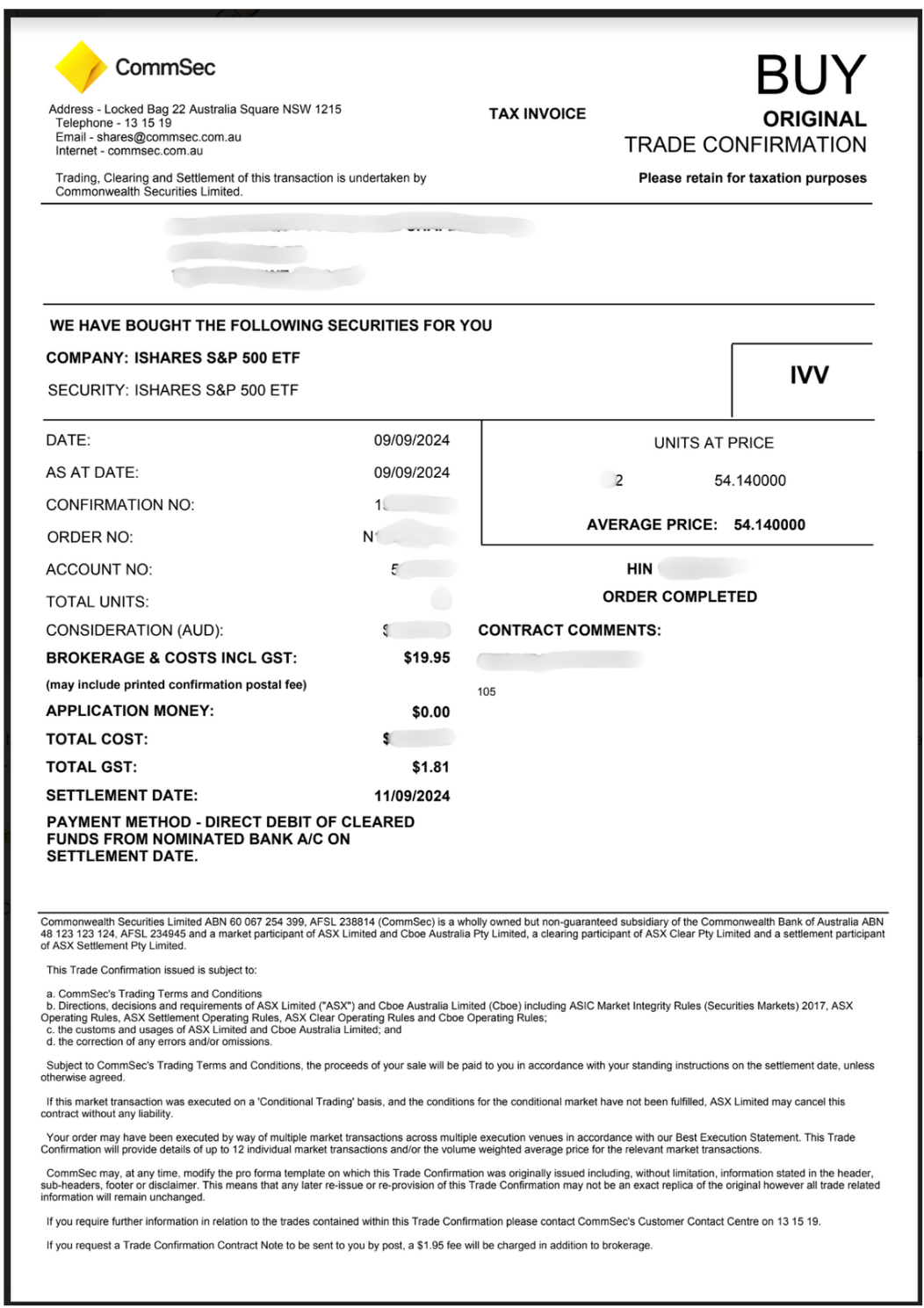

Order Confirmation Email

CommSec would send an email with the Order Confirmation Tax Invoice - that looks like below:

Important:

- In the above example, see the below:

- DATE = 09/09/2024

- SETTLEMENT DATE = 11/09/2024

- This means that CommSec will withdraw the money from the nominated bank account - in my case, the CDIA account.

This is when CommSec will debit the account, and cleared funds need to be available by 8:00 AM in the nominated settlement account.

Settlement

The money will be deducted from the nominated bank account on the settlement date.

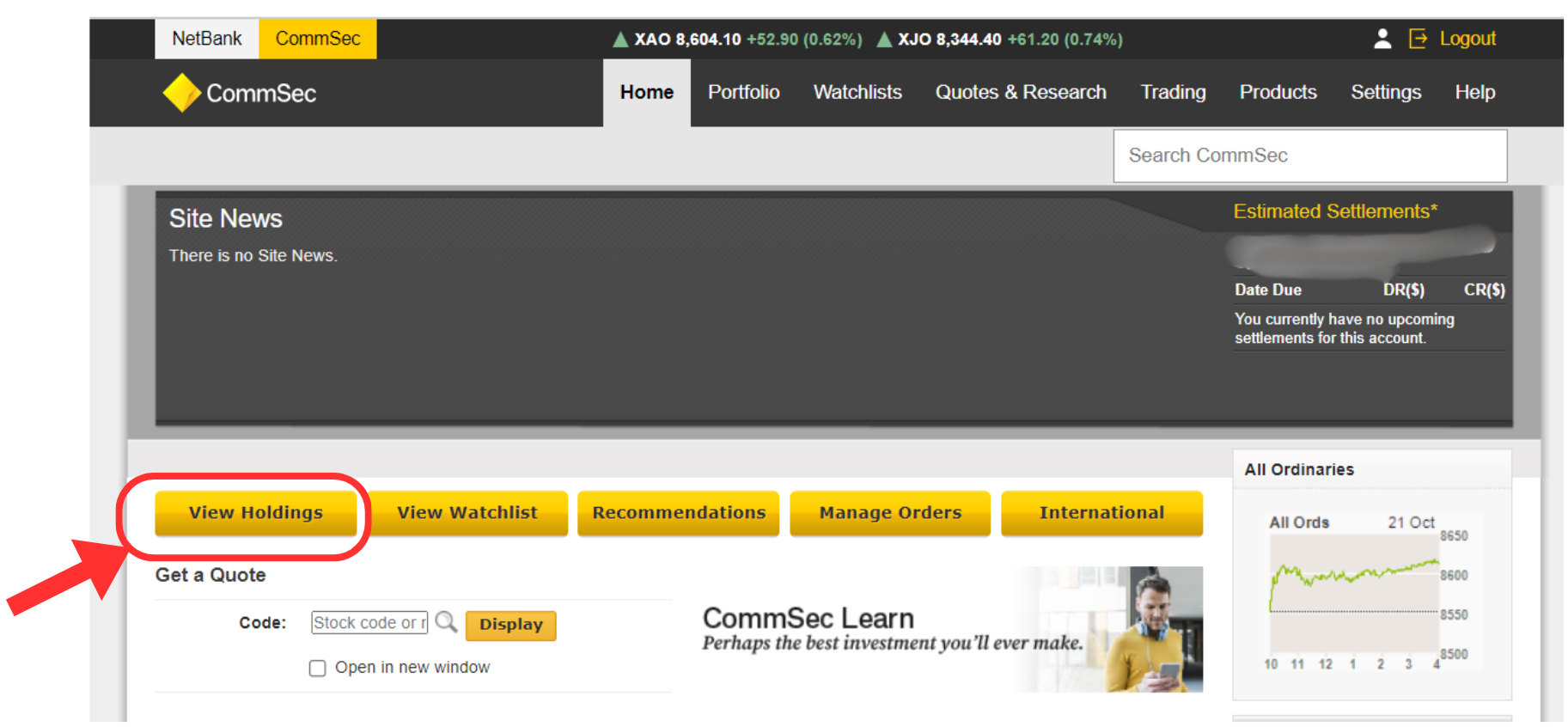

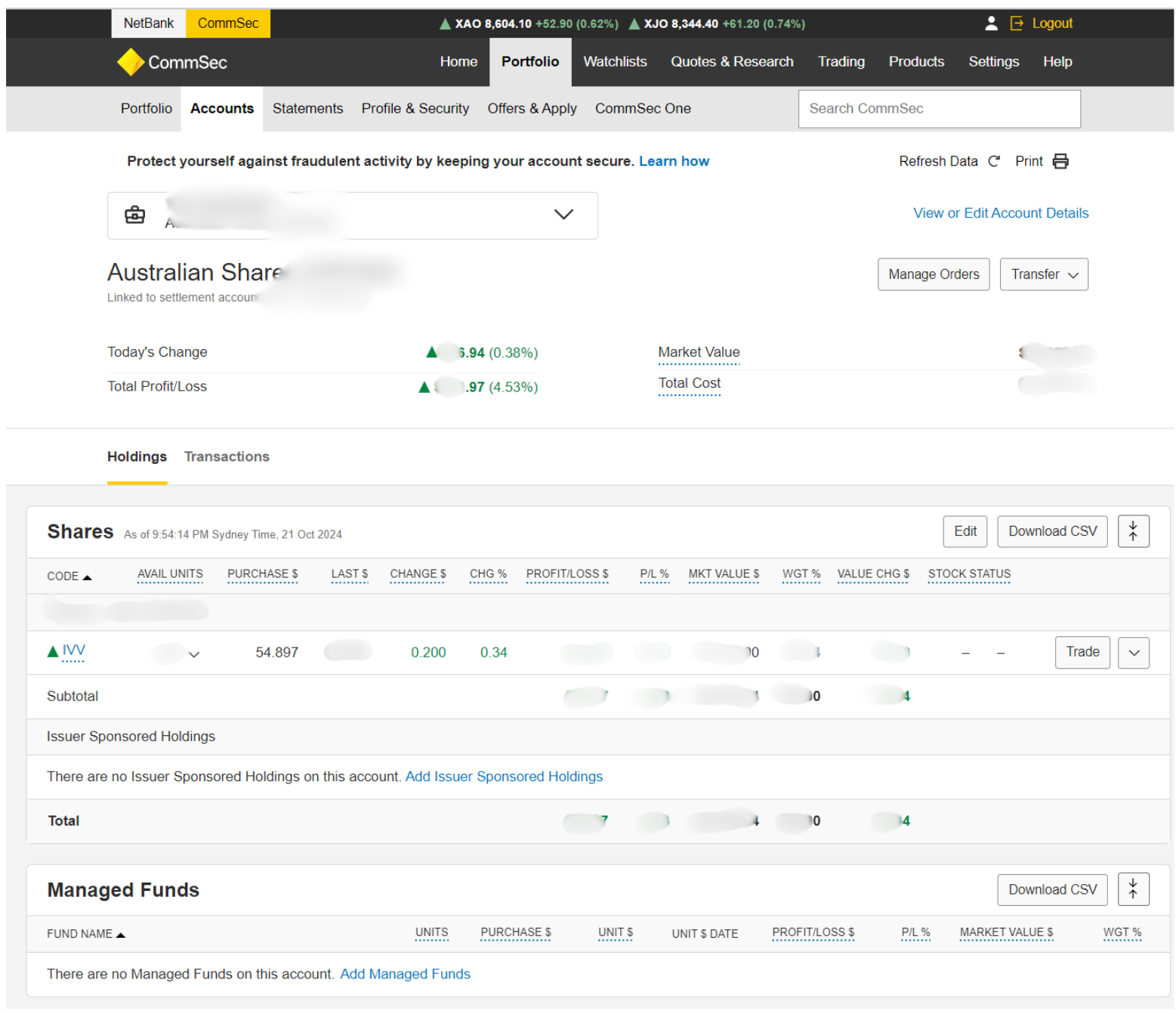

View Current Portfolio Holdings

To view the current holdings:

- Click View Holdings

This will show the account and the list of shares owned in this account.

Bookkeeping ETF transactions

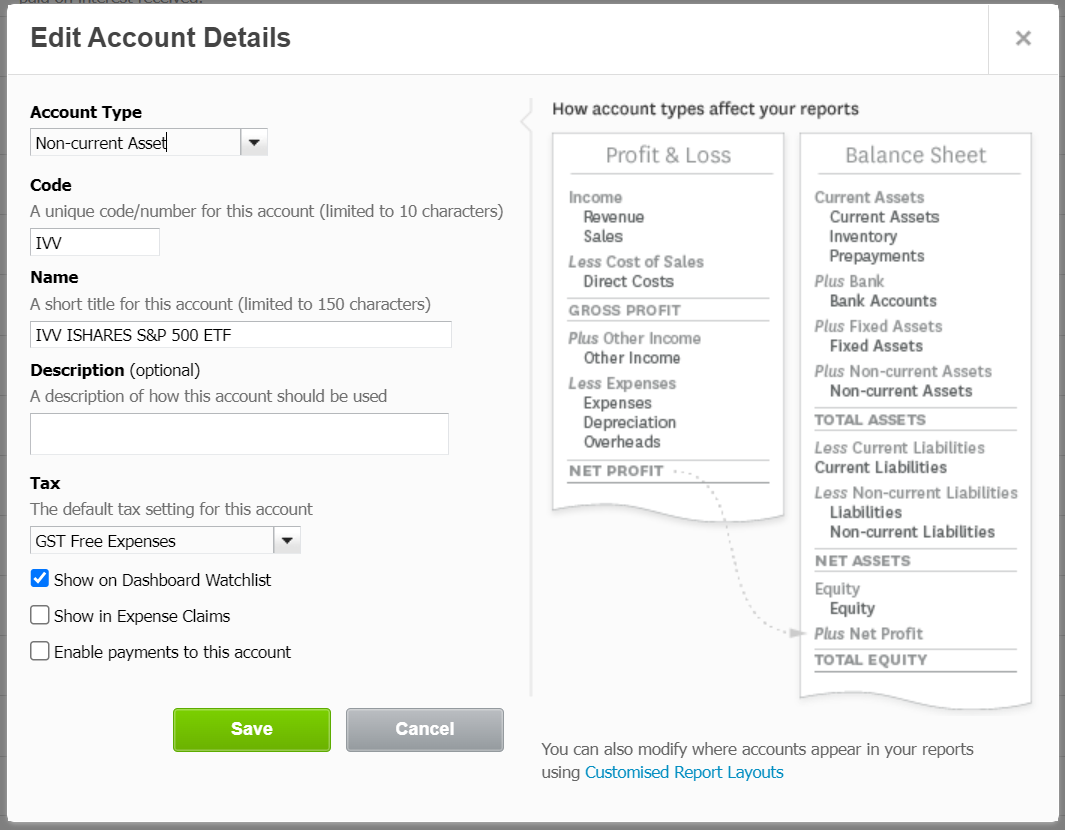

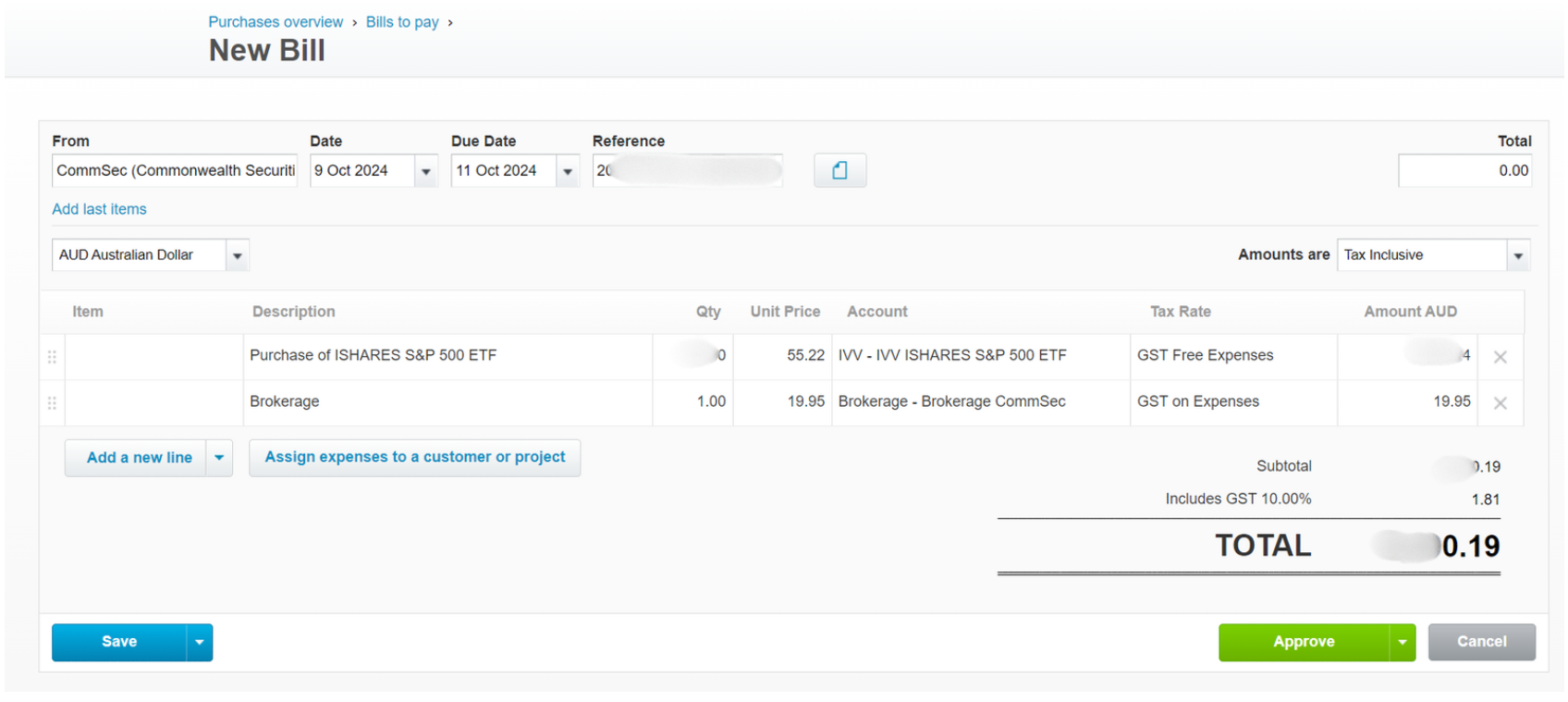

- To record the ETF purchase transactions, I have created the following Chart of Accounts:

- A code for Brokerage - to track all brokerage fees.

- A code for each ETF - to track the value of each ETF separately.

- Create a Bill to pay.

- Set ETF Purchase to Tax Rate: GST Free Expenses

- Set Brokerage t Tax Rate: GST on Expenses (this is as per the Tax Invoice emailed by CommSec).

What happens after settlement?

- I received a physical mail in the mailbox from each registrar of the ETF

- After investing in an ETF, I received a welcome letter from the ETF fund registrar.

- Each ETF might have a different fund registrar.

- For each ETF, sign up on the corresponding ETF's registrar's website to update your information (such as communication address, TFN, etc.) and receive further email communications. Read further on contacting Share Registry companies for each ETF purchased, and why it's important to communicate with them.

- I also received a letter from ASX called a CHESS statement.

My Challenges after investing in ETFs

After purchasing the first ETFs, the first 24 to 48 hours were very stressful. I constantly looked at the portfolio to see how much I had gained or lost.

This was not healthy.

I did not like it.

It was stressful.

So I changed my mindset.

Mindset

- We are here for the long run. We are looking at a 10-20-year horizon. We are not looking for short-term gains.

- Don't look at portfolio performance after investing. There will be good days, months, years, and there will be bad days, months and years. These highs and lows don't mean much in our strategy, where we look at a 10-20-year horizon.

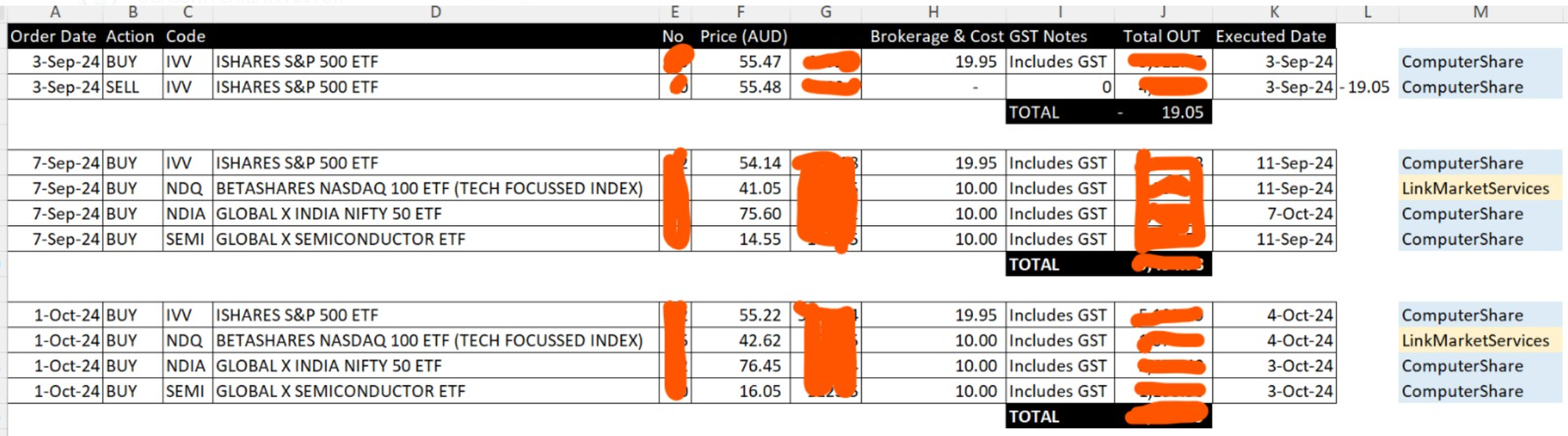

- Invest periodically once every month. Preferably on the 1st of the month. This strategy of investing every month is to balance out the ups and downs of the volatility when we invest a lot of money in a single transaction.

- Be consistent in the monthly investment.

- Keep track of the investments.

- Consider a portfolio allocation:

- 50 to 60% on low-risk ETFs such as the S&P 500

- 15 - 25 % on industry-specific ETFs

- 5 - 10% on country-specific ETFs

- I created an Excel file to keep track of my ETF investments. Below is a sample.

Past performance may not be indicative of future results.

Different types of investments involve varying degree of risk, and there can be no assurance that the future performance of any specific investment or investment strategy, or product made reference to directly or indirectly in this article, will be profitable.

Links and references to investment approaches and products are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor's investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment's value.

What do we do with the yields?

On 15-Oct-2024, I got my first dividend for IVV (ISHARES S&P 500 ETF)

The dividend was paid to my CommBank CDIA account.

I started thinking - what should I do with the dividend?

- Should I take out the money and use it?

- Should I reinvest a portion of the dividend back into IVV in this case?

- Should I reinvest the whole dividend back into the portfolio?

Read more on Reinvesting Dividends from ETF Investments.

Buying Stocks - International

This works differently, primarily because our base currency is AUD, and we will most likely purchase in another currency (e.g. USD).

This also requires a separate approval process in CommSec.

Next Step

Let's look at: