How do banks make money?

Teaching Kids the basics of financial literacy and business. Help them understand how we use banks and how banks use money to generate more money. Do we really need the banks?

What did I want to do?

- I wanted my kids Ash (12 years old) and Adh (10 years old) to understand how the banks make money and their role in the economy.

- I wanted to use this opportunity to explore concepts such as interest, lending, funding, and borrowing.

- We have already gone through why we need to invest our money.

Why do we use the banks?

Let's look at the most common reasons why we use banks.

A place to keep our money

Let's say we are working in a coffee shop, getting a monthly salary at the end of the month.

Let's say the coffee shop owner gives us the salary in cash (i.e., it is not transferred to the bank account).

When we get our salary, we must keep the money safe somewhere - so no one can steal from us.

One option is to keep the money somewhere safe... somewhere in our home? or somewhere we know the money is safe.

Keeping the money in our house has the risk of a burglar stealing the money. There is another issue - we will be continuously stressed about the possibility of someone stealing the money.

Another option is to keep the money in a "safer" place than our house - banks.

People generally keep their money in the bank because it's "safer" than keeping it in their houses.

A mechanism to transfer money

In the above example, where we worked in the coffee shop, the owner had to give us money for our monthly salary.

Another way he could do this is to instruct the bank to transfer the money to our account. This way, money from his bank account will be transferred to our bank account.

This saves us the effort of physically giving money.

Similarly, the coffee shop owner could pay multiple people their salaries and pay the vendors and suppliers through the bank - without having to move the money physically.

Note: With recent advances in the banking world, such as online banking, we can do this transfer online by logging into the bank's website.

Borrow money

We can borrow money from the bank if we need money to start a business or buy a house.

What is the business of the bank?

We saw that the banks provide the following services:

- Banks provide us with a place and mechanism to keep our money.

- Banks provide us with a mechanism to send and receive money.

- Banks loan us money when we need to borrow money.

Like any other business, banks are also in a business to make money.

Any business needs to do two things to make money:

- Create value that the customer wants

- Sell the value to the customer at a price higher than the cost they purchased the requirements to create the value.

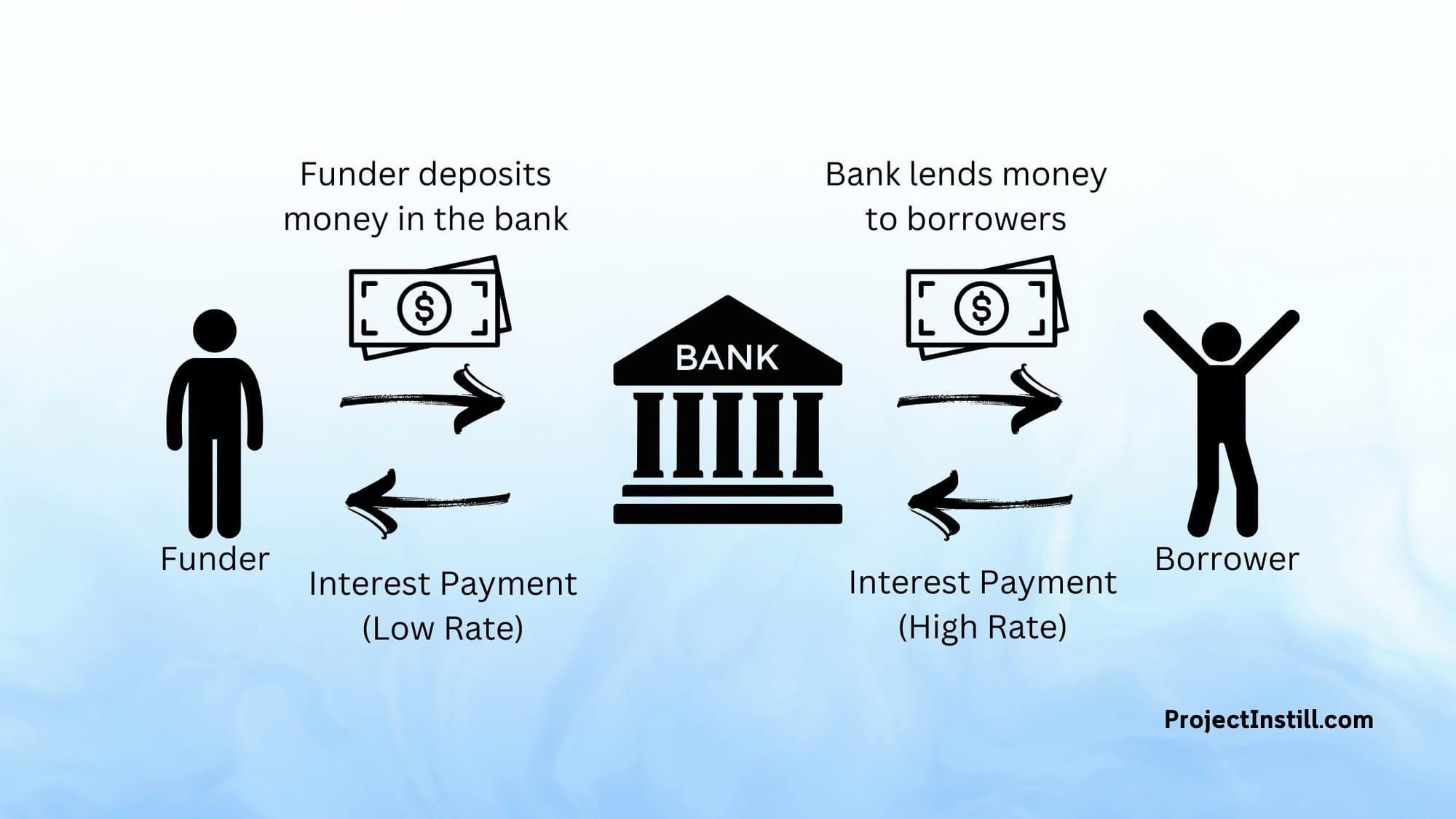

What do banks sell? And to whom?

- The banks sell money to customers who don't have enough money and need to borrow money. These customers are called borrowers.

Where do the banks get the money from?

- The bank gets money from the customers who keep the money in the bank because they don't have anywhere else to keep it. These customers are called funders.

What value does the banks provide?

- For the borrowers, the banks provide a venue to access the money. Without the bank, it will be difficult for the borrowers to find the funders directly.

- For the funders, the banks provide a venue to keep/store the money.

How does the bank make money?

- When the funders keep the money in the bank, the funders might transfer the money at any time to others. To incentivise funders, banks may provide certain savings accounts, where the bank will pay interest (as a % rate) to funders. This will entice the funders to keep the money in the bank account.

- The banks may give certain types of accounts and even place lock-in periods (e.g., we need to deposit money for 1 year) and make a payment of a higher % as interest. This will guarantee the bank that the funder will not remove the money and give it to others for that lock-in period.

- Once the bank has the money from the funders, the bank will give the money at a higher % interest to the borrowers.

Let's look at an example:

- If a funder keeps $1,000 at a bank, and let's say, the bank gives 3% interest in their savings account.

- If the funder keeps the $1,000 in the bank for 1 year, the funder will get 3%, which is $30.

- Meanwhile, let's say the bank loans the $1,000 to a borrower at 8% interest for 1 year. By the end of the year, the borrower will have to pay back 8%, which is $80, in addition to the $1,000.

- The bank would have made 8% - 3%, which is 5% (in this example, 80 - 30 = $50).

- With this $50, the bank would have to pay all it's costs, such as

- Office building rent

- Staff salaries/wages

- Technology infrastructure

Where do the banks get the funding from?

Let's look at this in a bit more detail:

- Other than keeping money in a savings account where the bank pays a % interest, there are other ways the Funders give money to the banks.

- Every time we deposit money from our salaries/paychecks, we give money to the bank. For these deposits, the banks don't pay the funders, and hence, their cost for this type of funding is nil.

- Every time a business (small, medium or large) deposits its business money in the bank account, the banks don't pay the funders (business owners); hence, their cost for this type of funding is nil.

- There are other types of organisations that deposit money in banks, such as government organisations.

- There are organisations such as retirement funds that deposit money in banks.

- Every time someone deposits money into a bank account, the bank can use the money to lend to borrowers at a % interest.

What is the objective of a bank?

The main objective of the bank is to make money. This is done by:

- Paying as little as possible for the money deposited by the funders

- Charging as much as possible for the money borrowed by the borrowers

What are some additional ways banks make money?

- Banks may charge a fee - for you to keep and maintain an account. The fee could be monthly or annual, depending on the facilities they provide.

- Banks may charge a fee for transferring money to others. Some banks may not charge domestic transfers but only international transfers.

- Banks may also use the money to invest in different investment vehicles and products that generate returns.

- Banks may charge a % of currency conversion when we transfer money from one currency to another.

- Banks may charge businesses for providing the technology support (e.g. EFTPOS machines) that businesses can use to charge their customers.

The list goes on...

Next Step

Let's look at:

- Central Reserve Bank

- Why Invest?