What are Expenses in Accounting? An introduction into expenses in bookkeeping for kids

Teaching kids about expenses and bookkeeping. Expense means Money going out.

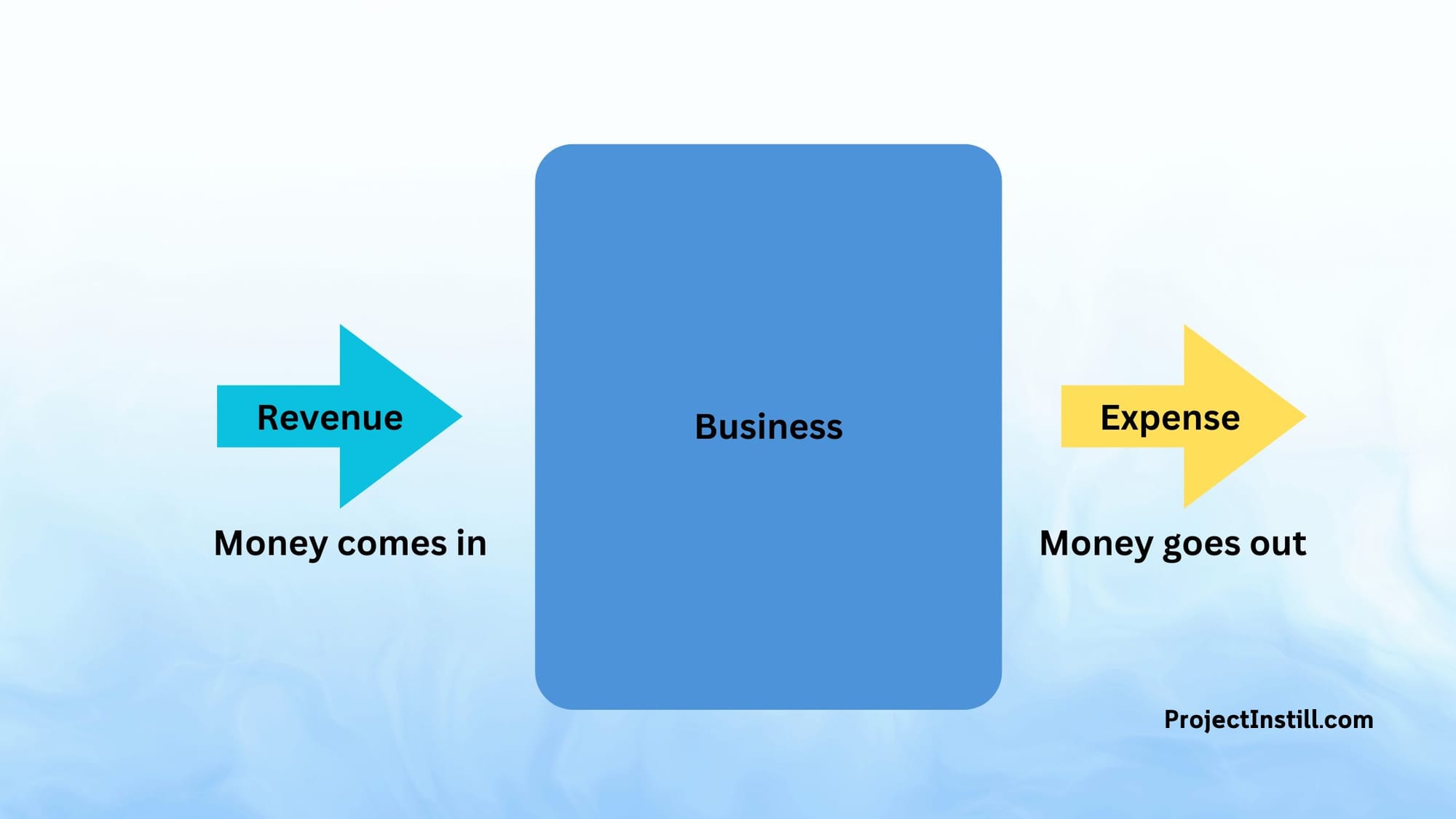

What is Expense?

In simple terms, money going out is an expense.

Revenue = The business gets money from customers (i.e. money comes in).

Expense = The business spends money to manage/run the business (i.e. money goes out).

Ideally, the goal would be for more money to come in (i.e. revenue), and less money to go out(i.e. Expense), so we have some money left with us - with which we can do whatever we want to do. This leftover money is called Profit - which we will cover on another day.

Now let's look at this with an example. Let's say we operate a coffee shop business.

Examples of Revenue (i.e. money coming in)

- Anything we sell - customers will give us money to buy things from us.

- Customers buying coffee from us will give us money.

- Customers buying cookies from us will give us money.

Examples of Expenses (i.e. money going out)

- In order to make coffee, we need to buy milk and coffee beans.

- These are expenses - money goes out - we need to buy them.

- As more and more people buy coffee from us, we need to keep buying more and more milk/coffee beans.

- In other words, we only need to buy more milk/coffee beans if people buy our coffee.

- In order to make coffee, we need to have a coffee machine in the first place.

- This again - money goes out - we need to buy the coffee machine.

- This will be more expensive than buying milk or coffee beans, but only once we need to buy the machine. Then we can keep using it for a very long time (provided there are no issues with the machine).

- Irrespective of whether customers buy our coffee or not, we have already spent the money on the coffee machine - the money has already gone out.

- Rent. If we don't own our shop, then we will need to pay rent (monthly) to the landlord.

- This means that every month, money goes out for the rent - this is an expense.

- Irrespective of whether customers buy our coffee or not, we need to keep paying rent for the shop.

- Staff Salary. We need people to make the coffee. We need to pay salary monthly - i.e. money goes out.

- This means that every month, money goes out for the staff salary - this is an expense.

- Irrespective of whether customers buy our coffee or not, we need to keep paying staff salaries.

The above are some examples of the expenses that a business might incur.

Some are called direct expenses; some are capital expenses, etc. - there are several terminologies - we will get to them later as we continue to learn about expenses.

- Expense means money going out.

- There are different types of expenses - but we can learn about them later.

We don't want to overload them with technicalities... not just yet!

Next Step

How do I teach and train in all the different types of expenses?

I wanted the kids to start bookkeeping with me on my businesses. I wanted them to start with expenses (i.e. Bills to Pay in Xero). This will give them an opportunity to see the different types of expenses (i.e. bills to pay) we pay out.

I wanted them to create and upload the bills we receive - in Xero.

This will give them an opportunity to see the different invoices and understand what constitutes an invoice, and the different types of invoices.

As we upload different types of invoices, it will give me an opportunity to teach them about a multitude of things about expenses, such as:

- Types of expenses - once off vs monthly vs annually.

- Issue date vs Due date in invoice

- Software subscription invoices are different to manual invoices raised by vendors

- What is GST? Which expenses are GST Free vs GST applied (inclusive vs exclusive)?

- Base currency AUD vs invoices in USD, which are paid in AUD, and as a result, currency exchange rates, and why it keeps changing daily. And the associated transaction charge by the bank.

- As part of this process, the kids will get used to different terminologies, vendors, software, etc

- ... and more.

After a period, when they have seen the different types of invoices, I could explain things like the below, at which point it will make more sense to them.

The below topics can become overwhelming at the start - so hold them off for a while:

- Capital Expenditure

- Operating vs Non-Operating

- Fixed vs Variable

- Balance sheet

- ... and of course... TAX!

Kids need information slowly and consistently - to ensure the basics are instilled into them.

So I gave them access to Xero - only to create and upload bills.