Recording an Expense of different currency in Xero - Atlassian Invoice for Confluence

Teaching kids about expenses and bookkeeping. This article explains the steps in recording an Atlassian invoice for Confluence that is in USD, but paid with our base currency AUD Card.

What did I want to do?

- I wanted my kids to record a bill invoiced in a currency different from our base currency.

- The Atlassian Invoice is in USD, and we pay with an AUD card.

- I wanted to introduce the below concepts:

- Invoice Currency Vs Base Currency

- Currency Exchange Rates & daily fluctuations

- Transaction charges levied by the bank for transacting in different currencies

- The kids had already done the following:

- They created their first bill to pay in Xero (A SquareSpace domain renewal invoice), and both the invoice currency and base currency were in AUD.

- To get a bit of practice in recording expenses, they recorded multiple SquareSpace domain invoices as expenses in Xero for practice.

Overview of the Atlassian Invoice

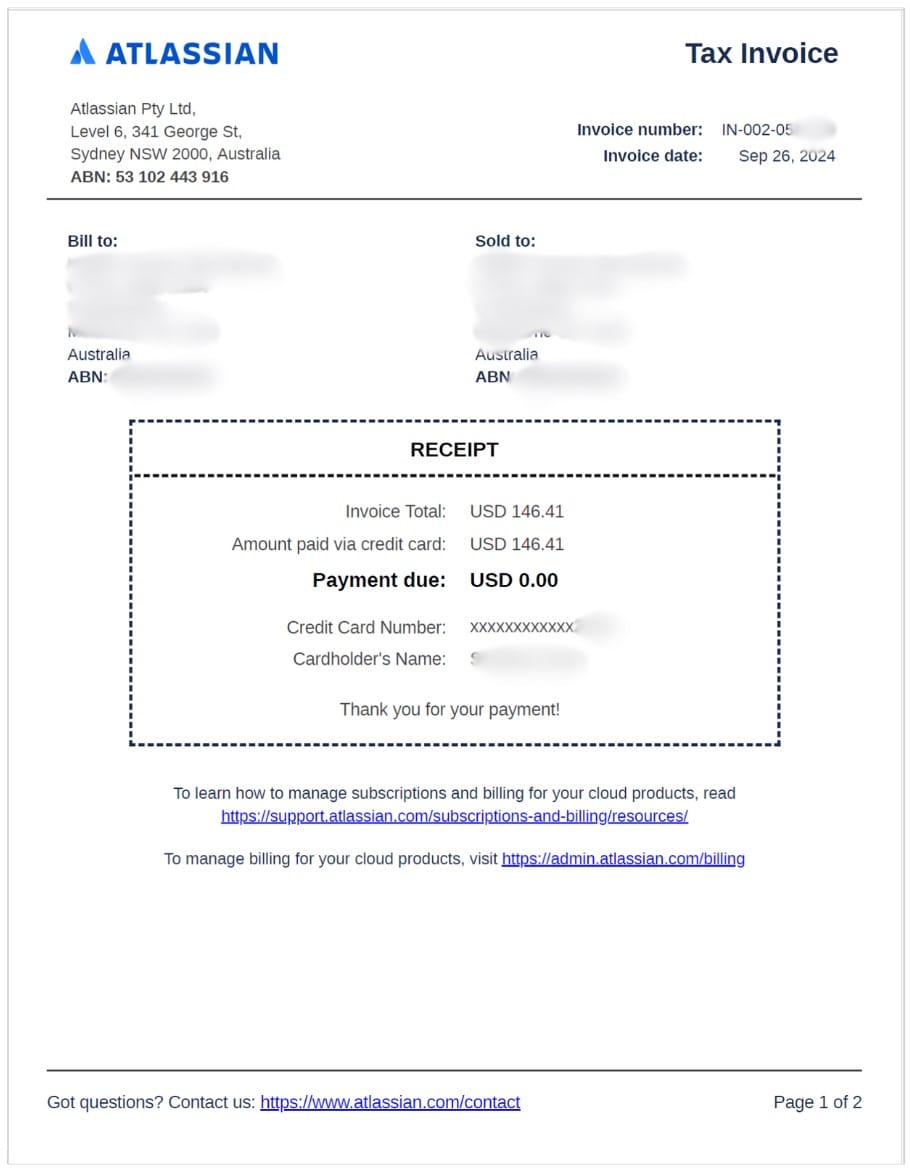

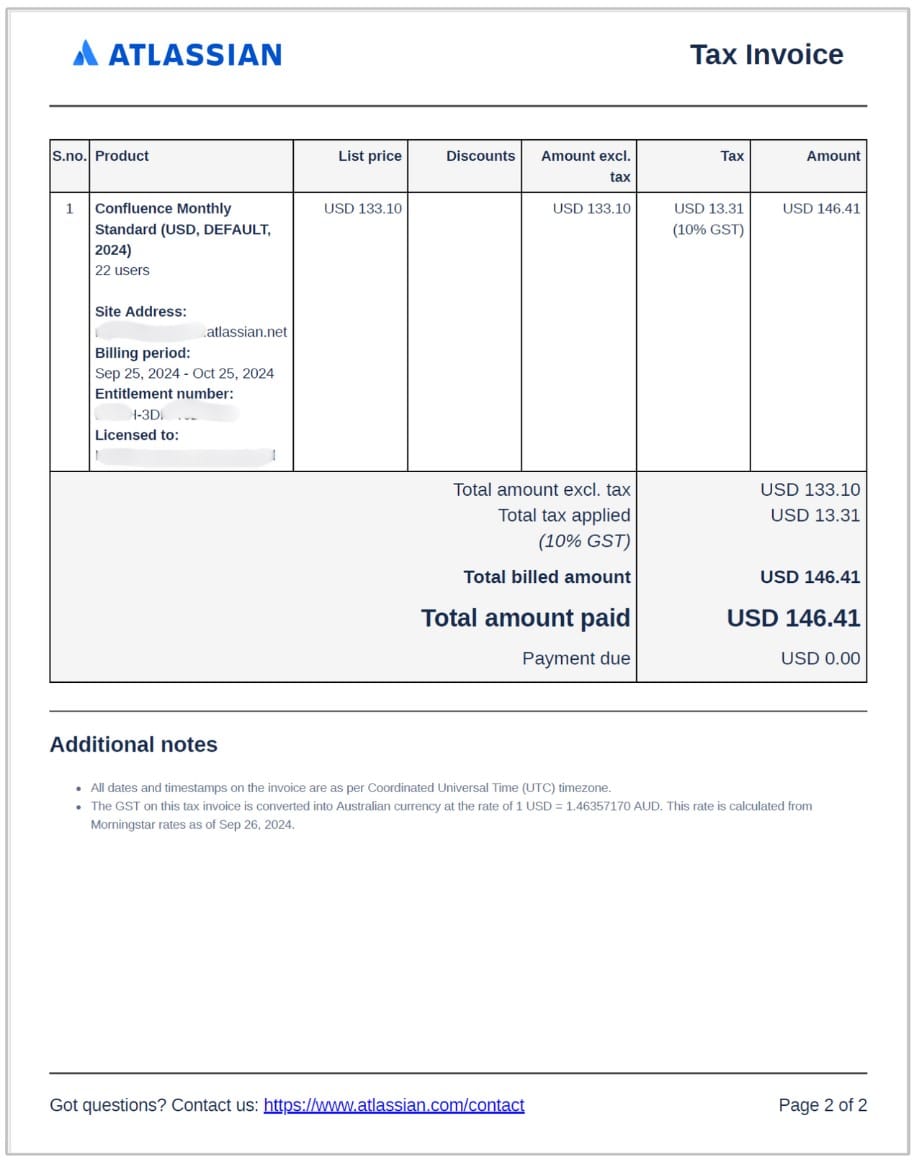

Below is what the invoice looks like. There are two pages.

Page 1

Page 2

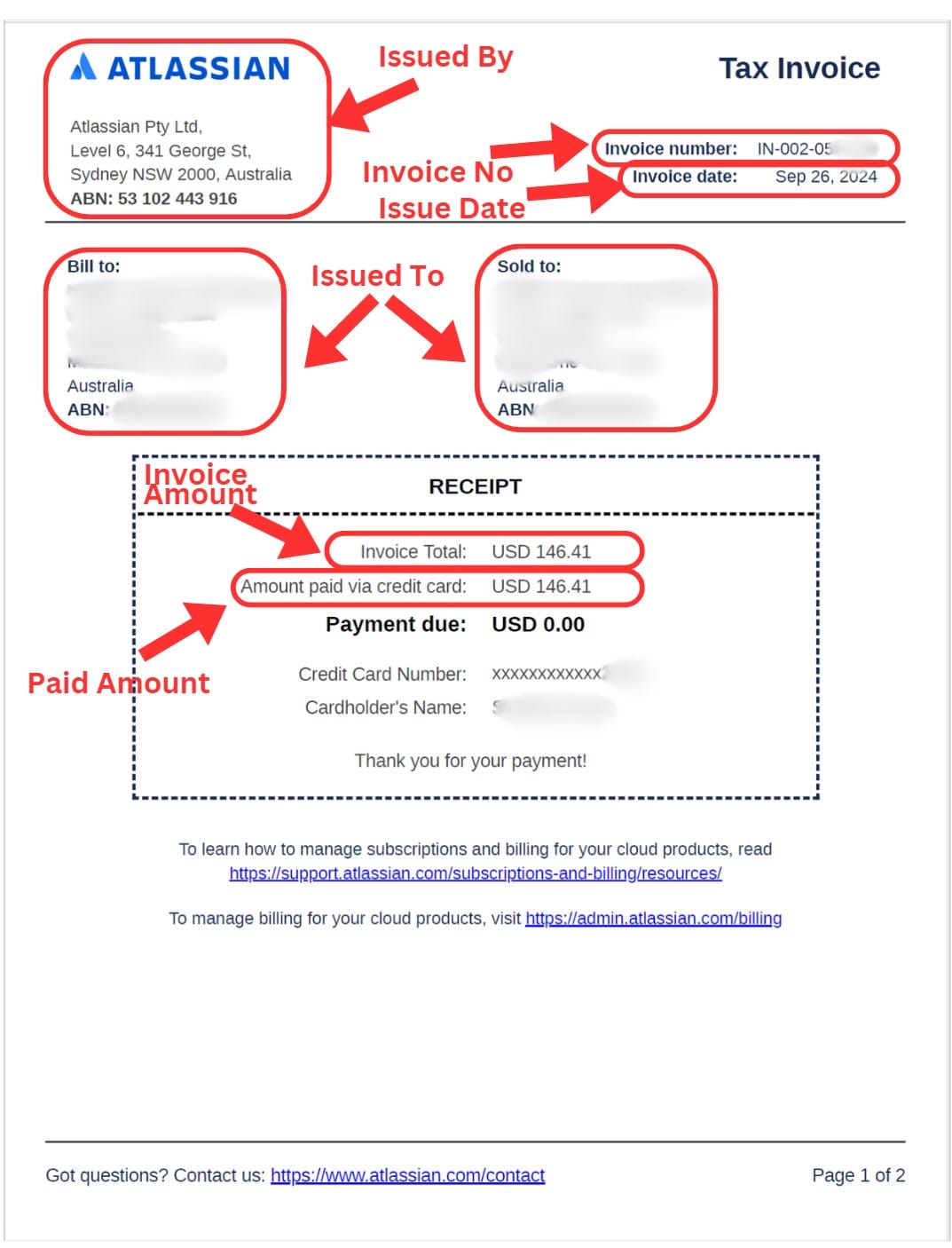

Let's look into the specifics of Page 1.

- Issued By: This is the company that sent us the invoice.

- Invoice No: Cleary identifiable. Unique reference for this invoice provided by Atlassian

- Invoice Date: Sep 26, 2024 - Clearly identifiable.

- Issued To: Clearly identifiable. This is addressed to our company.

Note: There is a Bill to & Sold to. Sometimes, this could be different for large companies. Hence, Atlassian has provision for this. For us, the same company information is entered. - Receipt Section

- Invoice Amount: Clearly Identifiable. 146.41 USD.

- Amount Paid: Clearly Identifiable. 146.41 USD.

- Amount Due: Clearly Identifiable. 0 USD.

Note: The receipt section shows that we have paid the invoice in full and have nothing more left to pay for this invoice.

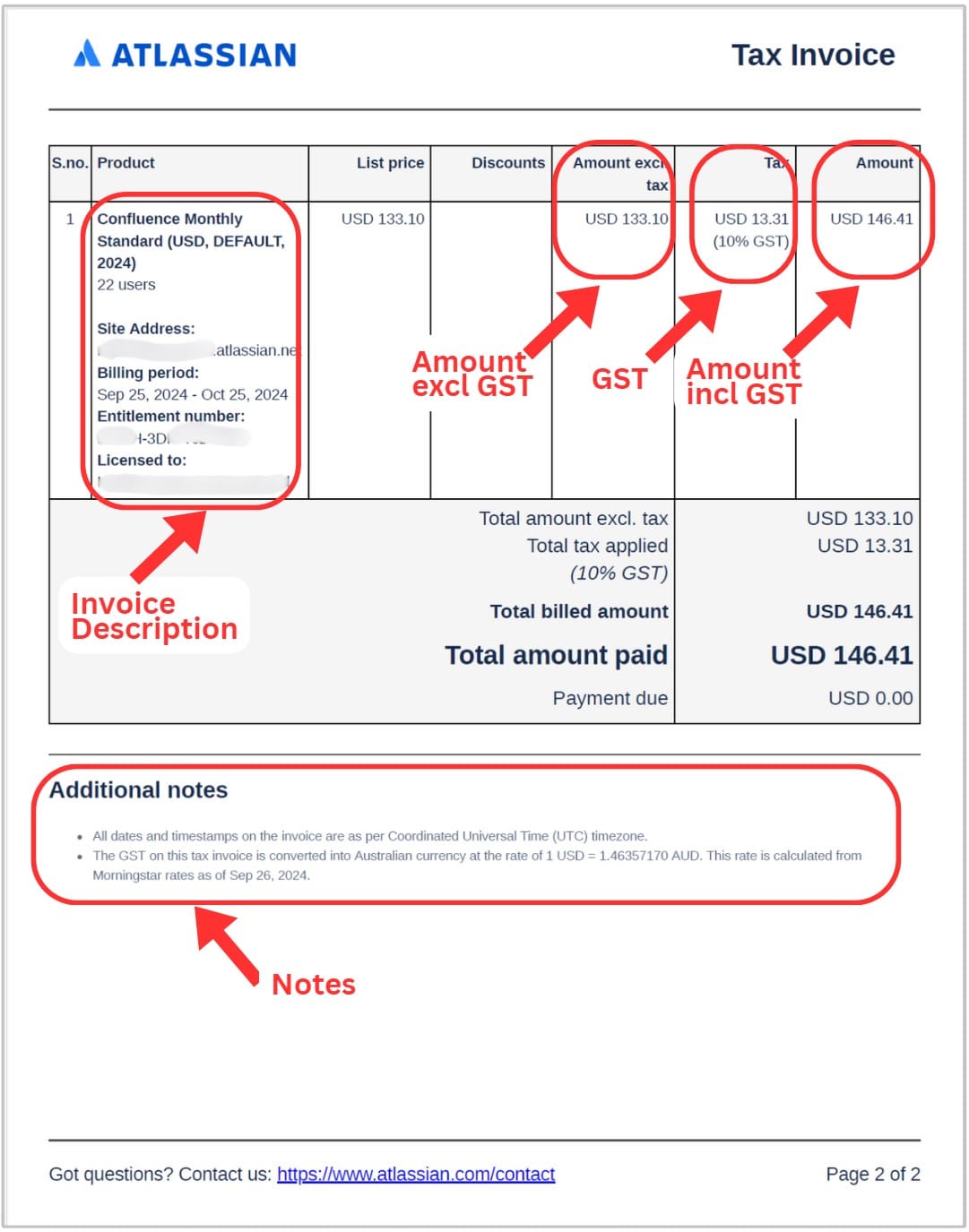

Let's look into the specifics of Page 2.

- Description: Clearly identifiable. This explains what is this invoice for.

- Amount excl Tax: Clearly identifiable. 133.10 USD

- Tax: Clearly identifiable. 13.31 USD. Note: It says the tax is 10% GST.

- Total Amount: Clearly identifiable. 146.41 USD, including the 10% GST.

Now, there is an interesting area that we should look at - the Notes.

Note 1: All dates and timestamps on the invoice are as per Coordinated Universal Time (UTC) timezone.

Note 2: The GST on this tax invoice is converted into Australian currency at the rate of 1 USD = 1.46357170 AUD. This rate is calculated from Morningstar rates as of Sep 26, 2024.

The 2nd note is essential.

This talks about the Currency Exchange Rate.

The exchange rate is the price of one currency expressed in terms of another currency.

In this example, the Currency Exchange Rate is 1 USD = 1.46357170 AUD.

If I want 1 USD, I must pay 1.46357170 AUD to buy 1 USD. In other words, if I give 1.46357170 AUD, I will get 1 USD in exchange.

I am buying USD because I have to pay the invoice in USD, but I only have AUD.

So, to pay this invoice priced in USD, how it works is:

Step 1: I sell AUD to buy the required USD

Step 2: Pay with USD

These steps occur when Atlassian takes money from my Australian Card (which I have pre-authorised).

The Exchange rate can be represented both ways:

1 USD = 1.46357170 AUD

or

1 AUD = 0.68326 USD

Both represent the same.

The note also says that the rate is as of a particular date (26-Sep-2024 in this example).

They actually change every minute (or every second).

This is based on Supply and Demand.

Whether one currency is in higher demand than another depends on the perceived value of owning it, either to pay for goods or services.

What do we mean by demand?

If people believe strongly that it is better to keep USD with them because USD can be (more) easily used to buy things, then people will want to keep more of USD - thereby increasing the demand for USD - thereby increasing the value of USD.

If a lot of people say that they don't want USD, then the demand for USD gets low - thereby decreasing the value of USD.

The market sets the rate.

If more people want USD, they are willing to pay more for USD - hence, the value of USD increases. In our example, we must pay more AUD to get 1 USD.

It's not just the market that's in the game. Banks also play a significant role in the currency exchange process, earning their share from the exchange rates.

So, we must keep looking at banks to see who gives us the best exchange rate to keep our costs low.

In summary, the Atlassian invoice is a well-constructed document that gives all the necessary information without us having to assume or infer anything.

The details are very clear, identifiable and precise.

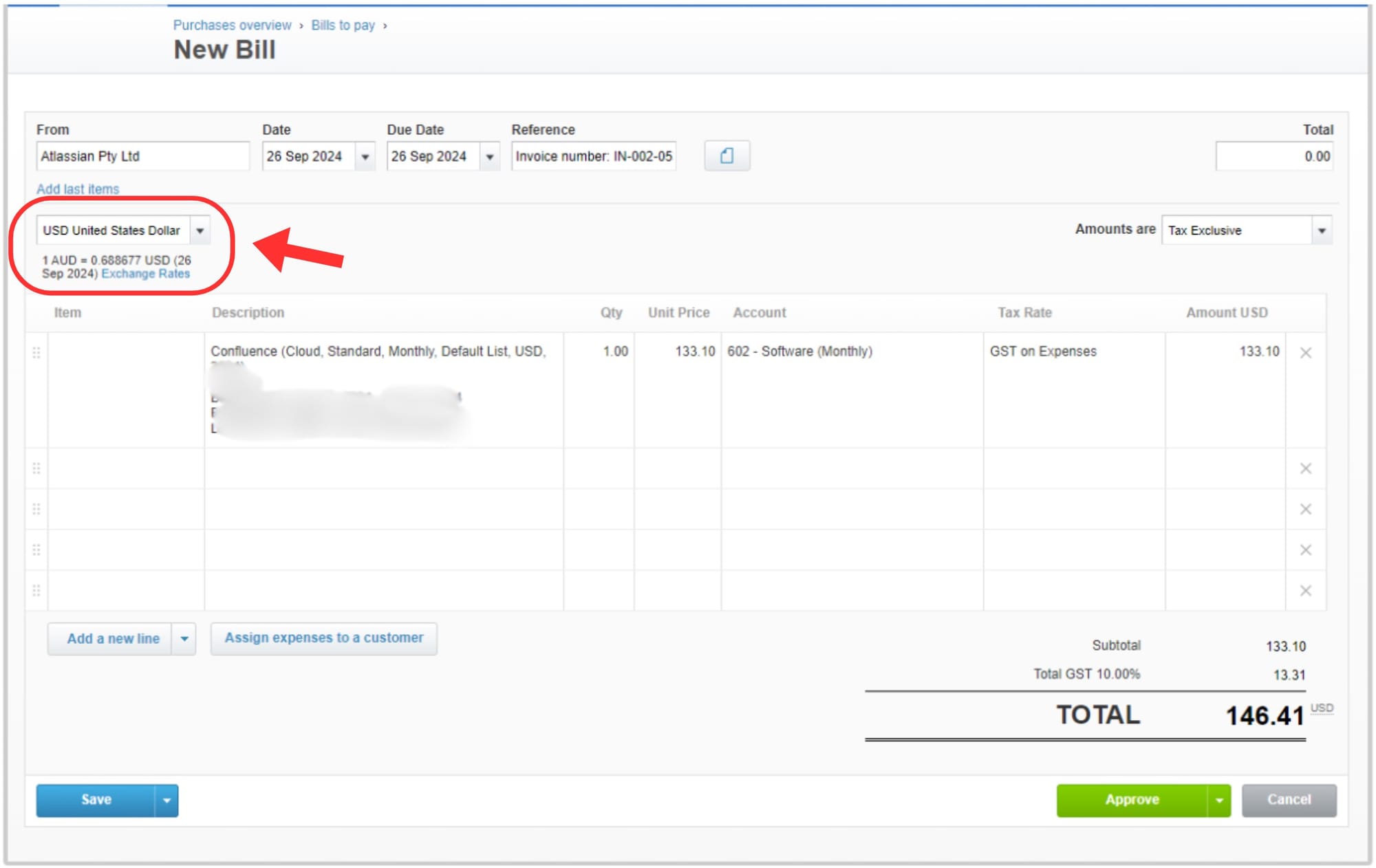

Recording the Atlassian Invoice in Xero as an Expense

When recording an invoice in another currency in Xero, the only difference when compared with recording the SquareSpace invoice was choosing the currency.

Reconciling the USD invoice with an AUD payment

Refer Reconciliation in Xero.

Note: When we reconciled, we also realised that there were bank charges for converting the currency AUD to USD to facilitate the payment of this invoice.

Next Step

Now it's time to record different types of invoices to see what we can learn next! Check out our next step here.