What is Accounting? Accounting Basics: Key Terms and Concepts

Teaching Kids Accounting basics: Revenue, cashflow, expenses — what does it all mean? A simple approach to learning the basics of accounting.

What did I want to do?

- I wanted my kids Ash (12 years old) and Adh (10 years old) to understand the necessity of managing the accounting process.

- I wanted to use this opportunity to explain/teach concepts like revenue, expense, profit... and reports concepts like balance sheets and income statements.

- I had already started them working on bookkeeping.

What is Accounting?

A business sells products or services to customers to make money. In addition to creating a product or service that customers love, we also need to manage the inflow and outflow of money.

Accounting is the the process of managing and tracking the money incoming into the business and outgoing out of the business is called accounting.

Who is an Accountant?

An accountant is a financial professional who records, reviews, analyses and reports on the business transactions on behalf of the business.

Note: To be qualified as an accountant, the person will need to study, meet the certification requirements and demonstrate competency to the governing accounting body of the country.

Do we need to be Accountants to start a business?

No.

When we start a business, we need accounting professionals to help and guide us for two things:

- How to effectively track our money?

- How can we stay compliant with the rules that the government's tax department enforces? This could be:

- Submitting the required reports to the Tax department periodically.

- Calculating and paying the right amount of Tax.

It will be beneficial to understand accounting terminologies. This will help us communicate with accounting professionals and also help us make decisions that consider accounting's impact on our business operations.

As a business owner, can we do the Accounting ourselves?

Depending on the size and scale of the business, business owners can do specific accounting tasks in-house.

Let me explain based on my personal experience:

- When I started my first company, I did the bookkeeping myself. Since the operation was small (less than five invoices a month and less than five expenses a month), the bookkeeping process was not something I had to do daily.

- What I did myself:

- I learnt the basics of bookkeeping.

- What I did myself:

- I used a bookkeeping tool (Xero) and recorded all the transactions myself. I learned how to record revenues, expenses, and profits.

- Whenever I encountered a new type of transaction I needed to record, I would contact my Accountant and ask for guidance on how to record it.

- This process of checking with the accountant on new transactions over the years has laid the foundation for me to constantly learn about the impact of accounting on every business decision I make. Having said that, I am still learning new things every day!

- I sought the help of my Accountant from a professional accountancy company:

- Formal reporting of Quarterly (i.e. every 3 months) BAS (Business Activity Statement) to the ATO (Australian Tax Office)

- Formalise the Company's Annual Tax Returns to declare the profit or loss as applicable.

- When I started the second company, again, I did all the bookkeeping myself - for both the 1st and 2nd companies (collectively, less than 20 invoices a month and less than 15 expenses a month). The operations were small, and I was able to manage the bookkeeping myself.

- This helped me keep the costs low.

- This also helped me to learn a lot of aspects of accounting... gradually as and on a demand basis.

- I engaged the Accountant for formal reporting with the ATO and for guidance as and when required. An Accountant from an external professional accounting company did all my formal reporting and submissions to the ATO (Australian Tax Office).

- When I started the Holding Company, things were starting to get a little complex.

- I engaged more of the Accountant's time as I needed more advice on specific aspects of accounting. For example, I needed to understand the tax implications when I sold my shares of the operating companies to the Holding Company.

- An external professional accountancy company did all formal reporting to the ATO.

- I still managed to do the bookkeeping myself for all the 3 companies.

- Then there was a 4th company. This company had a lot of transactions. This was a B2C (Business to Customer) operation, so daily sales and expenses occurred. There were at least 200 sales invoices and 150 expenses per month.

- I hired a person to manage bookkeeping for this company.

- I did not have the capacity to do the bookkeeping myself, and

- It was cost-effective to hire someone to manage the bookkeeping.

- However, since I had an understanding of Accounting/bookkeeping, I was able to guide and mentor the person. I also understood the impact of the bookkeeping person making any changes to the reporting.

- An Accountant from an external professional accounting company did all my formal reporting and submissions to the ATO (Australian Tax Office).

- I hired a person to manage bookkeeping for this company.

As you can see above, based on the volume of transactions, the business owner can decide to do the bookkeeping in-house (either by themselves or by hiring a person within the team). However, seeking guidance from a qualified accounting professional is always recommended.

Key Accounting Terms

We will teach the standard topics, and as we engage in further conversations, we will get into complex topics/issues and exception scenarios.

Example: If money going out of the business is an Expense, then if we issue a refund to a customer, is it also an Expense?

These kinds of exception topics will be covered at a later stage.

The focus at the moment is to introduce these concepts to the kids.

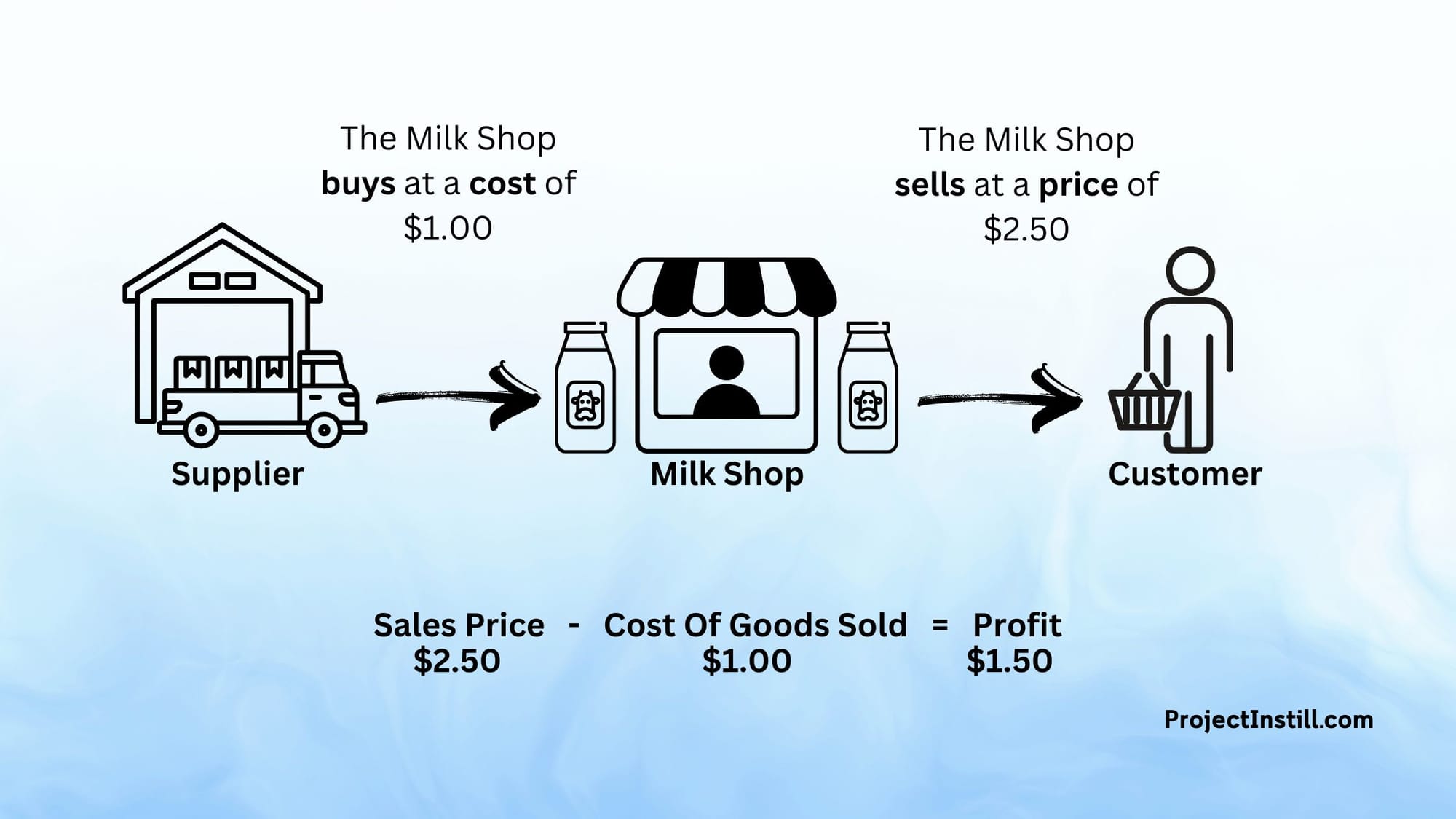

Cost vs Price

Cost: Usually, cost refers to the amount we pay our supplier to buy something.

Price: Usually, price refers to the amount customers pay to buy the product from us.

Let's look at an example. Let's say - we are running a Milk Shop - where we buy Milk from farmers and sell it to customers.

If we buy one bottle of milk from the farmer for $1.00 and sell the same bottle to our customers for $2.50, then:

- Cost of buying one bottle of milk = $1.00

- Price of 1 bottle of milk that we sell to our customers = $ 2.50

- The money we make by selling the bottle of Milk is the difference between the Price & Cost:

- Money we make = Price of $2.50 - Cost of $1.00

- Money we make = $1.50

Why do we need to make money?

- In the above example, we need to make money so that we can pay the rent for the milk shop, and

- we can take our surplus money and spend it on what we need (maybe buy our favourite chocolates?).

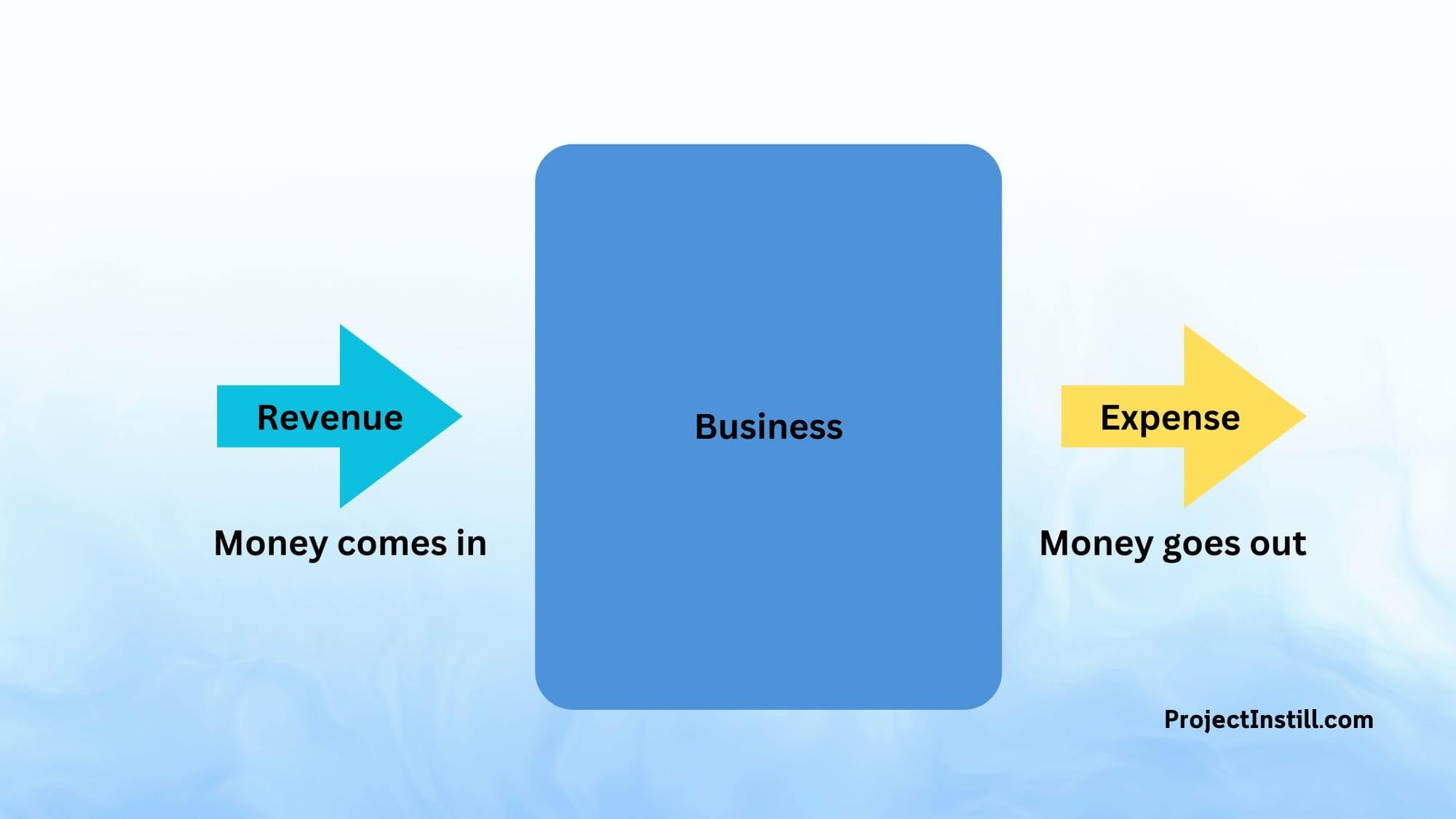

Revenue, Expense & Profit/Loss

- Revenue - money coming into the business. Usually, this is the money we earn from customers by selling goods or services to them.

- Expense - money going out of the business. Usually, this is the money we need to spend to create the goods or services we want to sell. (e.g. cost of goods sold, rent, salary)

- Profit - If we make more revenue than expenses, then we will have money in the business to use. The surplus money we have left is called profit.

- Loss - If we make less revenue than expenses, we lose money. This deficit of funds that we have lost is called loss.

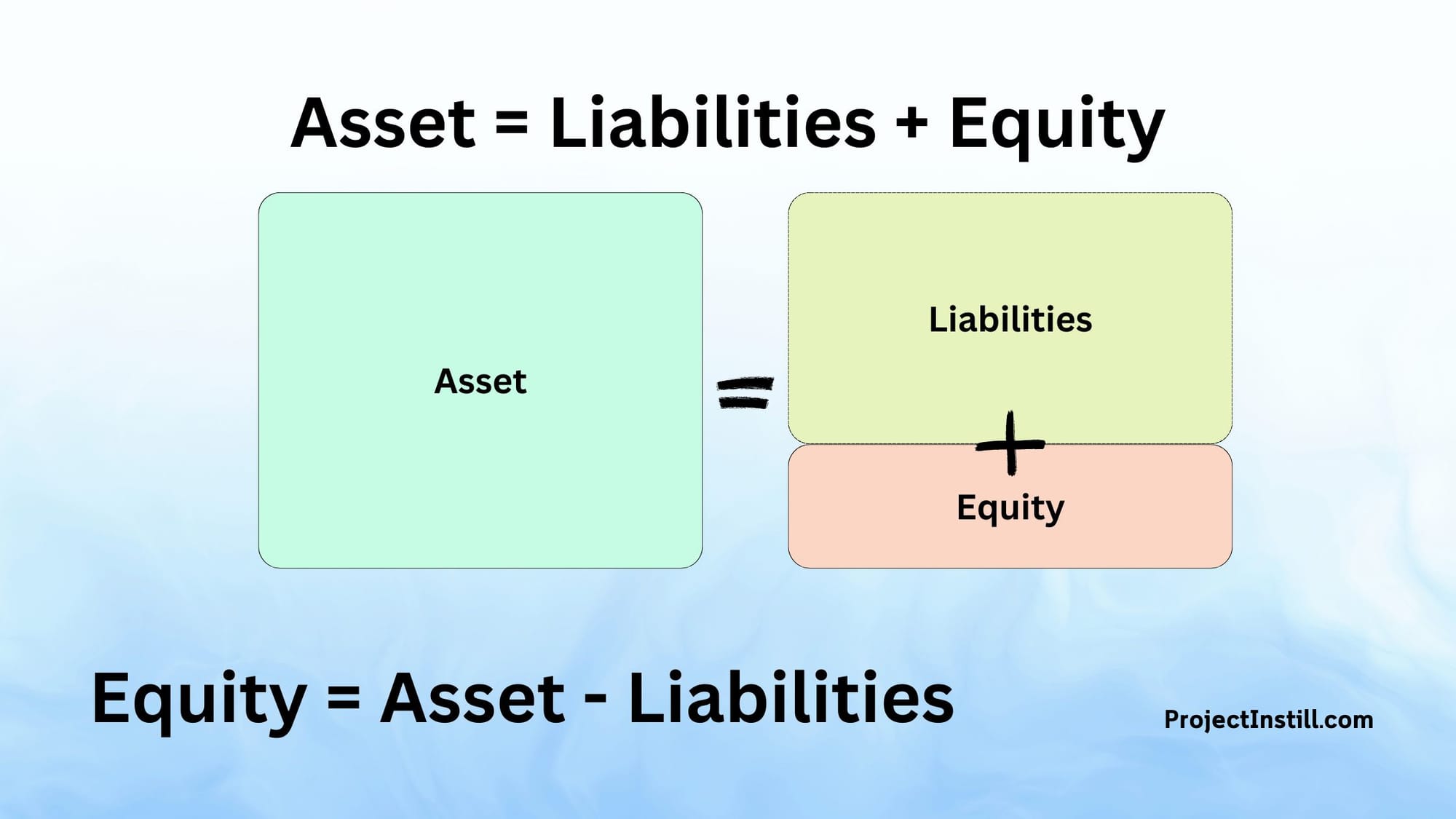

Asset, Liability and Equity

- Assets - These are items that we purchase and use over a very long period of time. For example, we must first purchase a coffee machine for a coffee shop business. We can use this coffee machine for a very long time. This coffee machine is an asset.

- Liability - Sometimes, we purchase some products from our supplier, but we negotiate with the supplier that we will pay after some time. These amounts that we have to pay to our Suppliers at a later date are called Liabilities. For example, we must buy milk and coffee beans from our suppliers for a coffee shop business. We might buy them daily, but we might pay for all the purchases together at the end of the month. The amount is a liability until we pay off the money to the supplier.

- Equity - Equity is the calculated difference between the Assets and Liabilities.

Let's look at an example.

Let's say we are buying a house for $ 100,000 by paying a deposit of 20% ($20,000) and borrowing the remaining 80% ($80,000) from the bank.

- Liability

- The loan amount that we have to pay back to the bank is $80,000.

- Asset

- The value of the property that we bought is $100,000

- Equity

- The calculated difference between Asset and Liability ($100,000 - $80,000) = $20,000 is the amount we paid as a deposit.

Some Tax Terms

- GST - The Goods and Services Tax - is a Tax that is charged for every transaction.

- The country's government defines this GST tax rate.

- The Government also decides which products and services need to be charged this GST and which don't.

- Example: Healthcare may not require GST to be charged. Essential products like bread may not be GST applicable.

- The businesses need to collect the GST and pay the Government Tax Department in regular intervals (i.e. monthly, quarterly, etc)

- Income Tax - This is the Tax that businesses need to pay the Government based on the profit made in that financial year.

Key Financial Reports

As business owners, it is good to see detailed transactions, but sometimes, we need to see a high-level bird's eye view.

So we look at summarized reports from the bookkeeping software or accounting team to get a sense of how our business is performing financially. Below are some of the key reports that we often use:

Income Sheet

- This report shows the company's profits and losses

- This report provides insights into the company's revenue generation, expenses and profitability.

Balance Sheet

- This report shows the company's assets and liabilities.

- This report also shows the equity left in the company.

- This report provides insights into the company's financial position in terms of:

- What is owned by the company?

- What is owed (i.e. we need to pay others for the products/services we have already taken from our suppliers)?

P&L (Profit and Loss) Statement

- This report summarizes the business income and reduces the expenses.

- This report is usually generated within a specific time frame (e.g. for one financial year).

- This report provides insights into the business performance to identify which categories are performing well.

Cashflow Statement

- This report summarises the amount of money coming in and going out of the company.

- This report provides insights at any point in time to check if we have sufficient cash to pay our obligations.

Bank Reconciliation

- This report compares and matches our company's bank statements with our accounting records.

- For more reading, refer Bank Reconciliation in bookkeeping.

Further reading:

- What is Tax? Why pay Tax?